Embedded financing is rapidly emerging as the preferred method of accessing credit in India, and this trend is expected to accelerate in the coming years.

In a survey conducted by Visa, reveal Approximately two-thirds of consumers and micro, small and medium-sized businesses (MSBs) in the country are more likely to switch to a provider offering embedded financing solutions, with interest particularly among those who have used embedded financing in the past. significant and showing positive results. Experience drives continued engagement.

The survey, which covered 693 MSBs and over 1,065 consumers in India, found that 65.9% of Indian consumers and 69.6% of MSBs would ditch their current financial services provider for an embedded lending solution. found to be very likely or very likely to switch to a financial services provider.

These percentages are even higher for consumers and MSBs with embedded lending experience. Among local consumers who recently used embedded financing, 79% are likely to switch to a provider that offers embedded financing options.

For MSBs, the share is even higher at 82%. These data not only show that familiarity with embedded lending increases the likelihood of continued usage and a positive customer experience, but also that industry players can build familiarity to acquire and retain customers. suggests that there is a need.

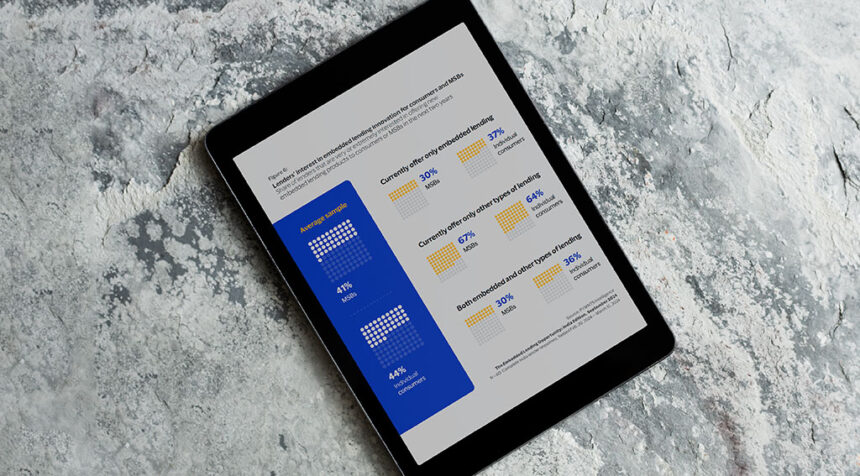

Across India, lenders are realizing the opportunities that embedded lending presents. 44% of financial institutions surveyed said they were very or very interested in rolling out new embedded lending products for consumers. 41% indicated the same for MSB. Approximately two-thirds of lenders that do not currently offer embedded lending have expressed strong interest in starting embedded lending, making embedded lending a key enabler for these providers to remain competitive. It shows that you are thinking about something important.

Adoption of embedded financing in India

PYMNTS Intelligence conducted a study across six global markets and found that India has one of the highest adoption rates of embedded lending in the world. In the past three months, 15% of Indian consumers reported taking advantage of embedded financing, ranking second among the countries surveyed after the US at 17%.

Adoption is particularly strong among several key segments, with Generation X (born between the mid-1960s and early 1980s) and Generation Z (born between 1996 and 2010) I’m in the lead. 20% of Gen X consumers report using embedded financing recently, compared to 18% of Gen Z consumers. These percentages are higher than the national average.

Adoption among MSBs in India is even more pronounced, with 37% of respondents reporting having used embedded financing in the previous year, the highest rate across the countries surveyed. Specifically, use is particularly high among small and medium-sized enterprises (SMEs), with companies with revenues between INR 46 million (US$547,000) and INR 832 million (US$10 million) accounting for 52% of embedded loans. It has emerged as the most prominent business user.

PYMNTS Intelligence attributes this high penetration rate to India’s rapid and widespread adoption of smartphones and the internet, as well as its relatively underdeveloped traditional financial services sector. These factors have enabled the country to leapfrog developed markets in the adoption of embedded financing, the report said.

The study also highlights the impact of cash flow stability on the use of embedded financing by both consumers and MSBs. For consumers, 21% of respondents with unstable cash flow said they had used embedded financing in the past three months, which was 38% higher than the consumer average. For MSBs, this trend is even stronger, with 49% of companies with volatile cash flows using embedded lending in the last year. This is 34% more than the MSB average and the highest of the six markets surveyed.

The findings show that embedded financing is becoming a lifeline for businesses dealing with unstable or fluctuating income streams, allowing them to maintain operations even when traditional banking solutions are less available or timely. It suggests that it will enable you to do business or meet financial obligations.

Challenges and barriers

Despite growing interest and adoption, this study reveals several challenges faced by consumers and MSBs when accessing embedded financing.

For consumers, the most frequent problem with embedded financing is unrelated offers, with 73% of people who recently used embedded financing reporting this issue. Other common issues for consumers include privacy and security concerns (35.3%) and friction in the application process (30.5%).

The application process was the most frequently cited pain point for MSBs, experienced by 65.1% of local MSBs who recently took advantage of embedded financing. This was followed by concerns about credit options and availability (62.4%), cost (51%), and repayment issues (49%).

Featured image credit: Edited from freepic