by calculated risk November 13, 2024 11:00:00 AM

From the New York Fed: Household debt increased moderately. Delinquency rates remain high

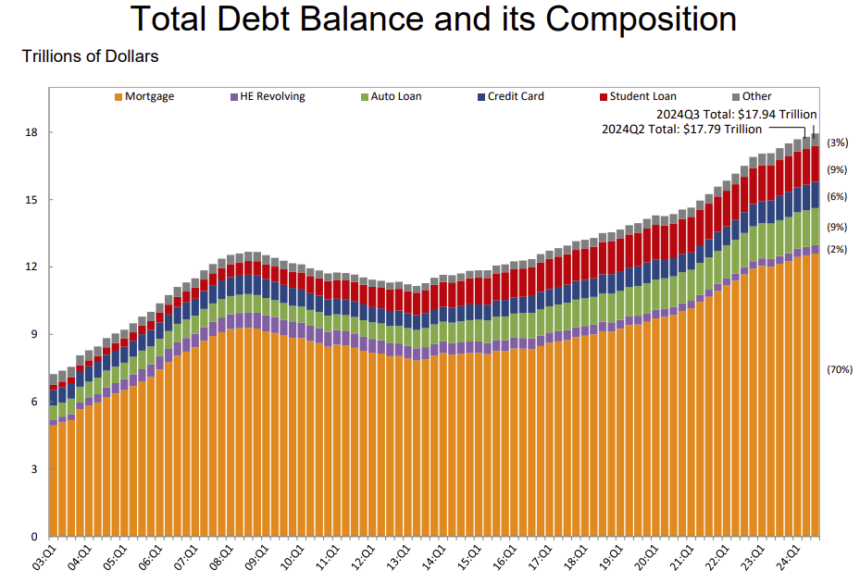

The Federal Reserve Bank of New York’s Microeconomic Data Center today announced that Quarterly report on household debt and credit. The report shows: Total household debt increased by $147 billion (0.8%) By the third quarter of 2024, it will reach $17.94 trillion. The report is based on data from the New York Fed’s national representatives. consumer credit panel. A one-page summary of key takeaways and supporting data points.

The New York Fed also released an accompanying statement. Blog post about Liberty Street Economics We examine trends in the total debt-to-income ratio and what it suggests about Americans’ ability to manage their debt.

“Household budget balances continue to increase in nominal terms, but income growth is outpacing debt.” said Dong-hoon Lee, economic research advisor at the New York Fed. “Still, even though delinquency trends have moderated to some extent this quarter, the rise in delinquency rates reveals stress for many households.”

Home loan balances increased by $75 billion from the previous quarter, reaching $12.59 trillion at the end of September. HELOC balances increased by $7 billion, the 10th consecutive quarterly increase since Q1 2022, to $387 billion. Credit card balances increased by $24 billion to $1.17 trillion. Auto loan balances increased by $18 billion to $1.64 trillion. Other balances, including retail cards and other consumer loans, were essentially flat, increasing $2 billion. Student loan balances increased by $21 billion and now stand at $1.61 trillion.

The pace of mortgage originations increased slightly from the pace observed in the previous four quarters, with new mortgage originations of $448 billion in the third quarter. Total limits on credit card accounts increased modestly to $63 billion, an increase of 1.3% from the previous quarter. HELOC limits increased by $9 billion, the 10th consecutive quarterly increase.

Total delinquency rates increased slightly from the previous quarter, with 3.5% of outstanding debt in some stage of delinquency. Rates of transition to delinquency varied. Credit card delinquency rates improved, with 8.8% of balances now in delinquency, up from 9.1% in the previous quarter. Early delinquency rates for auto loans and home loans worsened slightly, rising by 0.2 and 0.3 percentage points, respectively. About 126,000 consumers had bankruptcies added to their credit reports this quarter, down slightly from the previous quarter.

Emphasis added

Three graphs are shown below. report:

The first graph shows that household debt increased in the third quarter. Household debt previously peaked in 2008 and bottomed out in the third quarter of 2013. Unlike after the Great Recession, debt did not decline during the pandemic.

From the New York Fed:

Total nominal household debt outstanding in Q3 2024 increased by $147 billion, an increase of 0.8% from Q2 2024. The current balance is $17.94 trillion, an increase of $3.8 trillion from the end of 2019, just before the pandemic recession.

Overall delinquency rates increased in the third quarter. From the New York Fed:

Total delinquency rates increased slightly in Q3 2024. As of September, 3.5 percent of outstanding debt was in some stage of delinquency, up from 3.2 percent in the second quarter. …Delinquency transition rates varied. Credit card delinquency rates improved, with annualized balances in arrears at 8.8%, up from 9.1% in the previous quarter. Early delinquency rates for auto loans and home loans worsened slightly, rising by 0.2 percentage points and 0.3 percentage points, respectively.

From the New York Fed:

Credit scores for newly originated auto loan and home loan borrowers improved somewhat, and credit quality for newly originated loans improved slightly. Two-thirds of new home loans were made to borrowers with credit scores above 760, while 37% of auto loans were made to borrowers in the highest credit score group, making it a long-term It remains slightly below its high level.

There are many others report.