In today’s ‘Calculated Risk Real Estate’ newsletter: Moody’s: Apartment vacancy rate unchanged in the third quarter. Office vacancy rate is at an all-time high

A brief excerpt:

From an economist at Moody’s Analytics: Multifamily housing performance stabilized, office stress continued to manifest, retail vacancy rates decreased, and the industry cooled down.

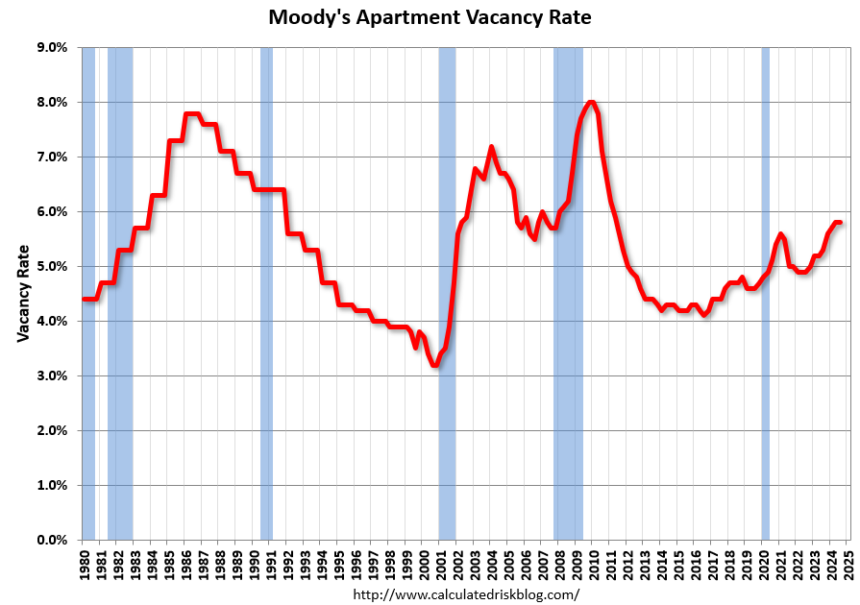

The national apartment vacancy rate remained flat at 5.8%, the highest level since 2011. Supply-side pressure was the main factor behind the increase in vacancies from the second half of 2022 onwards.

Moody’s Analytics (Race) reports that the apartment vacancy rate in the third quarter of 2024 was 5.8%, unchanged from an upwardly revised 5.8% in the second quarter, compared to the peak of the pandemic in the first quarter of 2021. This rose from 5.6%. This is the highest vacancy rate since 2011. Note that asking rents have decreased slightly year-over-year.

This graph shows apartment vacancy rates since 1980 (annual rates before 1999, quarterly rates after 1999). Note: Moody’s Analytics only covers large cities.

There’s a lot more to this article.