by Calculated Risk September 15, 2024, 10:17 AM

Most analysts expect the FOMC to cut the federal funds rate by 25 basis points when it meets this week, lowering the target range to 5% to 5.5%, with a 50 basis point cut even possible.

Market participants are currently split between a 25bp and 50bp cut this week. They are also pricing in a total of 75bp cuts by the November meeting and 100bp to 125bp cuts by December.

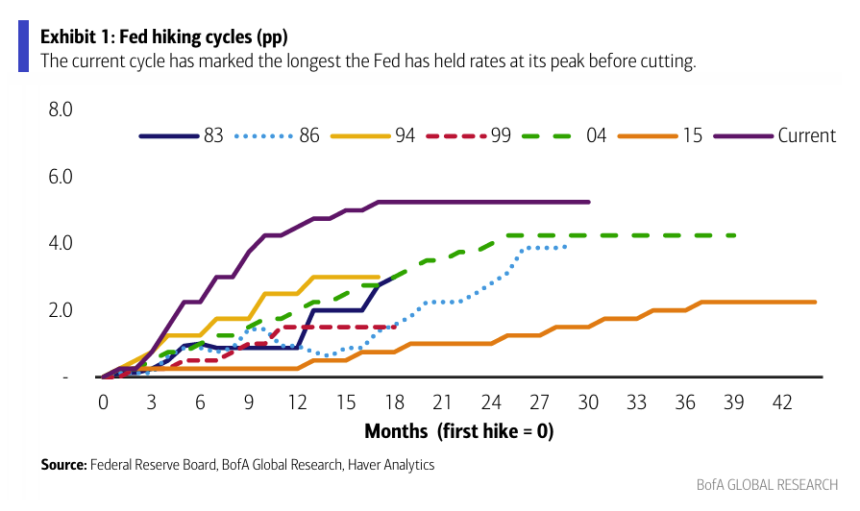

Next week, the Fed is widely expected to end its hold on interest rates after the longest hiking cycle in history (Display 1).

We expect the Fed to cut rates by 25 basis points, which would bring the Fed to a series of 25 basis points of rate cuts over the next five meetings. While the market still sees significant risks to a 50bp cut next week, this week’s data has us comfortable with a 25bp cut expectation. The main message from the meeting should be one of cautious optimism, despite growing concerns about downside risks.

Add emphasis

| Federal Reserve Board and Central Bank Governors’ GDP Projections and Changes in Real GDP1 | ||||

|---|---|---|---|---|

| Forecast Date | 2024 | 2025 | 2026 | |

| June 2024 | 1.9 to 2.3 | 1.8 to 2.2 | 1.8 to 2.1 | |

| March 2024 | 2.0 to 2.4 | 1.9 to 2.3 | 1.8 to 2.1 | |

1 Projections of changes in real GDP and inflation are from the fourth quarter of the previous year to the fourth quarter of the current year.

of The unemployment rate was 4.2%. August. This is the upper end of the June forecast.

| Federal Reserve Board and Central Bank Governors’ Unemployment Projections, Unemployment Rates2 | ||||

|---|---|---|---|---|

| Forecast Date | 2024 | 2025 | 2026 | |

| June 2024 | 3.9 to 4.2 | 3.9 to 4.3 | 3.9 to 4.3 | |

| March 2024 | 3.9 to 4.1 | 3.9 to 4.2 | 3.9 to 4.3 | |

2 Unemployment estimates are the average private sector unemployment rate for the fourth quarter of the year indicated.

the current July 2024PCE inflation rose 2.5% year-over-year, which was at the low end of our June forecast. Analysts’ current forecasts are for PCE inflation to fall to 2.3% year-over-year in August.

| Federal Reserve Board and Central Bank Governors’ Inflation Forecasts, PCE Inflation1 | ||||

|---|---|---|---|---|

| Forecast Date | 2024 | 2025 | 2026 | |

| June 2024 | 2.5 to 2.9 | 2.2 to 2.4 | From 2.0 to 2.1 | |

| March 2024 | 2.3 to 2.7 | 2.1 to 2.2 | From 2.0 to 2.1 | |

PCE Core Inflation It increased 2.6% year-on-year in July, lower than the FOMC’s fourth-quarter forecast in June, but analysts expect core PCE inflation to edge up slightly in August.

| Federal Reserve Board and Central Bank Governors’ Core Inflation Forecasts, Core Inflation1 | ||||

|---|---|---|---|---|

| Forecast Date | 2024 | 2025 | 2026 | |

| June 2024 | 2.8 to 3.0 | 2.3 to 2.4 | From 2.0 to 2.1 | |

| March 2024 | 2.5 to 2.8 | 2.1 to 2.3 | From 2.0 to 2.1 | |