Generative AI (GenAI) is revolutionizing the industry by tackling complex cognitive tasks at unprecedented scale and cost efficiency.

In financial services, we promise to streamline activities such as creating investment narratives, analyzing customer sentiment, and enhancing decision-making, achieving them in record time and at near-zero cost.

However, despite its transformative potential, many financial institutions find themselves facing challenges in implementing revenue-generating GenAI use cases.

Why are so many people still stuck at the idea stage and unable to move beyond proof of concept?

A strategic approach to use case selection and orchestration from a global technology and innovation partner Zuhlkehelps financial institutions (FIs) move beyond the proof-of-concept stage and deliver real value.

2024 by invitation only Insight Forum, Zuhlke leads a dynamic discussion About the impact of AI across the financial industry and its value chain.

The forum was hosted by the Global Finance & Technology Network (GFTN) as part of the Singapore FinTech Festival 2024.

Led by Ravi Patel, Head of Southeast Asia Financial Services, and Andrea Perl, Head of Regional Data and AI at Zühlke, this session, along with industry experts from Amazon Web Services (AWS), will discuss how financial institutions are implementing PoCs. We explored whether we could overcome the stages and successfully evolve from utilization. AI-driven operational efficiency opens new avenues for revenue generation.

Zero cognitive labor costs

“We frequently witness breakthrough advances in fundamental model capabilities.

To navigate this dynamic, Zühlke developed the GenAI Capability Map, which aligns current GenAI capabilities with human cognitive characteristics. ”

Andrea explained.

Andrea uses this map to prepare GenAI to take on more complex cognitive labor tasks, including natural language processing, creative functions like drafting investment narratives, and analyzing customer sentiment with social and emotional intelligence. I emphasized what I was able to do.

As GenAI takes on these roles, the associated costs of running them can approach zero.

Andrea cited a super app experiment where GenAI reduced push notification creation time for an app from 100 hours to 3 hours, while increasing conversion rates.

Inspiring success stories aside, building operational use cases requires significant investment. Achieving human-level accuracy with GenAI is possible, but difficult to achieve.

“After 20% of the project timeline, we reach about 80% accuracy. But it takes a lot of engineering to get to 95%, which is the human-level accuracy benchmark.

It also requires ongoing input from stakeholders and experts to achieve the required accuracy and keep it operational. ”

Andrea said.

Furthermore, many applications remain task-specific. For example, a GenAI solution that identifies relevant research papers cannot perform analysis on those papers simultaneously.

Moving from POC to operationalization

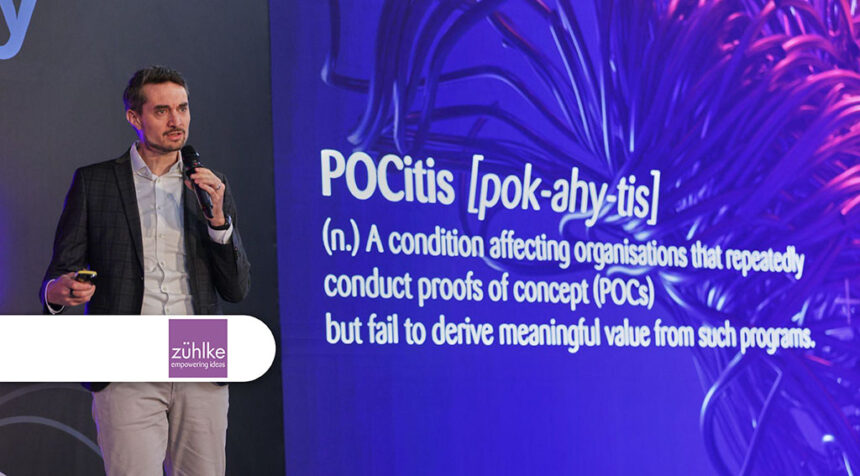

Zühlke, who coined the term “POC flame” to describe a common challenge faced by many organizations, sees proofs of concept (POCs) failing to successfully transition to scalable solutions that deliver meaningful value. I explained that it is often developed.

This phenomenon highlights significant hurdles in operationalizing innovative technologies like GenAI within financial services.

POC flames occur when AI use cases are not strategically chosen or well-aligned.

Organizations often lack sufficient capacity in terms of people, technology, processes, or data quality to move beyond the POC stage.

Addressing POC flames is becoming increasingly important for financial services businesses as rapid advances in AI outpace decision-makers’ ability to adapt.

We recommend a pragmatic approach to managing the large investments required to scale and operate a GenAI solution.

“Build use cases that align with your corporate strategy. Build multiple use cases within that field so you can reuse functionality and components.

A single use case often does not provide a positive return on investment for the functionality needed to operate. ”

Andrea advised.

By building GenAI capabilities incrementally and tailored to specific use cases, you can effectively balance people, processes, governance, and technology.

Education and subject matter experts required

Unlike traditional AI, GenAI requires stakeholders to deal with unstructured and non-deterministic outputs at scale (i.e., GenAI models can produce different outputs given the same inputs). Masu).

of Award-winning AI chatbot This product, co-created by Zühlke and UNIQA, demonstrates just that and is designed to assist UNIQA sales staff with rate and cost compensation inquiries.

“Chatbots can accurately answer policyholder questions about insurance coverage, but expert opinion is needed to verify accuracy. In this case, legal product experts are needed. It took about half a day for each two-week sprint. You have to have enough time with subject matter experts, otherwise you won’t be able to reach human-level accuracy.”

Andrea explained.

Additionally, cross-functional teams need to gain a better understanding of how to process and optimize the non-deterministic output generated by GenAI use cases.

To effectively manage GenAI, it is important to increase organizational maturity through education.

Without this foundational knowledge, organizations risk stalling their GenAI efforts before delivering meaningful value.

From efficiency to revenue generation

While many of GenAI’s use cases have clearly demonstrated success, especially in achieving efficiency gains, moving these applications to revenue-generating applications is an important step that many have yet to take.

This is important because building a revenue-generating GenAI platform comes with greater risks, especially in regulatory compliance and reputational risk.

A high degree of organizational maturity is required, especially for customer-facing deployments.

“Critical use cases that are close to the customer still require human oversight.”

Andrea explained.

Zühlke advises a step-by-step approach to a successful transition to build the organizational maturity needed to transition to revenue-generating GenAI use cases.

Start with internal operations that drive efficiency and move to customer-facing operations that promise revenue.

“For example, consider writing an investment story. The first step is to summarize the chief investment officer’s insights, then gradually incorporate customer data to ultimately create a personalized investment story tailored to each individual customer. It could be creating a story.

This is a real revenue case. This can have a clear impact on sales. ”

Andrea explained.

Data: Key differentiator

As models become commoditized and organizations reach higher levels of maturity, proprietary data will become a key differentiator from competitors in the near future.

“Ensuring that enterprise data is of high quality and meets today’s security standards is critical to effectively leveraging GenAI in the future.”

Andrea explained.

It is equally important to use responsible AI frameworks as a foundation for sustainable implementation of use cases.

Companies can proactively respond to this opportunity by starting small and identifying use cases that can be thought of and tested today.

Contact Zuhlke Explore how to ideate, create, and scale AI-enhanced models, processes, and products that have meaningful impact.