by calculated risk 10/05/2024 08:11:00 AM

This week’s major economic report is the September CPI.

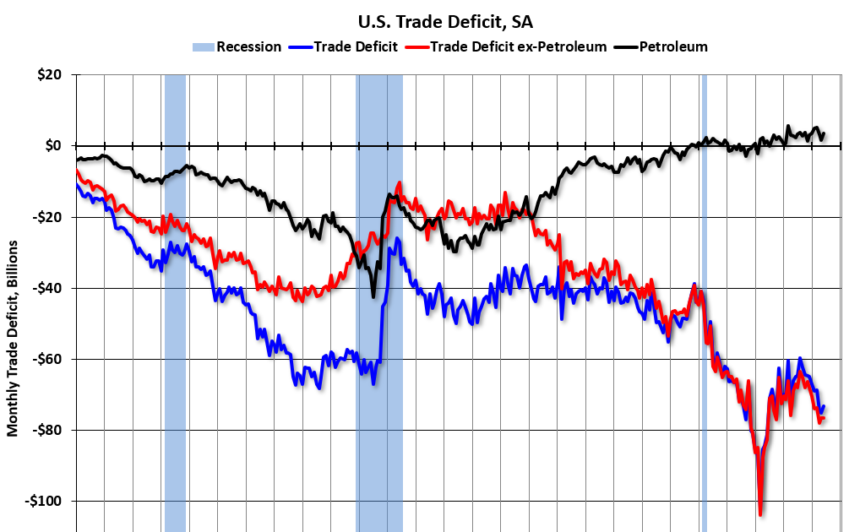

Other key indicators include September PPI and August trade deficit.

—– Monday, October 7th —–

No major economic announcements are scheduled.

—– October 8th (Tuesday) —–

6am: NFIB Small Business Optimism Index For September.

This graph shows the U.S. trade deficit with and without oil, according to the latest report. The blue line is the total deficit, the black line is the oil deficit, and the red line is the trade deficit excluding petroleum products.

—– Wednesday, October 9th —–

7:00 a.m. ET: Mortgage Bankers Association (MBA) Mortgage loan purchase application index.

2pm: FOMC MinutesMinutes of September 17-18, 2024

—– October 10th (Thursday) —–

8:30am: First weekly unemployment claim The report will be published. The consensus was 228,000 initial claims, up from 225,000 last week.

8:30am: September consumer price index From BLS. The consensus is for CPI to rise by 0.1% and core CPI to rise by 0.2%. The consensus is for CPI to rise 2.3% y/y and core CPI to rise 3.2% y/y.

—– October 11th (Friday) —–

8:30am: September producer price index From BLS. The consensus is for PPI to rise 0.1% and core PPI to rise 0.2%.

10am: University of Michigan Consumer Confidence Index (Preliminary version for October).