by calculated risk 10/06/2024 08:14:00 AM

Note: I mentioned apartments and offices in my newsletter. Moody’s: Apartment vacancy rate unchanged in the third quarter. Office vacancy rate at record high

Economists at Moody’s Analytics said: Multifamily housing performance is stable, office stress continues to manifest, retail vacancy rates are decreasing, and the industry is cooling down.

Data for Q3 2024 shows a slight decline in the long-standing retail sector vacancy rate of 10.4%, dropping to 10.3% this quarter.. Asking rents increased 0.3% to $21.85 and effective rents increased 0.4% to $24.87 per square foot. Consumer spending in the third quarter has so far exceeded expectations, with July in particular rising 1.1%. In August, sales rose slightly by 0.1%, but exceeded the expected decline of 0.2%. These results were driven by strong performance in online purchases and core retail sales, excluding autos, gasoline, building materials and food services, as well as a decline in the unemployment rate following four consecutive months of increases.

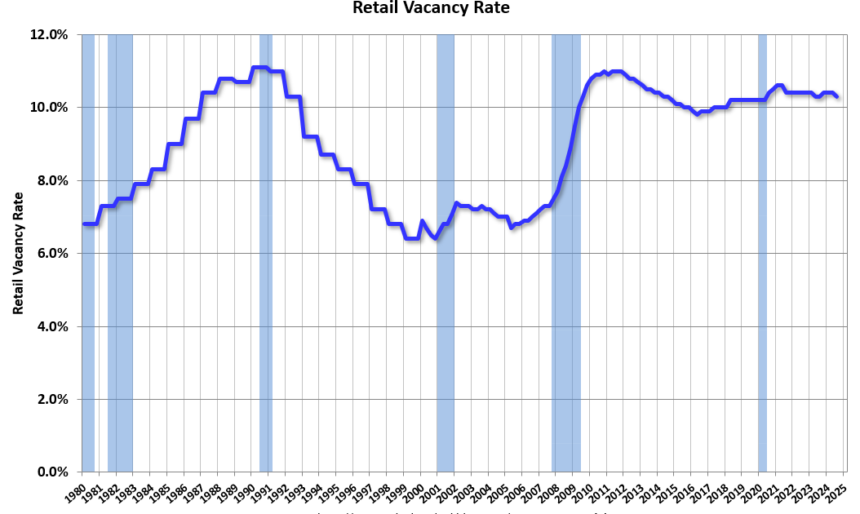

This graph shows strip mall vacancy rates since 1980 (data prior to 2000 are annual).

This graph shows strip mall vacancy rates since 1980 (data prior to 2000 are annual).The mid-2000s saw an increase in investment in malls as mall builders followed the “rooftop” (looser financing) of the housing boom. This caused vacancy rates to rise even before the recession began. Then, vacancy rates rose sharply during the recession and financial crisis.

Vacancy rates have remained fairly stable and high recently as online shopping continues to impact physical stores.