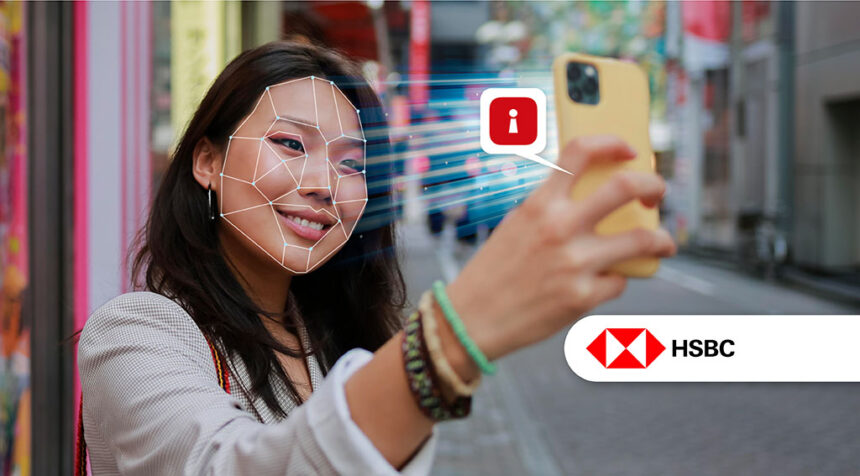

HSBC Singapore has reportedly become the first bank in the country to introduce Singpass Face Verification (SFV) for in-app provisioning of its mobile apps.

This feature enhances security by allowing users to verify their identity through Singpass, streamlining the process while aligning with new industry requirements.

These changes are mandated The Monetary Authority of Singapore (MAS) aims to strengthen security measures across digital banking to combat the growing number of scams and scams.

This phased certification is part of a broader effort to improve customer protection and security in Singapore’s banking sector.

Other recent initiatives include phasing out OTPs for digital token users and introducing features such as money lock to protect funds.

Ashmita Acharya, Head of Wealth and Personal Banking, HSBC Singapore, said: emphasized While being the first to adopt SFV for in-app provisioning is important, the goal is to ensure both security and convenience for customers.

Singpass Face Verification was developed by the Government Technology Agency of Singapore (GovTech) and is currently used by over 4.5 million Singpass users to access various public and private sector services.

Featured image credit: Edited from freepic