by Calculated Risk September 24, 2024 9:00 AM

S&P/Case-Shiller release Monthly Home Price Index for July (“July” is the three-month average of closing prices for May, June, and July).

The release includes prices for 20 individual cities, two composite indexes (10 cities and 20 cities), and a monthly national index.

From S&P S&P CoreLogic Case-Shiller Index to Remain at All-Time High in July 2024

S&P CoreLogic The Case-Shiller U.S. National Home Price NSA Index, which covers all nine U.S. census tracts, recorded a 5.0% year-over-year increase in July.New York’s annual growth rate in July was 8.8%, down from the previous month’s 7.4% annual growth rate. The 20-city composite index was up 5.9% year-on-year, down from the previous month’s 6.5% growth rate. New York once again recorded the highest annual growth rate among the 20 cities in July, increasing by 8.8%, followed by Las Vegas and Los Angeles, which increased by 8.2% and 7.2%, respectively. Portland had the lowest year-on-year growth rate, increasing 0.8% in July, the same as the previous month.

…

The upward trend in the U.S. National Index, 20-City Composite Index, and 10-City Composite Index continued to slow from the previous month, with the National Index increasing 0.1% before seasonal adjustment, and the 20-City Composite Index and 10-City Composite Index both remaining flat from the previous month.After seasonal adjustment, the U.S. national index increased 0.2% from the previous month, while the 20-city composite index and the 10-city composite index both increased 0.3% from the previous month.

“Taking into account the seasonality of homebuying, our national indexes have now reached record highs for the 14th consecutive year,” said Brian D. Luke, CFA, head of Commodities, Real and Digital Assets. “With the S&P 500 hitting 39 all-time highs and the S&P GSCI Gold TR hitting 35 all-time highs, the housing market is on a similar trajectory. Growth has come at a cost, with all but two markets slowing last month, eight markets experiencing monthly declines and the lowest annual growth rate in the nation for 2024. Overall, the indexes continue to grow at rates above their long-term averages when accounting for inflation.”

“Over three- and five-year periods, we continue to see outperformance at most of the lower end of the market,” Luke continues. “Tampa’s lower end was the best performing market in the nation with a five-year performance of 88%. The New York market was the best performing market for the year, posting an 8.9% increase. New York’s lower end index, which includes home prices up to $533,000, led the growth with an annual increase of 10.8%. Over the five-year period, markets such as New York and Atlanta saw their lower end indexes outperform the market by up to 20% and 18%, respectively. The relative outperformance of the lower end index has benefited first-time homebuyers while creating difficulties for those looking for their first home. The opposite is happening in California, which has the most expensive upper end of the market in the country, all well over $1 million. In San Diego, Los Angeles and San Francisco, the upper end indexes have outperformed on a one- and three-year basis, making the wealthy even wealthier.”

Add emphasis

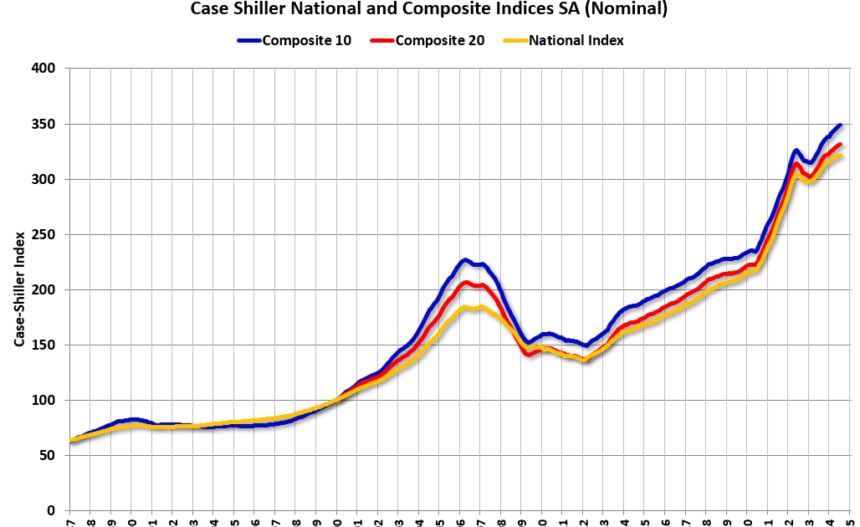

The first chart shows the nominal seasonally adjusted Composite 10 index, the Composite 20 index, and the national index (the Composite 20 index was launched in January 2000).

The Composite 10 Index rose 0.3% in July (SA). The Composite 20 Index rose 0.3% in July (SA).

The national index increased by 0.2% in July (SA).

Composite 10 SA increased 6.8% year over year. Composite 20 SA increased 5.9% year over year.

The national index SA increased by 5.0% year-on-year.

The annual price change was close to what we expected, and we’ll provide more details later.