by calculated risk 10/09/2024 03:35:00 PM

From the Association of American Railroads (AAR) railway time indicator. Graphs and excerpts are reproduced with permission..

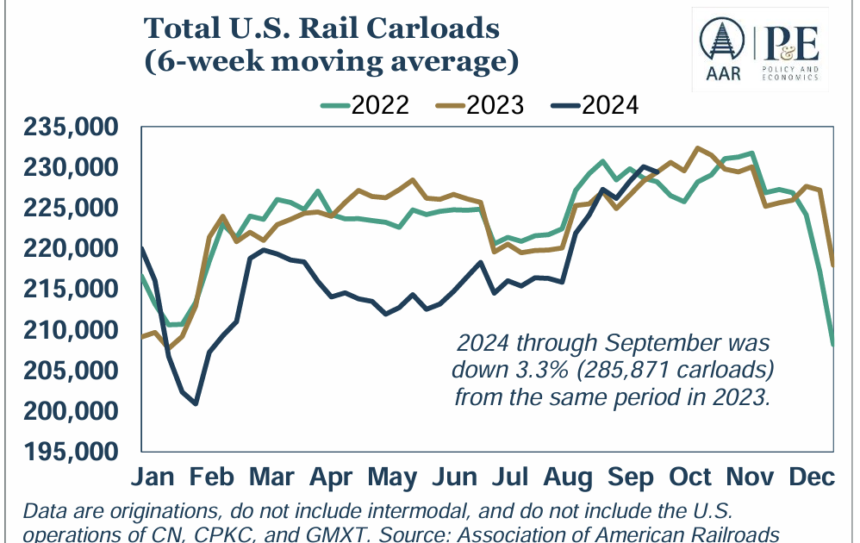

Year-to-date total vehicle loads in 2024 through September were down 3.3% (285,871 vehicles) year over year and down 3.0% compared to the first nine months of 2022. 2024 So far, total vehicle payload has decreased year-on-year each year. Months except August. … U.S. intermodal transportation from the beginning of 2024 to September was 10.2 million vehicles, an increase of 9.5% (882,064 vehicles) from last year and the fourth highest January-September total on record.

Emphasis added

This graph is Railway time indicator report shows the six-week average of vehicle loads over the past three years. Total cargo capacity in September was down 0.5% compared to the previous year.

Vehicle loads excluding coal were more promising, increasing by 2.9% in Q3 2024 compared to Q3 2023, suggesting continued demand for rail transport. Excluding coal, total vehicle loads in the first nine months of 2024 increased by 1.4% (86,782 vehicles) compared to the same period in 2023.

U.S. intermodal transport origins in September 2024 increased by 10.7% (108,257 containers and trailers) compared to September 2023, marking more than one consecutive year of year-over-year growth. Intermodal transportation in Q3 2024 increased by 11.0% compared to Q3 2023, the largest year-over-year increase for a quarter since Q2 2021. The average number of intermodal transportation calls in the third quarter of 2024 was 274,500. Only in 2018 did the third quarter for integrated intermodal transportation fare better.

Note: Rail traffic was low even before the pandemic.. The AAR noted that in 2019, “trade tensions and a decline in manufacturing output led to a decline in rail traffic.”