in recent postsI made the following argument:

So why hasn’t overall inflation been as temporary as many expected? The answer is simple. All cumulative inflation since 2019 has been demand-side, and demand-side inflation is permanent. Over the past five years, PCE inflation has exceeded the Fed’s 2% target by a total of nearly 8 percentage points. NGDP growth totaled about 10% above the 4% annual rate. That’s the whole problem, supply shocks have nothing to do with it. Rather, there were enough supply shocks (mainly immigration) that extreme demand stimulus kept inflation 2% below expected levels. In fact, the Fed got lucky.

This last line should be modified to read: The Fed actually very lucky.

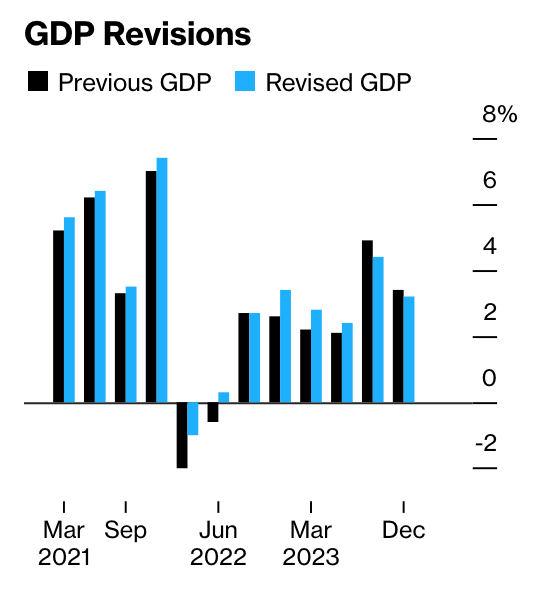

Today, the government announced revised forecasts for GDP growth from 2021 to 2023. bloomberg has a graph showing real output data, but NGDP was also revised by a similar amount.

Some observations:

In 2022, I debated with some commenters about whether we are in a recession. When I said otherwise, they pointed out that real GDP growth was negative for two consecutive quarters. I responded that this is not an official NBER standard and that other data points to a strong economy. According to the revised data, he had less than two negative quarters. By any reasonable standard, there was no recession in 2022.

In the previous post cited above, I said that NGDP growth would overshoot by 10%. In the revised data, the overshoot was 11.5%, providing evidence that monetary policy was even more excessive than we thought, and further confirming that a “supply shock” was not the problem. A strong supply side kept excess inflation at around 8%, or 3.5% below what would be expected from monetary policy alone. On the plus side, the economic potential may be slightly higher than we assumed. This is probably due to increased immigration, but also probably reflects increased productivity.

Previous data showed much stronger growth in GDP than in GDI, even though they are conceptually identical. Gross domestic income has been revised upwards more significantly than GDP, so the difference is now much smaller.

Previous GDI growth estimates (yellow bars) were completely meaningless given the strong employment growth.