by Calculated Risk September 25, 2024 7:00 AM

From the MBA: Latest MBA Weekly Survey Shows Increase in Mortgage Applications

According to the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending September 20, 2024, mortgage applications increased 11.0% from the previous week.

The Market Composite Index, a measure of mortgage application volume, increased 11.0% week-over-week on a seasonally adjusted basis. The unadjusted index increased 11% week-over-week. The Refinance Index increased 20% week-over-week and was 175% higher than the same week a year ago. The seasonally adjusted purchasing index rose 1 percent from the previous week. The unadjusted purchasing index rose 0.4% from the previous week. That’s a 2 percent increase from the same week a year ago..

“Mortgage applications increased to the highest level since July 2022, driven by a 20% increase in refinance applications following a strong increase the previous week. The 30-year fixed rate fell for the eighth consecutive week to 6.13%, while FHA rates fell to 5.99%, below the psychologically important 6% level,” said Joel Kang, MBA vice president and deputy chief economist. “As a result of the lower interest rates, we saw sharp week-over-week increases in both conventional and government-backed refinance applications. With refinances now at 55.7%, the level of refinance activity is still modest compared to previous refinance waves, but they now represent the majority of applications given the seasonal slowdown in purchasing activity.”

Kang added, “Average loan amounts increased for both purchase applications and refinance applications, bringing the overall average loan amount to $413,100, the highest in the history of the survey.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased from 6.15% to 6.13%, and points for loans with an 80% LTV (loan-to-value ratio) increased from 0.56 (including origination fees) to 0.57.

Add emphasis

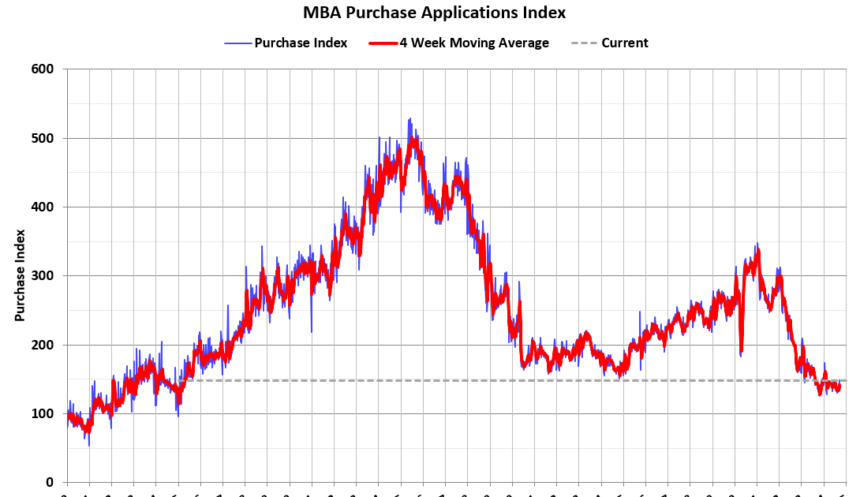

The first chart shows the MBA Mortgage Purchase Index.

According to the MBA: Purchasing activity increased 2.0% year over year Not adjusted.

Red is the four-week average (blue is weekly).

Purchase application activity is up about 18% from its lows in late October 2023 but is still about 2% below the lows when the housing bubble burst.

Rising mortgage rates have caused the refinance index to fall sharply in 2022, after remaining roughly flat for two years, but it has recently risen significantly as mortgage rates have fallen.