by calculated risk October 29, 2024 09:00:00 AM

S&P/Case Shiller released Monthly House Price Index for August (“August” is the three-month average of closing prices for June, July, and August).

This release includes prices for 20 individual cities, two composite indexes (10 cities and 20 cities), and a monthly national index.

From S&P S&P CoreLogic Case-Shiller Index Up 4.2% Annually in August 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, which covers all nine U.S. Census sectors, reported an annualized return of 4.2% in August.This was a decrease from the previous month’s annual rate of increase of 4.8%. For the 10 cities overall, the annual rate of growth was 6.0%, slowing down from the previous month’s annual rate of increase of 6.8%. The 20-city total increased by 5.2% year-on-year, slowing down from the 5.9% increase in the previous month. New York continued to have the highest annual growth rate among the 20 cities with an 8.1% increase in August, followed by Las Vegas and Chicago with increases of 7.3% and 7.2%, respectively. Denver had the lowest year-over-year growth rate of 0.7%.

…

Before seasonally adjusted, the upward trend of the U.S. National Index, 20 City Composite Index, and 10 City Composite Index reversed in August, with the national index decreasing by -0.1%, and the 20 City Composite Index and 10 City Composite Index decreasing by -0.3%. Ta. This month’s return is -0.4% respectively.The seasonally adjusted U.S. national index rose 0.3% from the previous month, the 20-city composite index rose 0.4% from the previous month, and the 10-city composite index rose 0.3% from the previous month.

“Home price growth is starting to show signs of strain.”this is the slowest annual increase in mortgage rates since they peaked in 2023,” said Brian D. Luke, CFA, Head of Commodities, Real Assets and Digital Assets. “As students return to school, home buyers appear to be less motivated to push the index higher than they were in the summer. Over the past six months, prices have continued to decelerate, with increases below the long-term average of 4.8%. After smoothing the data to account for seasonality, home prices continued to reach record highs for 15 consecutive months.

“Regionally, all markets remain positive.” Luke continued. “Denver had the lowest annual growth rate of all markets this year, lagging behind Portland for the first time since the spring.The Northeast remains the best-performing region, with a Currently, New York, Las Vegas, and Chicago are the only markets that are experiencing record highs. This highlights a slight advantage in the home price market, with higher growth in the Northeast and West than in the South, with blue states outpacing red states starting in July 2023.

Emphasis added

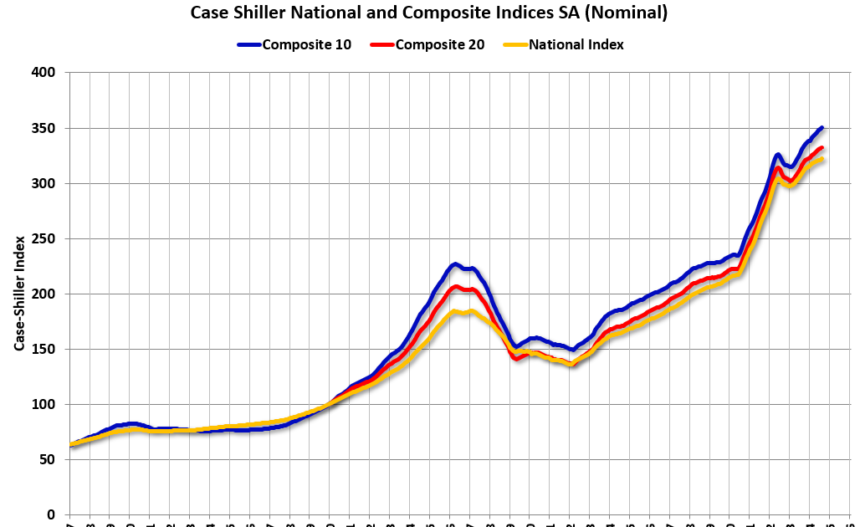

The first graph shows the nominal seasonally adjusted Composite 10 Index, Composite 20 Index, and National Index (the Composite 20 Index was launched in January 2000).

The Composite 10 Index rose 0.3% in August (SA). The Composite 20 Index rose by 0.4% (SA) in August.

The US index rose 0.3% (SA) in August.

Composite 10 SA was up 6.0% year over year. Composite 20 SA rose 5.2% year over year.

The national index SA rose 4.2% year-on-year.

Annual price changes were close to expectations. I’ll eat more later.