by Calculated Risk September 12, 2024 12:58 PM

In today’s Real Estate Newsletter: “Home ATMs” were mostly closed in the second quarter

excerpt:

During the housing bubble, many homeowners borrowed heavily against the equity in their homes, which they jokingly called “home ATMs,” and this contributed to the subsequent collapse of the housing bubble, as many homeowners had negative equity in their homes when home prices fell.

Unlike during the housing bubble, most homeowners today are not in negative equity. News from CoreLogic this morning: Homeowner Wealth Insights – Q2 2024

According to the report, home equity for U.S. homeowners with mortgages (which represent about 62% of all real estate) will grow 8.0% year over year, for a total increase of $1.3 trillion, an average increase of $25,000 per borrower starting in the second quarter of 2023, and bringing total homeowner net worth to more than $17.6 trillion by the second quarter of 2024.

From Q2 2023 to Q2 2024, the total number of homes with negative mortgage balances fell 4.2% to 1 million, or 1.7% of all mortgaged properties.

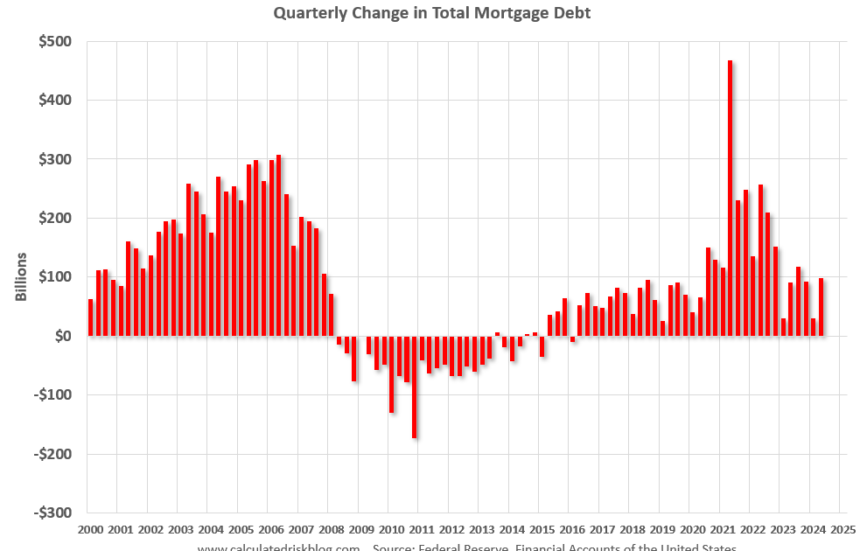

Here’s the Federal Reserve’s quarterly mortgage debt growth: United States Financial Statements – Z.1 (also known as the Flow of Funds Report) was released today. The mid-2000s saw a large increase in mortgage debt associated with the housing bubble.

Q2 2024 mortgage debt is up $99 billion from $31 billion in Q1, but down from a cycle peak of $467 billion in Q2 2021. Note that mortgage debt has been declining for almost seven years as large amounts of debt have been wiped out through distressed loan sales (foreclosures and short sales).

However, some of this debt is being used to increase the housing stock (purchasing new homes), so it is not all mortgage-backed securities (MEWs).

There’s much more to this article. Subscribe now https://calculatedrisk.substack.com/.