by Calculated Risk September 17, 2024, 10:00 AM

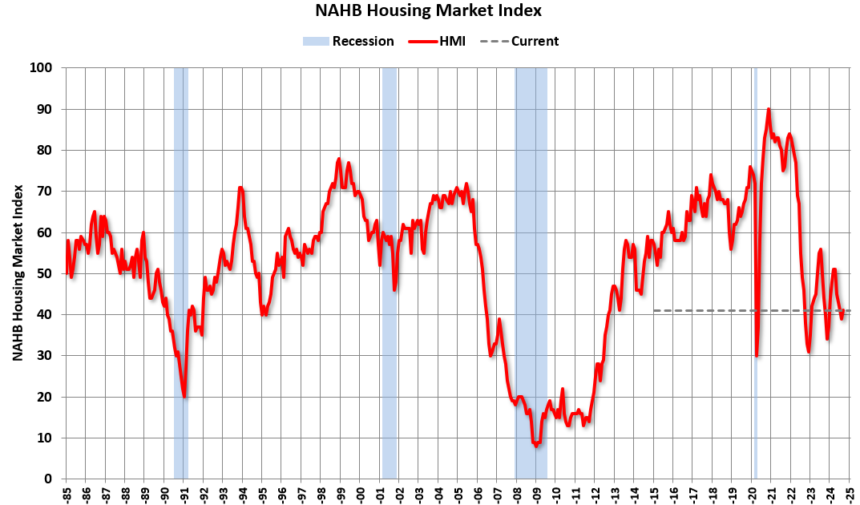

The National Association of Home Builders (NAHB) announced that its Housing Market Index (HMI) rose to 41 from 39 in the previous month. A reading below 50 indicates that more builders view home sales conditions as poor than as good.

From the NAHB: Homebuilder sentiment rises as interest rates fall, but homebuying challenges remain

Mortgage rates fell more than half a percentage point from early August to mid-September, according to Freddie Mac, and builder sentiment has risen slightly this month, even as builders continue to grapple with rising costs.

Builder confidence in the new single-family home market was 41 in September.According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), released today, the home price index rose 2 points from 39 points in August, ending a four-month series of declines.

“Thanks to lower interest rates, homebuilders have a positive outlook for future new home sales for the first time since May 2024,” said Carl Harris, a custom homebuilder in Wichita, Kansas, and chairman of the NAHB. “However, construction costs remain high relative to household budgets, dampening some enthusiasm for current housing market conditions. Additionally, as lower mortgage rates weaken the mortgage rate lock-in effect, homebuilders will face competition from growing existing home inventory in many markets.”

“With inflation subdued, the Federal Reserve is expected to begin a cycle of monetary easing this week, which will put downward pressure on mortgage rates and lower interest rates on land development and home construction loans,” said Robert Dietz, chief economist at NAHB. “Lowering construction costs is critical to mitigating home affordability.”

The latest HMI survey also revealed that the percentage of builders that reduced prices in September fell one percentage point for the first time since April, to 32%, and the average reduction rate was 5%, falling below 6% for the first time since July 2022. Meanwhile, the use of sales incentives fell to 61% in September, from 64% in August.

…

All three HMI indices increased in September: the index showing current sales conditions rose one point to 45, the component measuring sales expectations over the next six months rose four points to 53, and the index showing store visits by potential buyers rose two points to 27.Looking at the three-month moving average of regional HMI scores, the Northeast fell three points to 49, the Midwest rose one point to 40, the South fell one point to 41, and the West rose two points to 39.

Add emphasis

This graph shows the NAHB index since January 1985.

This was slightly above the consensus estimate.