by Calculated Risk June 17, 2024 2:15 PM

Today’s Calculated Risk Real Estate Newsletter: Comparing the current housing market to 1978-1982

Short excerpt:

In March 2022 I wrote: Housing: Don’t compare the current housing boom to a bubble and bust

It’s natural to compare the current housing boom to the housing bubble of the mid-2000s. The bubble and subsequent bust are part of our collective memory. And graphs of nominal home prices and price-to-rent ratios are eerily similar to those of the housing bubble.

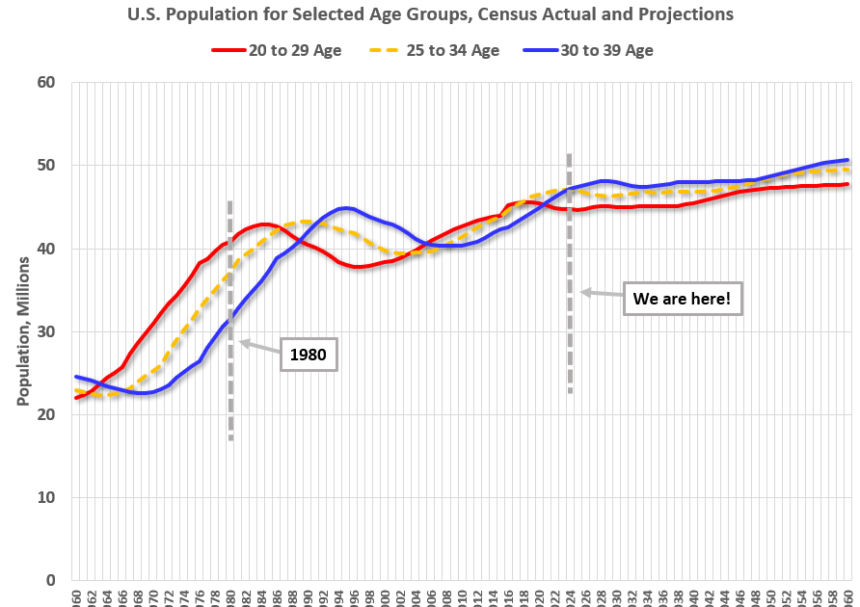

But there are also big differences: First, lending was pretty strong during the current boom, whereas in the mid-2000s, underwriting standards for loans were almost nonexistent (“fog the mirror and you’ll get a loan”). And second, demographics are much more favorable today than they were in the mid-2000s.

I then suggested comparing the current situation to the period from 1978 to 1982, and outlined some similarities between the two periods (though there is no such thing as a perfect comparison).

1. The demographics were similar

2. Housing prices have skyrocketed.

3. Inflation accelerates

4. The Federal Reserve raised interest rates to control inflation.

5. Mortgage payments soar

Here we explore and discuss what this means for house prices.

There’s a lot more in the article.