by calculated risk October 26, 2024 08:11:00 AM

Boo!

This week’s major reports are preliminary estimates of third-quarter GDP and October employment statistics.

Other key indicators include personal income/expenditures and PCE prices in September, Case-Shiller home prices in August, ISM manufacturing and services index in October, and automobile sales in October.

—– Monday, October 28th —–

10:30am: Dallas Fed Manufacturing Activity Survey For October. This will be the last regional Fed survey in October.

—– Tuesday, October 29th —–

9 a.m. ET: S&P/Case-Shiller Home Price Index For August. The consensus is for the Composite 20 index to rise 6.0% year over year.

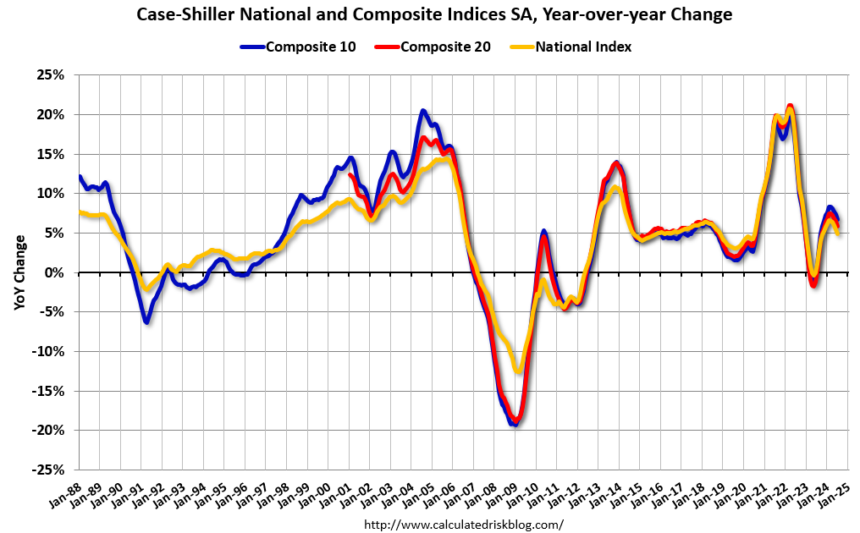

9 a.m. ET: S&P/Case-Shiller Home Price Index For August. The consensus is for the Composite 20 index to rise 6.0% year over year.This graph shows the year-over-year change in the Nominal Seasonally Adjusted National Index, Composite 10 Index, and Composite 20 Index through the most recent report (Composite 20 started in January 2000).

9am: FHFA Home Price Index For August. Originally it was a repeat sale only for GSE, but there is also an expanded index.

This graph shows the number of jobs from JOLTS (black line), hires (purple), layoffs, layoffs and other (red column), and terminations (light blue column).

The number of job openings in August increased to 8.04 million from 7.71 million in July.

The number of job openings (for black people) decreased by 14% from the previous year. Retirees decreased by 14% compared to the previous year.

10am: Q3 Vacant housing and home ownership Report from the Census Bureau.

—– Wednesday, October 30th —–

7:00 a.m. ET: Mortgage Bankers Association (MBA) Mortgage loan purchase application index.

8:15am: ADP Employment Report For October. This report is for private payroll only (not government). The consensus was for 108,000 jobs to be added, down from 143,000 in September.

8:30am: Gross Domestic Product, Q3 2024 (Advance Estimates). The consensus is that real GDP grew at an annual rate of 3.0% in the third quarter, unchanged from 3.0% in the second quarter.

10am: Pending Home Sales Index For September. The consensus is for a 1.0% decline in the index.

—– Thursday, October 31st —–

8:30am: First weekly unemployment claim The report will be published. The consensus was 230,000 initial claims, up from 227,000 last week.

8:30 a.m. ET: personal income and expenses For September. The consensus is that personal income will increase by 0.4% and personal spending will increase by 0.4%. And the core PCE price index will increase by 0.3%. PCE prices are expected to rise 2.1% year-on-year, and core PCE prices are expected to rise 2.6% year-on-year.

9:45am: Chicago Purchasing Managers Index For October. The consensus is expected to be 46.0, down from 46.6 in September.

—– Friday, November 1st —–

8:30am: employment report For October. The consensus is that employment will increase by 120,000 people and the unemployment rate will remain unchanged at 4.1%.

8:30am: employment report For October. The consensus is that employment will increase by 120,000 people and the unemployment rate will remain unchanged at 4.1%.In September, 254,000 jobs were added, bringing the unemployment rate to 4.1%.

This chart shows the number of jobs added each month since January 2021.

10am: ISM Manufacturing Index For October. The consensus was 47.6, up from 47.2.

10am: construction expenditure For September. The consensus is that spending will remain unchanged.

Consensus is for sales of 15.8 million SAAR, unchanged from September’s 15.8 million SAAR (seasonally adjusted annual rate).

This chart shows light vehicle sales since BEA began keeping data in 1967. The dashed line is the current sales rate.