Lars Svensson argued that monetary policymakers should “target forecasts,” meaning they should set policy where they expect it to lead to on-target inflation.

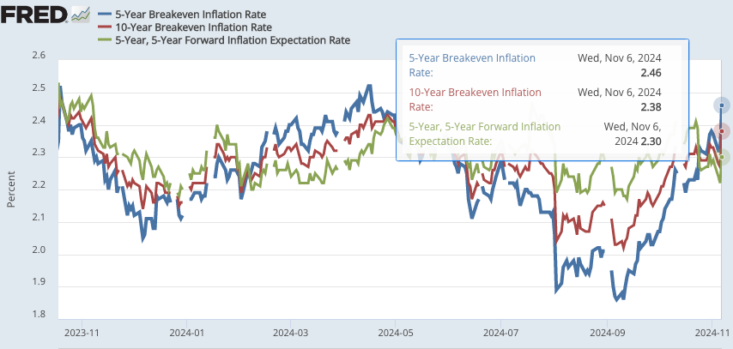

Some high inflation figures in early 2024 raised concerns that we were not on track for a soft landing. Inflation eased at the end of the year, and the Fed began cutting interest rates in September. But in recent weeks, the five-year inflation break-even point has been creeping higher, jumping to 2.46% yesterday. To be clear, this interest rate differential is based on CPI, which is slightly higher than the Fed’s targeted PCE index. Nevertheless, it suggests that inflation is still expected to exceed the Fed’s 2% target. Also, despite the Fed’s dual mandate, the labor market is currently strong, and there is no justification for intentionally pushing inflation above target.

The Federal Reserve meets today to discuss monetary policy. It will be interesting to see how they respond to the recent spike in TIPS spreads. If they adhere to Lars Svensson’s goal of predictive maxims, they would be expected to tighten monetary policy.

It is also worth considering how the NGDP futures targeting regime would address this issue. In current market conditions, we expect most investors to take long positions in NGDP futures, which would force the Fed to take a fairly extreme short position, and if NGDP growth exceeds its target, the Fed will be exposed to severe losses. But I also believe that the Fed is not willing to accept that risk and will tighten policy enough to restore confidence in financial markets.

PS. Many experts believe that the election results were largely influenced by public anger over inflation. If so, the bond market’s reaction to the election is certainly something to consider. If inflation is indeed the issue people care most about, how should the media portray the market’s reaction to the election? How did the media portray the market reaction to the election? (To be clear, inflation is not the economic issue I care about most.)

In other words, never make inferences from changes in the inflation rate.

PPS. Speaking of market predictions, Alex Tabarrok says: great new postwhich has implications far beyond election prediction markets.