Singaporean authorities have reported that scams impersonating government officials are on the rise, with the number of incidents and losses nearly doubling compared to the previous year.

The Singapore Police Force (SPF) and Monetary Authority of Singapore (MAS) revealed that more than 1,100 incidents were reported from January to October 2024, resulting in losses of at least S$120 million. .

This is a significant increase from the 680 incidents and S$67 million losses recorded in the same period in 2023.

These scams involve fraudsters posing as bank officials, often claiming to represent major Singapore banks such as DBS, OCBC, UOB and Standard Chartered.

Victims receive false claims about suspicious transactions associated with fraudulent credit cards or accounts.

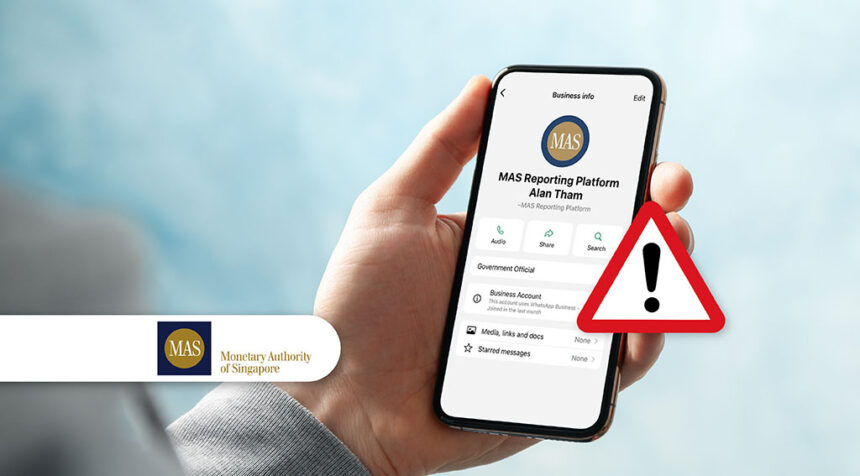

Once the victim denies knowledge of such activity, the scammer transfers the call to an accomplice posing as a government official, sometimes using a video call to provide fake credentials, agency logos, or Present forged warrant cards or official documents to make it look more convincing.

Communication may also move to messaging apps like WhatsApp.

Victims are often accused of serious crimes, such as money laundering, and are forced to transfer funds to so-called “safety accounts” for investigation purposes.

SPF and MAS stressed that banks will not forward calls to external parties such as the police or other government agencies.

They also reiterated that police will never ask individuals to transfer money to a “safety account” as part of an investigation.

To protect themselves from such scams, the public is urged to enable security features on their devices, such as blocking international calls, and employ two-factor or multi-factor authentication for their online accounts.

The authorities also recommend using a money lock feature to secure your savings and regularly monitoring banking alerts for unusual activity.

SPF and MAS called on the public to check any suspicious information with trusted sources such as ScamShield helpline 1799 and ScamShield. Websiteis advised.

Authorities encourage individuals to raise awareness by reporting suspicious activity and sharing information about these scams with family and friends.

Victims are urged to immediately contact their bank to stop the fraudulent transaction and report it to police via the police hotline at 1800-255-0000 or online reporting platforms. www.police.gov.sg/i-witness.

Featured image credit: Edited from freepic