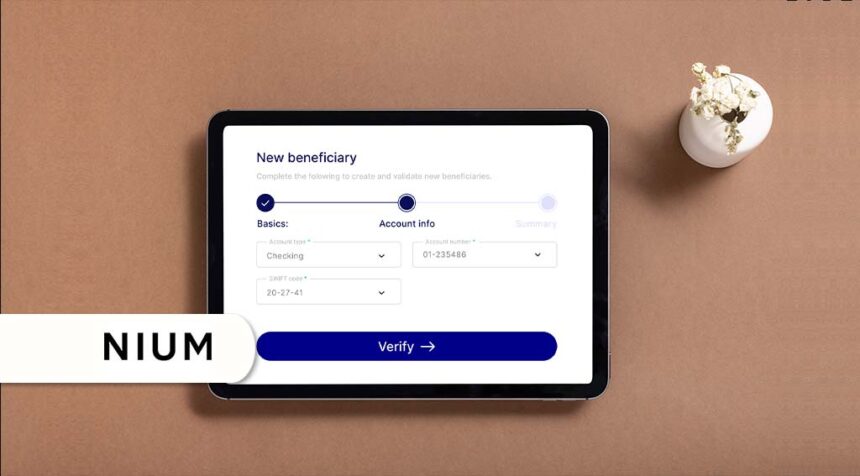

Global payment infrastructure provider nium has launched Nium Verify, a real-time bank account verification service available in 50 markets.

Designed for businesses and individuals, Nium Verify lets you instantly verify your bank account details before making a transaction.

This reduces payment failures, operational inefficiencies, and compliance risks for cross-border payments.

Payment failures cost the global economy an estimated USD 118.5 billion in 2020. This is often due to outdated and error-prone validation methods. Nium Verify provides solutions through direct integration with national clearing systems and major banks.

This real-time verification process helps prevent errors and strengthen regulatory compliance, especially in regions such as the UK and EU.

The service also streamlines marketplace onboarding by verifying account details even if payments are not processed immediately.

Nium Verify automates verification through a single API, reducing the need for manual intervention, lowering operational costs, and simplifying payment workflows.

In addition to Nium’s global payments network, this launch complements recent developments that enable financial institutions to: Connect using existing Swift features and infrastructure.

“Nium Verify comes at a critical time when companies need to expand internationally and make payments to multiple beneficiaries around the world. We provide solutions that also enhance the security and compliance of transactions across the world.

This allows businesses to confidently verify account details, eliminating costly erroneous payments, preventing fraud, and improving the customer experience. ”

Alex Johnson, chief payments officer at Nium, said:

Featured image credit: Edited from freepic