by calculated risk October 2, 2024 11:04:00 AM

In today’s ‘Calculated Risk Real Estate’ newsletter: FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV, and Credit Scores

A brief excerpt:

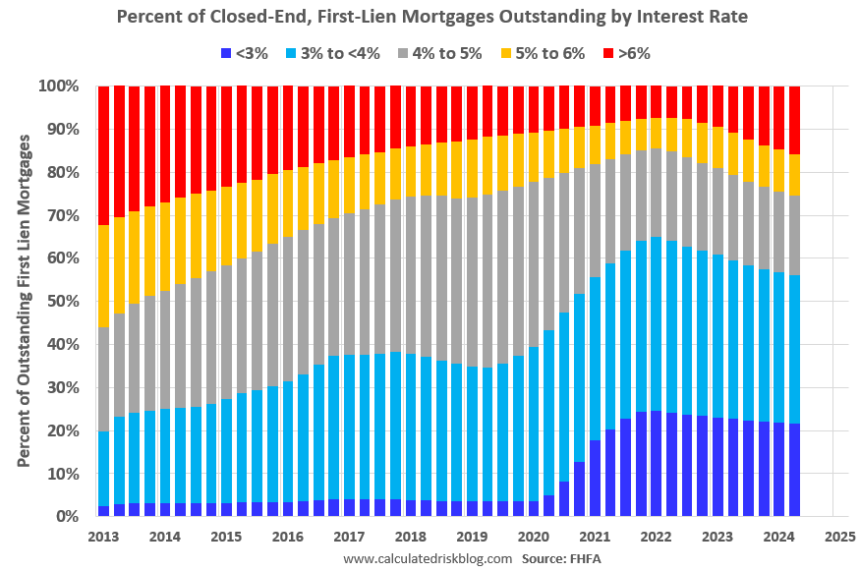

Below is a graph of mortgage balances by interest rate, average mortgage interest rate, borrower credit score, and current loan-to-value (LTV) through Q2 2024 from FHFA’s National Mortgage Database (recently released).

…The following data shows the interest rate distribution for closed-end, fixed-rate, one- to four-family mortgage loan balances at the end of each quarter from Q1 2013 through Q2 2024.

This shows that the proportion of loans below 3% and even below 4% has skyrocketed since the beginning of 2020, as mortgage rates have fallen sharply during the pandemic. The percentage of loans outstanding below 4% peaked at 65.2% in Q1 2022 (now 56.2%), and the percentage below 5% peaked at 85.5% (now 74.6%). These low existing mortgage rates make it difficult for homeowners to sell their home and buy a new home because their monthly payments increase rapidly. This is the main reason why inventory levels for existing homes are so low.

There’s a lot more to this article.