by calculated risk November 13, 2024 07:00:00 AM

From MBA: Mortgage applications increase in latest MBA weekly survey

According to data from the Mortgage Bankers Association’s (MBA) Mortgage Applications Weekly Survey for the week ending November 8, 2024, the number of mortgage applications increased 0.5% from the previous week.

The market composite index, which measures the number of mortgage loan applications, rose 0.5% from a week ago on a seasonally adjusted basis. On an unadjusted basis, the index decreased by 2% compared to the previous week. The refinance index fell 2% from the previous week and rose 43% compared to the same week last year. The seasonally adjusted purchasing index increased by 2% compared to a week ago. The unadjusted purchasing index decreased by 2% compared to the previous week; 1 percent increase compared to the same week a year ago.

“Mortgage rates continued to rise last week, driven by rising U.S. Treasury yields, as financial markets digested the expected impact of the Trump presidency. A 25 basis point Fed rate cut was already expected. , it had little impact on moving the market,” said Joel Kang, MBA vice provost and principal deputy economist. “Last week, the 30-year fixed rate hit 6.86%, the highest level since July 2024. However, despite the rate increase, the number of applications increased for the first time in seven weeks.”

Additionally, Kan added, “Purchase offers have rebounded and remained near year-ago levels. FHA and VA purchase offers led overall purchase activity, increasing 3% and 9%, respectively. FHA mortgage rates bucked the overall trend and fell throughout the week, which may have helped some borrowers, while higher interest rates led to a slight increase in refinance activity. It has fallen to its lowest level since May 2024.

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased from 0.68 to 0.60 percentage points for 80% lenders (including origination fees) and increased from 6.81% to 6.86%. . Loan to Value (LTV).

Emphasis added

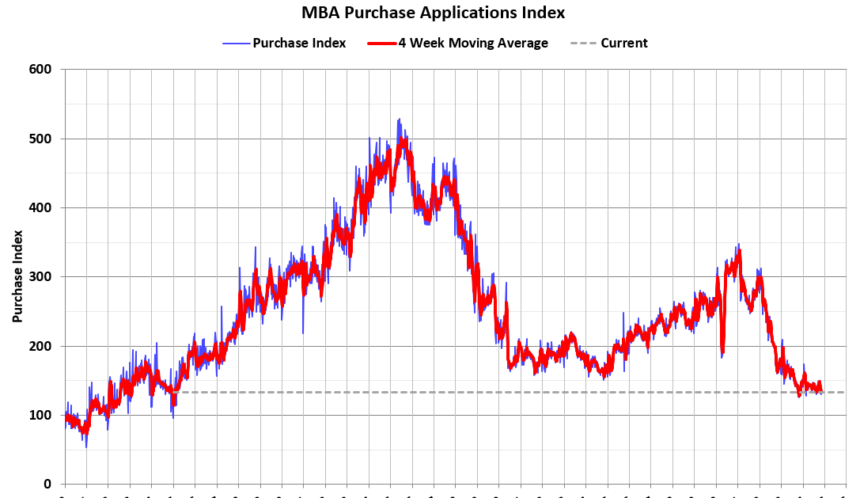

The first graph shows the MBA Mortgage Purchase Index.

According to M.B.A. Purchasing activity increased by 1% YoY Unadjusted.

Red is the 4-week average (blue is weekly).

Purchase application activity is up about 6% from its low in late October 2023, but is still about 12% below its lowest level during the housing crisis.

The refinance index rose in September as mortgage rates fell, but fell as interest rates rose again.