Eve is here. Mr. Wolf’s scenario for inflation is interesting, but given the flurry of data revisions and unexpected forecasts, is what the official report currently portrays more accurate than what appeared to be released a month ago? It’s natural to have doubts. We welcome your thoughts on the situation in your region and industry.

However, even if inflation worsens (which is likely to happen regardless of the trajectory of the U.S. economy if oil prices rise significantly and remain high as a result of the escalation of conflict in the Middle East), stagflation is inevitable. It seems that there is. Higher interest rates discourage borrowing and reduce the valuation of companies with long-term and/or speculative returns, namely technology in particular. That means less investment. The second way that inflation inhibits investment is that, above a certain level (which historically seems to be between 6% and 7%), the meaning of financial statements begins to be called into question. This is because each item inflates at a different rate, and the differences are important. When I was growing up, choices like whether to use LIFO or FIFO accounting for inventory were important.

This created uncertainty as to whether the reported cash flows accurately represented the health of the company (e.g., using historical asset values for depreciation expense could reduce the need for ongoing capital expenditures). may be underestimated). That uncertainty had the effect of increasing investors’ demands for returns, pushing down stock valuations overall.

These considerations ignore how inflation, especially inflation of necessities such as food and fuel, is politically destabilizing.

This means that even if the economy gets too hot, it will eventually self-correct. However, the result may still be stagflation rather than recession.

Written by Wolf Richter, Wolf Street Editor. It was first published in wolf street

When the Fed lowered interest rates on September 18, it focused on labor market data showing that job creation had suddenly slowed to weak levels, with decent consumer spending data, decent income growth, and very We also paid attention to the state of savings, which has fallen sharply. rate. And the trend seemed terrible.

But a revised version and new data arrived 11 days after the Fed’s decision. And the whole scenario changed.

So, at a summary level, economic growth in three of the last four revised quarters was well above the 10-year average of inflation-adjusted GDP growth of about 2.0%.

- Q3 2023: +4.4%

- Q4 2023: +3.2%

- Q1 2024: +1.6%

- Q2 2024: +3.0%

The third quarter also looks pretty strong. The Atlanta Fed’s GDPNow estimate of real GDP growth for the third quarter is now 3.2%, with consumer spending contributing 2.2 percentage points and nonresidential capital spending contributing 0.9 percentage points.

Regarding hurricanes and tornadoes that caused so much destruction and fear, weekly unemployment claims in affected areas temporarily dropped as workplaces temporarily closed and people found it difficult to get to work. There will be a sharp increase in the unemployment rate. . However, the United States has experienced the horrors of hurricanes and tornadoes many times. What quickly follows is a spending and investment boom from cleaning, replacing, and rebuilding, all of which contribute to employment and economic activity.

A number of significant upward revisions were made after the Fed meeting.

Consumer income, savings rate, spending, GNI, GDP The upward revision was made on September 27, 11 days after the Fed’s interest rate cutting meeting.

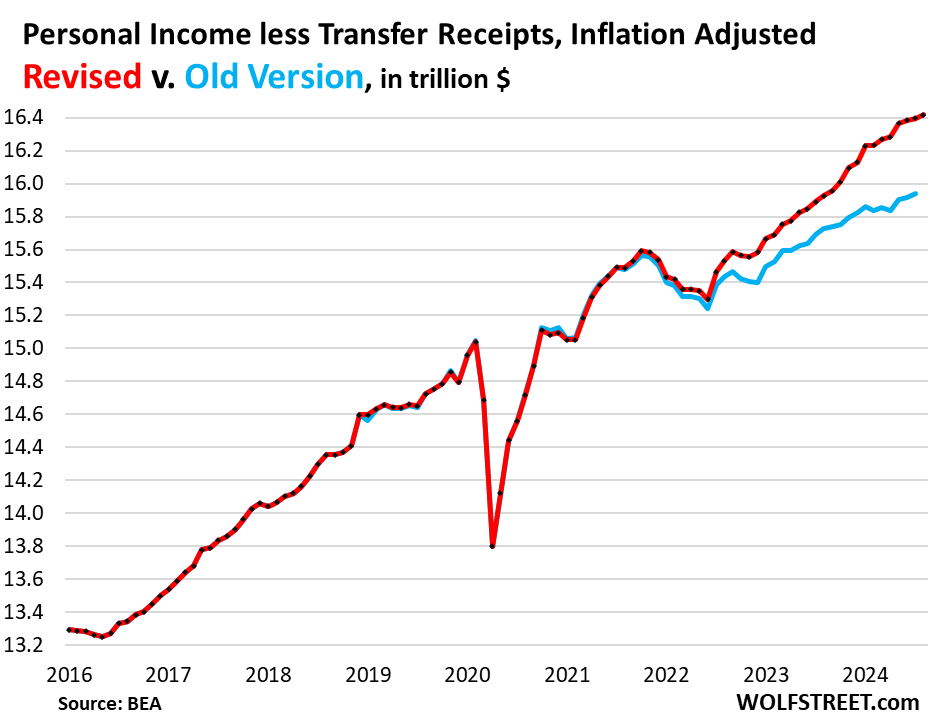

of Annual revisions to consumer income and savings rates were significant. This time, going back to 2022, consumer spending was also revised upward, but not by much.

These massive upward revisions to income and savings rates solve the mystery of why consumers are holding out so well. Then, the GDP growth rate was revised upward slightly and the GNI growth rate was revised upward significantly, bringing the growth rates of GDP and GNI (gross national income) back to the same level.

The scale of the reform is staggering, and we are now talking about a massive influx of legal and illegal immigrants, estimated by the Congressional Budget Office to total about 6 million in 2022 and 2023, and even more in 2024. We speculated that the 2020 market would finally be gaining acceptance in 2020. Part of the data. A large proportion of them participate in the labor force, and many of them work, earn money, and spend money, thereby increasing income and expenditure data.

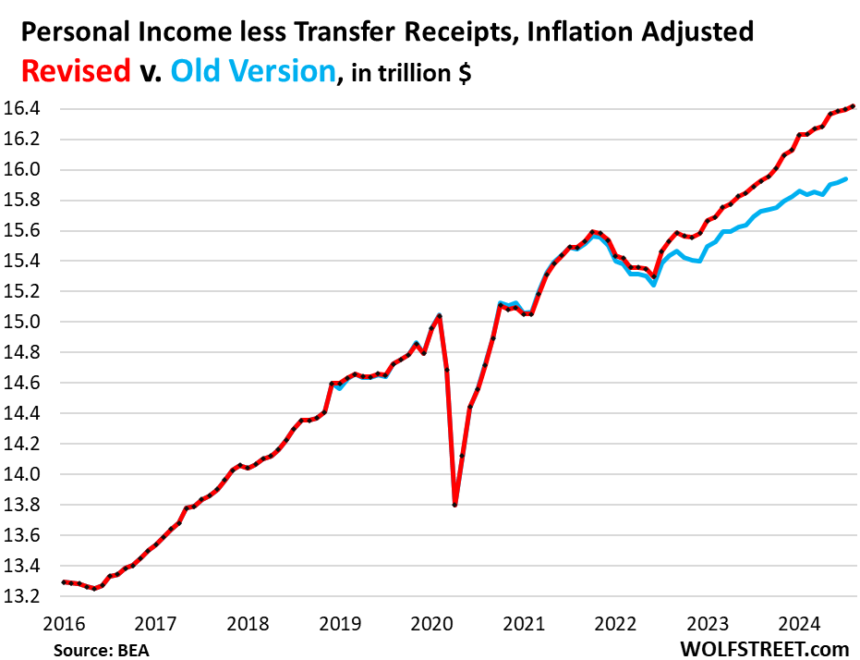

No transfer receipts (i.e., no government payments to individuals, such as Social Security, Veterans Affairs, Unemployment Insurance Compensation, or Welfare) for two years from July 2022 to July 2024, adjusted for inflation. Personal income is as follows.

The revision to the savings rate is important because it shows that consumers are spending significantly less than they would have spent retroactively to 2022 and saving the rest, which bodes well for future consumption. It will be.

Savings rates (the proportion of disposable income that consumers do not spend) have been revised upward in surprising ways, as incomes have been revised upwards and spending has been revised upwards, but to a lesser extent. The adjusted savings rate in July was 4.9%. . The previous version of the savings rate for July was just 2.9%.

We’ve seen the expansion of cash accounts such as CDs, money market funds, and Treasury bills, and we’ve seen households not only have a lot of cash, but continue to increase their cash holdings. And this continued expansion of cash holdings, A better signal of consumer health than anemic savings rate. This has now been borne out by major revisions to savings rates dating back two years.

Non-agricultural employment figures have been revised upward. It’s October 4th, 16 days after the Fed meeting.

The Fed’s main reason for the 50 basis point cut was the sudden deterioration in nonfarm employment data. The three-month average of salaried jobs created slowed dramatically in July and August, due in part to downward revisions to earlier data. , we noted that at the time, it was a disconcerting sight.

However, this headline emerged after the previous statistics were revised upward in response to the strong employment report for September. OK, forget it. This is a false alarm. The labor market is doing well. Last month’s bad news has been corrected and wages have jumped. Is there a need for further interest rate cuts?

“The distortions of the pandemic and the sudden entry of millions of hard-to-trace immigrants into the labor market are wreaking havoc on data accuracy,” the subtitle said. There’s no such thing as data flogging.

Also, another mystery has been solved. The weak jobs report for July and August was not matched by other jobs numbers that were much better.

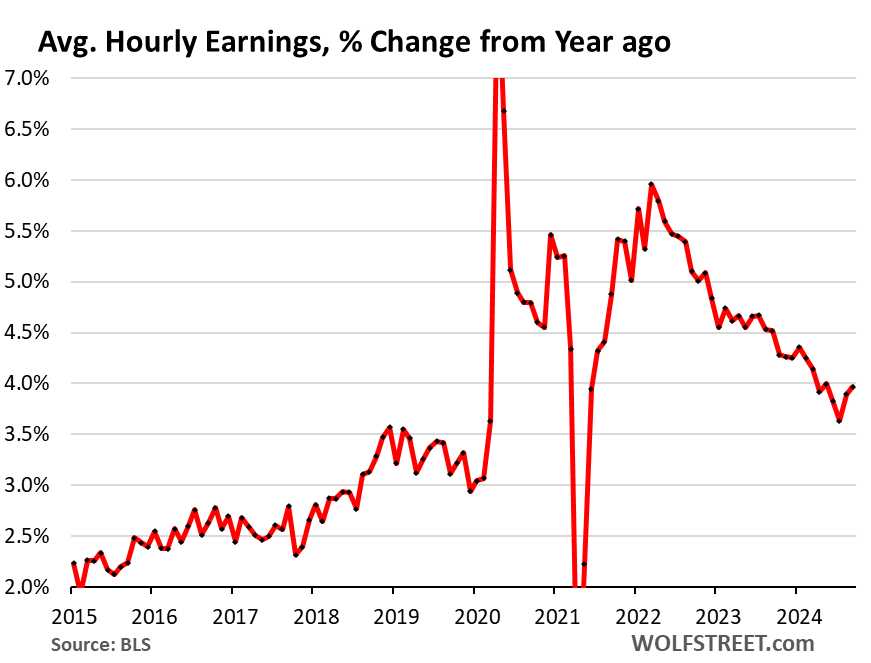

Hourly wage growth was also revised upward, with the revised three-month average earnings growth rate rising to an annual rate of 4.3%.

The year-on-year comparison in September rose to 4.0%, exceeding the same month last year for the second consecutive month. The combined growth rate for the past two months is the largest two-month period since March 2022, and is well above the peak from 2017 to 2019.

“So this accelerating wage growth is no longer going in the right direction when it comes to inflation, and what the Fed is concerned about,” we said at the time.

Therefore, inflation is no longer moving in the right direction.

Energy prices have plummeted, obscuring problems other than energy.

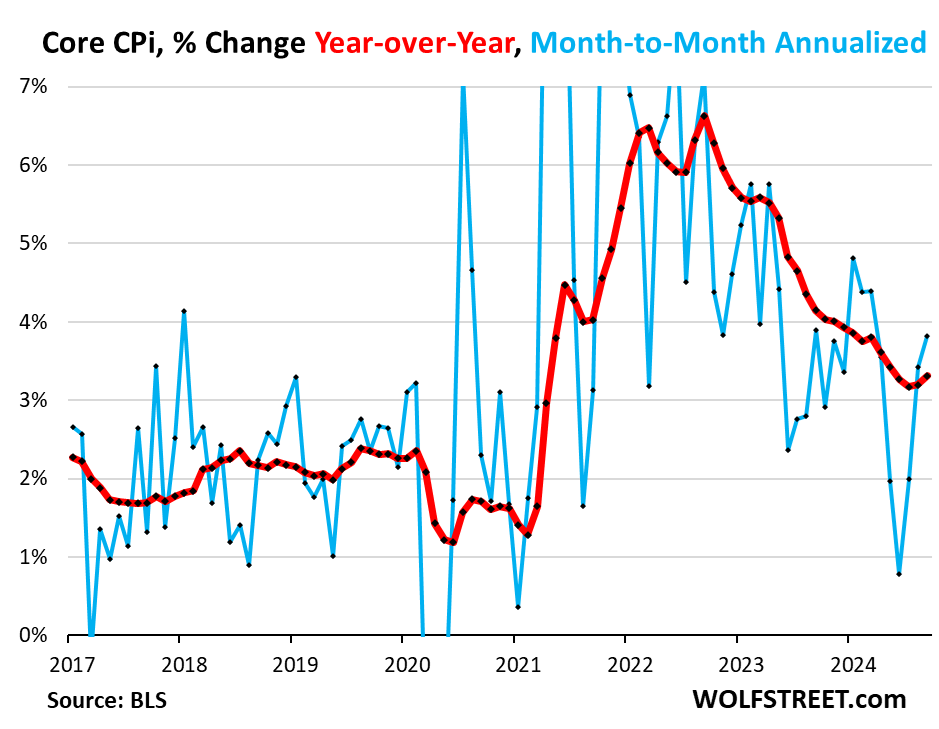

Core CPI excluding energy products and services and food accelerated for the third straight month in September to +3.8% annualized (blue line), which accelerated the 12-month rate to 3.3% (red line) I did.

Inflation in the service industry turned out to be stagnant. And for some cars, the price of used cars has fallen, which has been a major factor pushing down core CPI since mid-2022. But they made a U-turn in September and headed for greater heights (see for more information)Behind the scenes of CPI inflation”).

This is not the rampant inflation of two years ago, it’s much lower than that, and while the Fed has been successful in bringing inflation down, it’s still accelerating again because inflation is still too high to begin with.

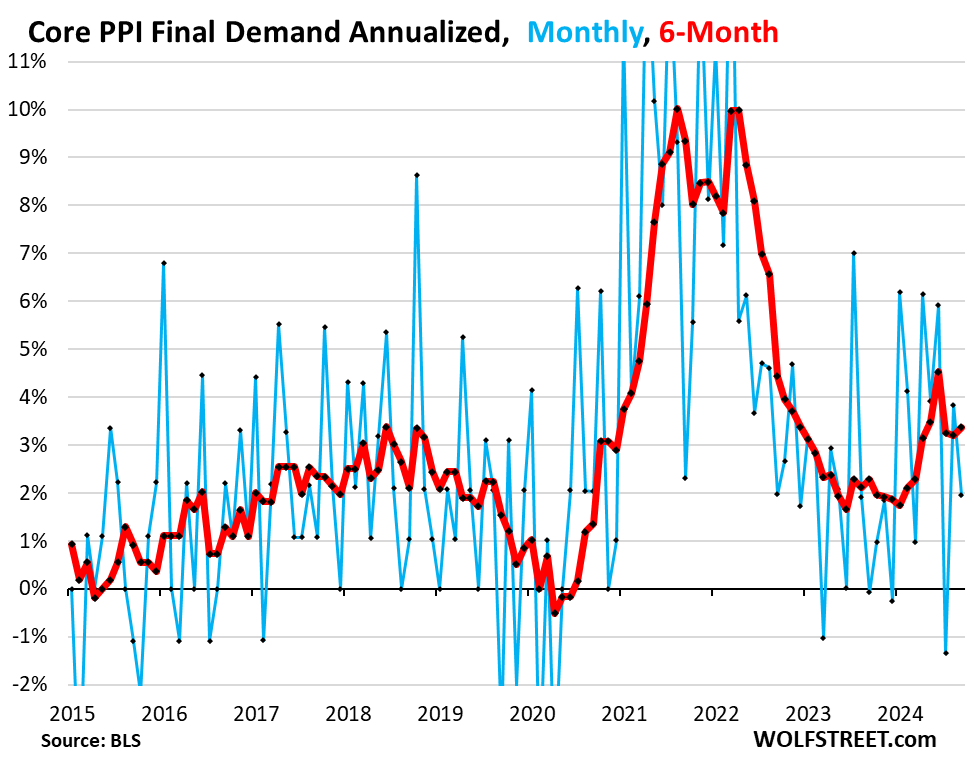

Beyond the sharp decline in energy prices, producer-level inflation has been trending in the wrong direction throughout the year due to an acceleration in services inflation after last year’s positive indicators.

And on Friday, Core producer price index deteriorated significantly due to significant upward revision This accelerated the 6-month average (red) to +3.4% annualized in September. Last year, it was hovering well around the 2% line.

Fed policy rates remain well above inflation

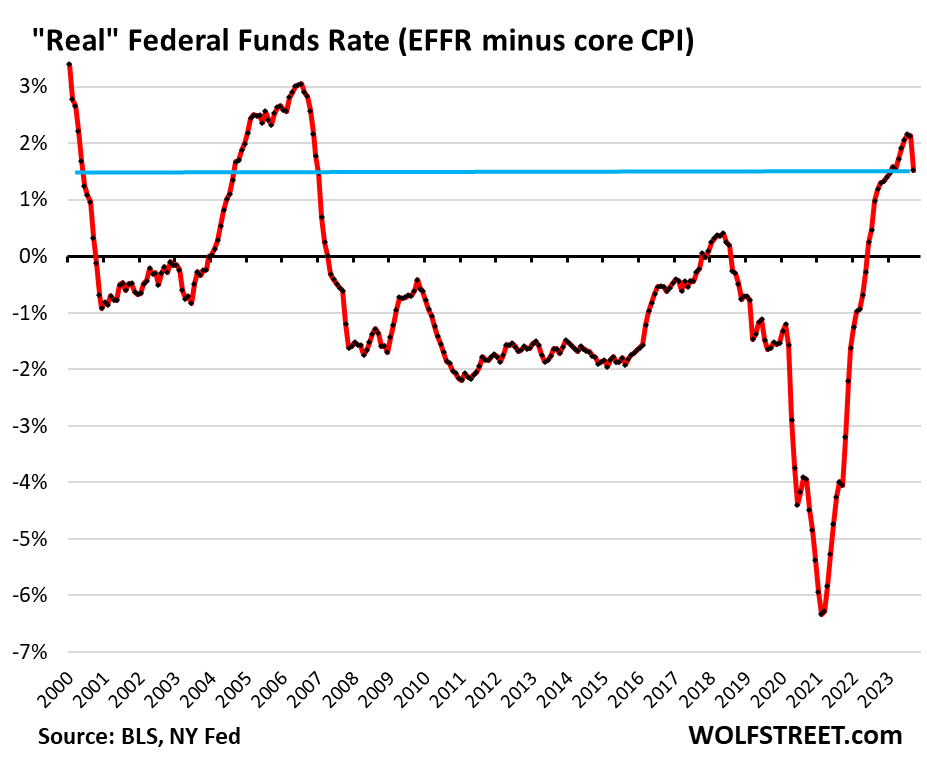

The effective federal funds rate (EFFR), the Fed’s policy rate target, fell to 4.83% after the rate cut, which is about 1.5 percentage points above the 12-month core CPI inflation rate. EFFR minus core CPI represents “real” EFFR adjusted for core CPI inflation.

The zero line marks the point where EFFR equals core CPI. In the post-crisis ZIRP era, the real EFFR spent most of its time in negative territory. In 2021, real EFFR fell to a historically deep negative level as inflation exploded and the Fed continued to keep interest rates near 0% and conducted $120 billion in quantitative easing per month. The Fed called this phenomenon “transitory” and we called the Fed “the most reckless Fed in history” (Google it for fun).

The Fed’s assumption is that a policy rate significantly above the inflation rate is above the theoretical “neutral” rate and therefore “restrictive.”

Fed directors disagree about where the neutral rate is, and since it is only a notional rate, no one knows, so they also disagree about how restrictive the current policy rate is. are divided, but agree that it is restrictive, at least for some people. range.

However, what we are seeing in economic indicators is that policy rates may not be restrictive after all, and that “neutral” rates may be higher.

The signal still diverges

Some sectors have been particularly hard hit by rising interest rates. Commercial real estate has been in recession for two years. CRE, which went into a frenzy during ZIRP, is currently in a difficult financial situation. But it may help squeeze out the excess and reprice real estate within what makes economic sense.

After a boom in industrial goods during the pandemic, manufacturing is trending flat at a high level.

But other sectors, including consumer, are booming and rising even higher.

At the far end of the high flyers, AI’s spectacular bubble has sparked a huge investment boom, fueling an apparently insatiable demand for specialized semiconductors from building power plants and data centers to stimulating employment and even office rentals. and stimulated a wave of corporate spending and investment. , a wave of venture capital investment in startups that include AI in their descriptions. As it relates to the AI bubble, interest rates appear to be very exciting.

Given the current rate of inflation (12-month core CPI is 3.3%) and the Fed’s policy rate before the cut was 5.25% to 5.5%, it makes sense to cut rates to bring them closer to inflation. But, the goal is to keep it well above the inflation rate.

The media, not the Fed, declared victory over inflation.

The problem arises when inflation accelerates consistently. Chairman Powell and the Fed’s board members have repeatedly pointed out this risk. They are well aware of this risk. They are concerned that inflation will once again continue to move in the wrong direction. Inflation has been trending in the wrong direction in recent months, but for a sustained acceleration we need to see more bad data, given the volatility of the data, to establish a solid trend. There will be a need. And they have concerns about it. They haven’t declared victory, or so they say. But no matter what the Fed or the data say, the media is proclaiming victory over inflation.

If inflation accelerates, the Fed could pause interest rate cuts and take another wait-and-see approach. And if the data available by the November meeting points in that direction, it would be wise to wait and see.

And if wait-and-see doesn’t stop inflation from accelerating, the Fed could raise rates again if interest rates aren’t restrictive enough to rein in inflation (which becomes more likely with each rate cut). Interest rate cuts are not permanent. Such scenarios are starting to appear on the horizon again.

The current situation also suggests that higher interest rates may actually be good for the economy as a whole, especially in the long run, including because a significant cost of capital fosters better, more disciplined, and more productive decisions. It suggests something.