Eve is here. Angry Bear’s Bill Haskell offered his services summarizing an important Wall Street Journal article on the shortcomings of Medicare Advantage plans. I was careless not to cover this article at the time, and am grateful to Haskell for bringing it more attention.

Despite all the hype about extra services and no-premium plans, it is not well understood that Medicare Advantage plans are a second tier of coverage. Medicare is divided into Traditional Medicare, which generally provides fairly comprehensive coverage, although it costs a little more, and Medicare Advantage, which has a simpler network and more gatekeeping to limit the delivery of care, among other things. I am. The Wall Street Journal examines how adverse selection works, where patients who received cheaper or lower-level services in Medicare Advantage plans switch to traditional Medicare if their condition worsens. Explaining.

We regularly post about the downsides of Medicare Advantage because some seniors who can afford traditional Medicare are too often lured into enrolling in Medicare Advantage by persistent TV ads. Keep in mind that Medicare Advantage may be a good choice if you contract with an HMO that is primarily affiliated with a hospital system. But even those “fairly good” plans are limited to Medicare B coverage within the HMO’s footprint and cannot, for example, seek out specialists who are not in that HMO’s network.

Written by Bill Haskell. It was first published in angry bear

The government has made it possible for people to choose between traditional Medicare and Medicare Advantage for their care at age 65. The alternative was offered in the name of commercial health care, which provided better medical care and other services at lower costs to those eligible for Medicare. Medicare Advantage plans also have superficial and meaningful pluses that aren’t available in traditional Medicare. The same thing could be provided by Traditional Medicare, unless the government decides not to allow it to do so. Medigap is included as part of your Medicare Advantage plan, but you’ll still have to pay for it through traditional Medicare. The same applies to Part D (Drugs).

It has been said that Medicare Advantage alone cannot compete with traditional Medicare. It turns out neither can compete with VA healthcare. It’s about a difference.

As people age, medical costs increase. Costs show up more in Medigap plans than in Medicare Advantage. Traditional Medicare typically increases Medicare B deductibles and copays. I’m going to use part of my Medicare B. wall street journal Article and easy-to-understand graphs that detail the rest of the story. I am also a WSJ subscriber.

However, as beneficiaries become more ill, they may find it more difficult to access Medicare Advantage services than those receiving traditional Medicare. This is the result of insurance companies actively controlling health care, such as requiring patients to approve certain services and restricting the hospitals and doctors patients can access.

It worsens as a person ages.

of wall street journal We found that people are twice as likely to leave Medicare Advantage and switch to traditional Medicare in their final year of life as other enrollees. This occurred from 2016 to 2022. Approximately 300,075 people dropped out of private plans during the period from 2016 to 2022, and after leaving, they often ended up staying in hospitals or nursing homes for long periods of time. Returning to traditional Medicare resulted in a large bill being paid by Medicare. hospital insurance (2.9% distributed to workers and businesses) Fund.

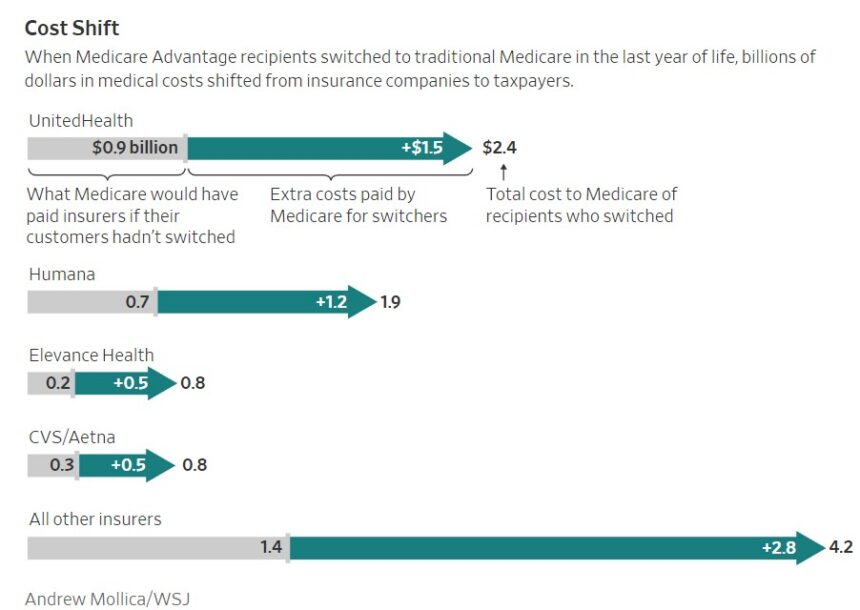

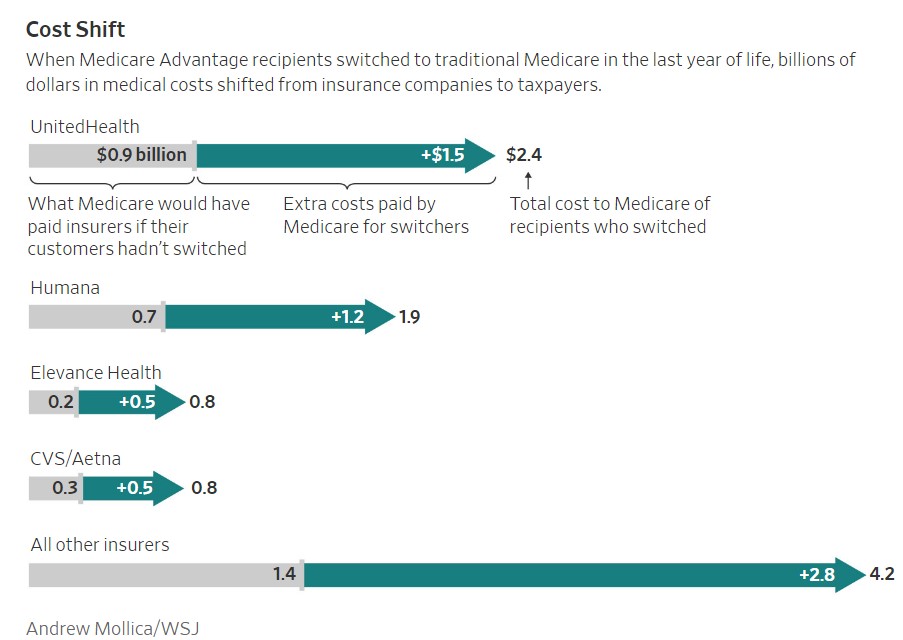

In one WSJ end-of-life care example, the total cost was $900 million if the patient had enrolled in traditional Medicare, compared to $2.4 billion for those who reverted to traditional Medicare from Medicare Advantage. It was a dollar amount. of wall street journal provides a chart (see below) detailing the costs you’ll recoup using different providers for MA plans compared to traditional Medicare.

Medicare Advantage insurers avoided a total of $10 billion in medical costs incurred by dropouts during that period, the analysis found. If those beneficiaries had stayed in the plan, the government would have paid insurance companies about $3.5 billion in premiums. That means companies saved more than $6 billion in net savings during this period.

“These are some of the most expensive services, and they’re what some of the most expensive patients receive,” says Dr. John, a physician and researcher at New York’s Mount Sinai Hospital who focuses on end-of-life care. Claire Ankuda says.

“Plans have a strong incentive to reduce the cost of health care delivery.”

A Wall Street Journal analysis of Medicare data found a pattern of critically ill patients on Medicare Advantage dropping private insurance at the same time their health needs spike. Many people make the switch after encountering problems getting health insurance coverage.

Plans run by private insurance companies in the Medicare Advantage system are supposed to provide elderly and disabled people with the same benefits they get from traditional Medicare. This plan can be a good deal for people because it limits out-of-pocket costs and often offers additional benefits, such as dental care.

The government pays premiums for Medicare Advantage through CMS.

Medicare Advantage companies say they use Medicare standards when reviewing and approving medical services, and that they improve care for members, including at the end of life. Their oversight ensures clients receive safe, appropriate and quality care, they said.

UnitedHealth spokesman Matthew Wiggin said the magazine’s analysis focused on a small portion of the company’s Medicare beneficiaries and that nearly all Medicare Advantage participants were satisfied with the program. He disputed that denial of care by insurance companies is influencing people’s decisions to switch from Medicare Advantage, and that patients are reaching the end of their lives and may switch insurance for a variety of reasons. He said there is.