by calculated risk 10/02/2024 07:00:00 AM

From MBA: Mortgage applications drop in latest MBA weekly survey

Mortgage application volume for the week ending September 27, 2024, fell 1.3% from the previous week, according to data from the Mortgage Bankers Association’s (MBA) Weekly Application Survey.

The market composite index, which measures the number of home loan applications, fell by 1.3% from a week ago, seasonally adjusted. On an unadjusted basis, the index decreased by 1% compared to the previous week. The refinance index fell 3% from the previous week and rose 186% compared to the same week last year. Seasonally adjusted purchasing index rose 1% compared to a week ago. The unadjusted purchasing index increased by 1% compared to the previous week; 9% increase compared to the same week a year ago.

“Statistics released last week showed that the economy continues to grow at a solid pace, even as inflation continues to decline. As a result, mortgage rates have risen modestly and 30% The annual fixed mortgage rate increased slightly to 6.14%,” said Mike Fratantoni, MBA senior vice president and chief economist. The move led to a decline in refinance applications for the week, but they are still nearly three times the pace of last year. ”

Fratantoni added:The news this week was that more homebuyers appear to be entering the market. Purchase offer activity increased this week and is up more than 9% compared to last year at this point. Inventory of both new and existing homes is increasing through 2024, meaning potential buyers have properties to consider, and mortgage rates are now slightly lower, making them more affordable. It means that it is. ”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increases from 6.13% to 6.14%, with the 80th percentile point increasing from 0.57 (including origination fees) to 0.61. did. Loan to Value (LTV).

Emphasis added

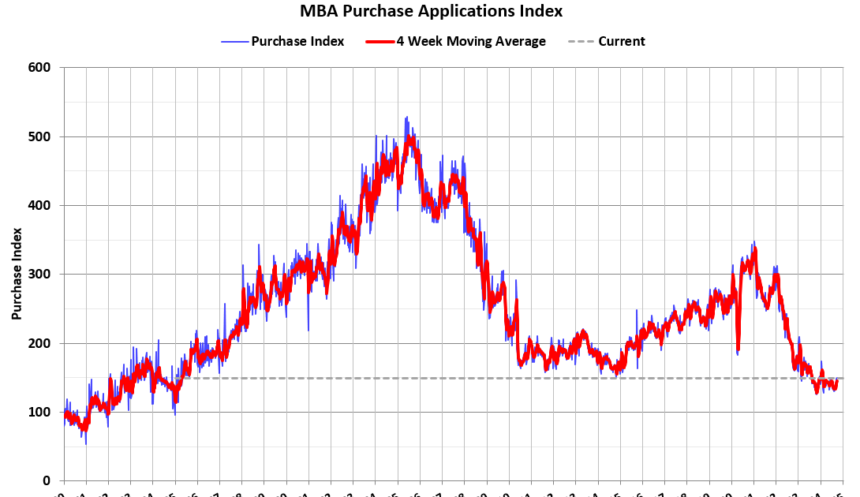

The first graph shows the MBA Mortgage Purchase Index.

According to M.B.A. Purchasing activity increased by 9% YoY Unadjusted.

Red is the 4-week average (blue is weekly).

Purchase application activity is up about 19% from its low in late October 2023, but is still about 1% below its lowest level during the housing crisis.

The refinance index fell sharply in 2022 due to rising mortgage rates, remained roughly flat for two years, but has recently increased significantly as mortgage rates have fallen.