“Fighting Deepfakes and Identity Fraud – Jumio’s Holistic Approach to Building Identity Trust” and “As AI fraud is predicted to reach USD 40 billion, Jumio delivers adaptive verification.”

recent hong kong police 27 people arrested It is related to a deepfake scam that defrauded victims of $46 million. Fraudsters used AI technology to create fictitious female identities for online dating, changing their appearance and voice. The proliferation of generative AI is expected to result in the following outcomes: Fraud losses will reach US$40 billion by 2027 — While this is unique to the United States, financial institutions need to strengthen their anti-fraud strategies.

According to recent research, JumioLeading provider of automated AI-powered identity, risk signals and compliance solutions 78% of Singapore consumers believe their bank is doing enough to protect customers from deepfake-based fraud I understand that you are concerned about whether you are Consumers are switching banks due to inadequate fraud protection.

Banks are grappling with security concerns arising from AI-based fraud, as well as demands for innovation in the increasingly competitive fintech space and emerging banking startups, super apps and e-wallets resurgent across Southeast Asia. How can we strike a good balance?

Frederick Ho, vice president of Jumio in APAC, said his eKYC company has implemented advanced liveness detection to counter advanced fraud tactics such as face morphing, face swapping, and camera injection in the eKYC process. It said it is addressing vulnerabilities in its database and biometric identity verification systems against deepfakes and identity theft. . Jumio will bring its holistic approach to building identity trust to the Singapore FinTech Festival 2024 from 6 to 8 November.

Jumio’s comprehensive data hub provides access to a variety of industry-leading third-party data sources to further ensure customer identity, assess risk and automatically drive decisions in client workflows. Masu. The main risk services that Jumio checks include global IDs, social security numbers (SSNs), phone numbers, government databases, email, regional IPs, addresses, devices, and bank identification numbers (BINs).

Ho explained that identity verification can be used not only to verify new customers, but also to verify existing customers through the concept of re-KYC (the process of updating and verifying customer information to ensure compliance with KYC regulations). did.

“Regular reviews and re-KYC are typically performed annually for high-risk customers, every two years for medium-risk customers, and every three to five years for low-risk customers. Regulators are typically less concerned with low-risk customers, but some banks initiate re-examination based on high-risk behavior. and is critical to effectively combating illicit financial activities such as money laundering and terrorist financing.”

Mr. Ho said.

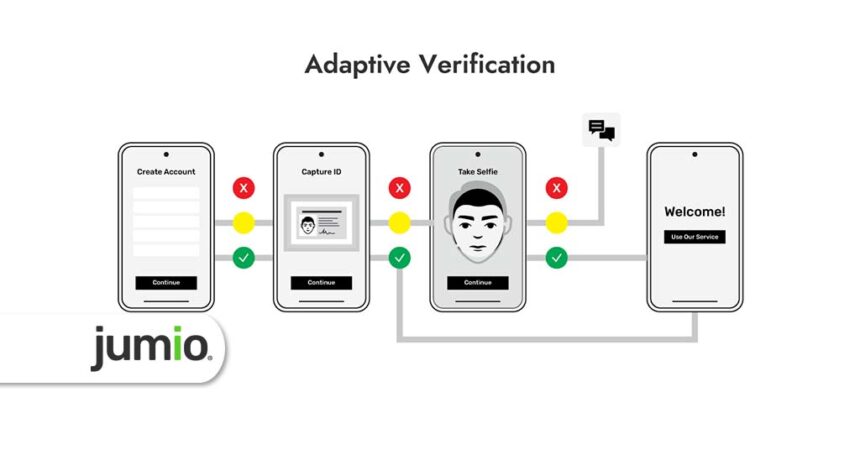

The Jumio platform provides AI-driven eKYC, risk assessment, and AML compliance services in a unified workflow to verify the identity of new and existing users, combat fraud, and help meet compliance obligations across the customer journey. Masu.

Every company is different in terms of risk tolerance, compliance requirements, and consumer expectations. The process began with the client defining the workflow and engagement rules.

“Jumio helps customers manage customer risk from the start by checking for a variety of risk signals from new customer onboarding to device risk, location, email and phone number verification, and address verification. The level of verification checks can be adjusted as the customer progresses, giving clients a comprehensive and adaptive way to combat fraud while ensuring a seamless experience for their customers. You can now build your eKYC workflow.”

Mr. Ho said.

To learn more about our latest fraud detection capabilities, visit Jumio’s SFF booth in Hall 3 at Singapore EXPO.