by calculated risk 11/09/2024 08:11:00 AM

This week’s major economic reports are October CPI and retail sales.

This week, for the manufacturing industry, the October industrial production and November New York Federal Reserve Bank surveys will be released.

—– Monday, November 11th —–

veterans day holiday: Most banks will be closed for Veterans Day. The stock market will open.

—– Tuesday, November 12th —–

6am: NFIB Small Business Optimism Index For October.

2pm: Senior Loan Officer Awareness Survey regarding Bank Loan Practices (SLOOS) in October.

—– Wednesday, November 13th —–

7:00 a.m. ET: Mortgage Bankers Association (MBA) Mortgage loan purchase application index.

8:30am: October consumer price index From BLS. The consensus is for CPI to rise by 0.2% and core CPI to rise by 0.3%. The consensus is for CPI to rise 2.6% y/y and core CPI to rise 3.3% y/y.

11 a.m.: New York Fed: Third Quarter Quarterly Report on Household Debt and Credit

—– Thursday, November 14th —–

8:30am: First weekly unemployment claim The report will be published. The consensus was 255,000 initial claims, up from 221,000 last week.

8:30am: October producer price index From BLS. The consensus is for PPI to rise 0.3% and core PPI to rise 0.2%.

3pm: Speech by Federal Reserve Chairman Jerome Powell, economic outlookin a meeting with Federal Reserve Chairman Jerome Powell, Dallas, Texas.

—– Friday, November 15th —–

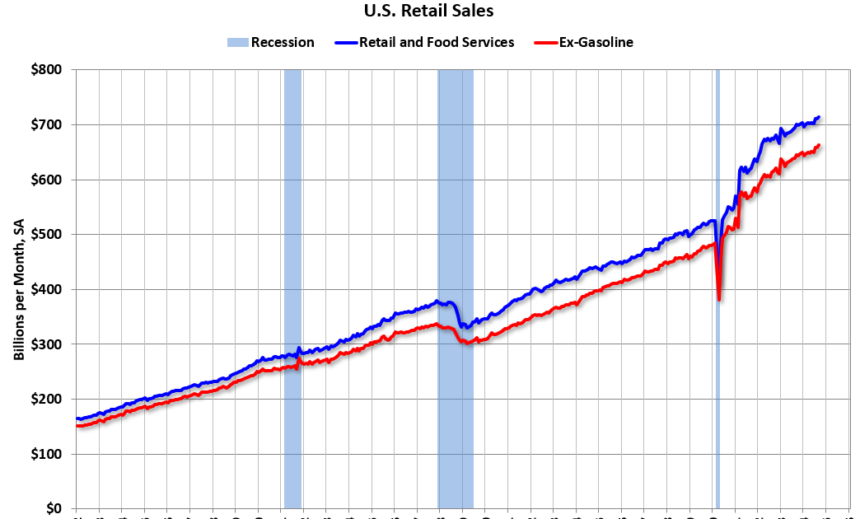

8:30 a.m. ET: retail sales The October edition will be released.

8:30 a.m. ET: retail sales The October edition will be released.The consensus is for retail sales to increase by 0.3%.

This graph shows retail sales since 1992. This is seasonally adjusted monthly retail sales and food services (totals and excluding gasoline).

8:30 a.m.: New York Fed Empire State Manufacturing Survey For November. Consensus is expected at 3.5, up from -11.9.

This graph shows industrial production since 1967.

The consensus is for industrial production to decline by 0.2% and capacity utilization to fall to 77.3%.