by calculated risk October 30, 2024 07:00:00 AM

From MBA: Mortgage applications drop in latest MBA weekly survey

According to data from the Mortgage Bankers Association’s (MBA) Weekly Application Survey for the week ending October 25, 2024, the number of mortgage applications decreased by 0.1% from the previous week.

The market composite index, which measures the number of home loan applications, fell by 0.1% from a week ago on a seasonally adjusted basis. On an unadjusted basis, the index decreased by 1% compared to the previous week. The refinance index fell 6% from the previous week and rose 84% compared to the same week last year. The seasonally adjusted purchasing index increased by 5% compared to a week ago. The unadjusted purchasing index increased by 4% compared to the previous week; 10 percent increase compared to the same week one year ago.

“Mortgage applications were essentially flat last week as interest rates rose for the fourth time in five weeks due to bond market volatility ahead of the presidential election and the next FOMC meeting. 30-year fixed rates 6.73%, the highest level since July 2024,” said Joel Kang, MBA Vice President and Principal Deputy Economist. “After a brief spike in activity in September when interest rates fell by about 60 basis points, a rebound in refinances led to a 27% decline in overall applications.Government refinances accounted for most of the decline, compared to last week. It decreased by 12%.”

Kang added: “Purchase offers increased compared to the holiday-shortened week, up 10% year-over-year. Short-term purchase offer activity has weakened, but as inventory for sale gradually declines. , we continue to expect housing demand from younger homebuyers to support purchase growth in the coming years.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased from 6.52% to 6.73%, with the 80th percentile point going from 0.64 to 0.69 (including origination fees). Loan to Value (LTV)

Emphasis added

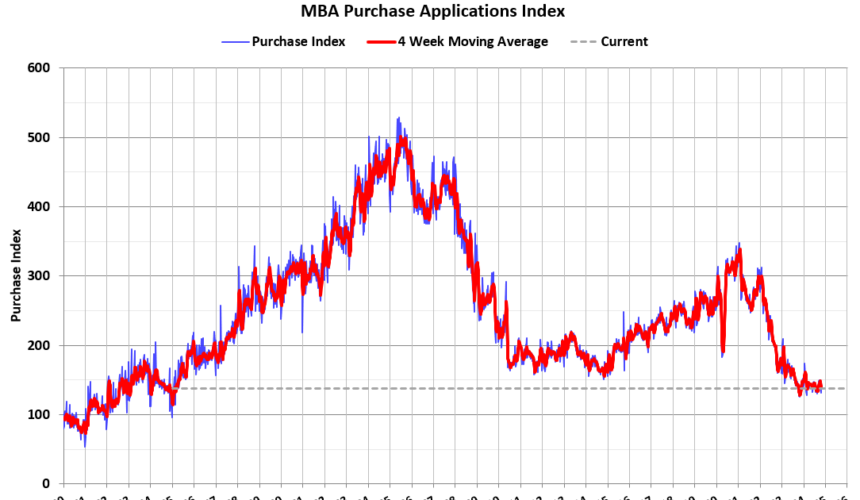

The first graph shows the MBA Mortgage Purchase Index.

According to M.B.A. Purchasing activity increased by 10% YoY Unadjusted.

Red is the 4-week average (blue is weekly).

Purchase application activity is up about 10% from its lowest level in late October 2023, but remains about 9% below its lowest level during the housing crisis.

Due to rising mortgage rates, the refinance index rose significantly last month as mortgage rates fell, but has declined over the past five weeks as interest rates have risen again.