by Calculated Risk June 19, 2024, 10:00 AM

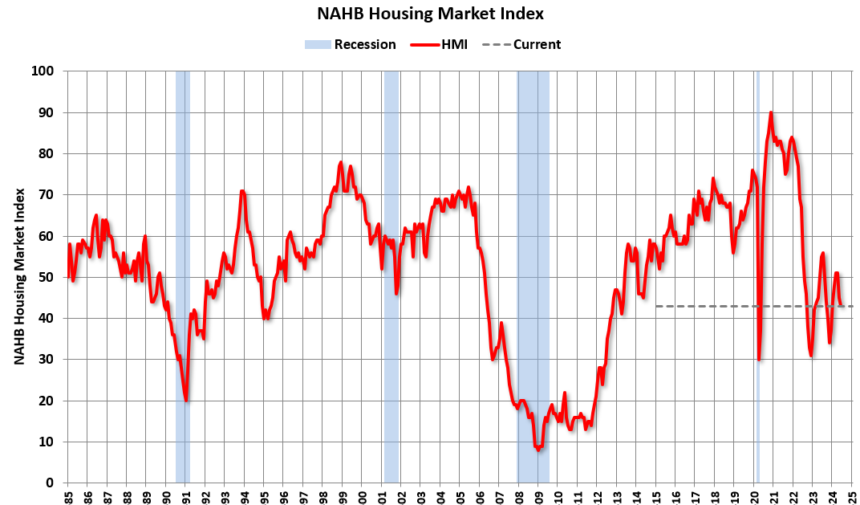

The National Association of Home Builders (NAHB) announced that its Housing Market Index (HMI) fell to 43 from 45 last month. A reading below 50 indicates that more builders view home sales conditions as poor than as good.

From the NAHB: High mortgage interest rates erode confidence among homebuilders

Builder sentiment remains depressed as mortgage interest rates remain in the 7% range and construction financing costs are also rising.

Builder confidence in the new single-family home market was 43 in June.According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today, the home price index has fallen 2 percentage points since May. This is the lowest reading since December 2023.

“Staying high mortgage rates are putting many potential buyers off purchasing,” says NAHB president Carl Harris, a custom home builder in Wichita, Kan. “Homebuilders are also dealing with rising interest rates on construction and development loans, a chronic labor shortage and a shortage of buildable land.”

“We find ourselves in an unusual situation, with home price inflation currently running at 5.4% year-over-year and no progress in reducing home price inflation making it difficult for the Federal Reserve to achieve its 2% inflation target,” said NAHB chief economist Robert Dietz. “The best way to reduce home price inflation and bring overall inflation down to the 2% range is to increase the nation’s housing supply. A more favorable interest rate environment for construction and development loans would help achieve this goal.”

The June HMI survey also revealed that 29% of homebuilders reduced home prices in June to boost sales.This was the highest share (31%) since January 2024, and significantly higher than the 25% in May. However, the average price cut in June remained stable at 6% for the 12th consecutive month. Use of sales incentives rose to 61% in June. Up from 59% in May, this metric is the highest share since January 2024 (62%).

…

All three HMI component indices fell in June, dropping below the key threshold of 50 for the first time since December 2023. The HMI index, which measures current sales conditions, fell three points to 48 in June, while the component index measuring sales expectations over the next six months fell four points to 47 and the gauge showing the influx of would-be buyers fell two points to 28.Looking at the three-month moving average of regional HMI scores, the Northeast remained stable at 62, the Midwest fell three points to 47, the South fell three points to 46, and the West fell two points to 41.

Add emphasis

This graph shows the NAHB index since January 1985.

This was below consensus expectations.