Will generative AI in payments accelerate financial institutions’ path to revenue growth and cost optimization?

ChatGPT, with zero humility, answers “yes,” presenting multiple pieces of evidence from analysts including McKinsey, Forbes, and EY.

What’s even more reassuring is that 54% of FSIs surveyed across EMEA, the US and APAC have already incorporated AI into their services or are expanding their efforts, and 61% plan to use Gen AI in 2024.

Artificial intelligence has been a prominent driving force in many industries for over a decade.

Open WayThe company, which provides digital payments technology to banks, processors, national payment switches and mobile wallet operators, has found that customers are seeing the benefits of AI.

Generative AI in payments is revolutionizing the payments sector.

For example, Nexi, a pan-European acquirer serving two million merchants, began a project in 2021 to integrate machine learning into its infrastructure to enhance risk management, marketing, and operations.

Similarly, Enfuce, the fastest growing CaaS provider in the Nordics, highlights that AI-based scoring will be a major disruptor in consumer and SME lending.

Additionally, Network International, a leading processor in the MEA region, is using Mastercard’s AI-powered Brighterion platform to enhance its fraud prevention services.

Gen AI in payments has been one of the hottest topics this year, and for OpenWay client LOTTE, a consumer finance brand in Southeast Asia, Gen AI is one of its investment priorities for 2024.

Notably, Nexi predicts that in 2024, Gen AI will “create hyper-personalized solutions that enhance shopper experiences.”

Removing the barriers to harnessing the full potential of Gen AI in payments

Gen AI embedded in digital payments infrastructure is like a powerful computer in a race car: It needs data from multiple sensors to optimize acceleration.

Ensuring optimal trajectory requires the wheels to predictably respond to commands, yet financial institutions cite “data quality and access” and “overly complex infrastructure” as the biggest barriers to deriving more value from Gen AI.

To overcome these barriers, Gen AI needs a payment processing platform with strong data management and a 24/7 online front and back office.

This is exactly Way 4 It is the highest rated software platform by Datos Insights, Juniper and Gartner.

Way4 instantly analyzes customer and transaction details, including both incoming and historical data, and streams the consolidated data in real time to the AI.

Additionally, when Gen AI suggests enhancements to products, risk rules, or customer service scenarios, Way4 can instantly implement these requests.

Gen AI can configure new payment services with flexible parameters instead of hard coding.

Approximately 95% of Way4’s product features are parameterizable, compared to only 30-40% in competing systems.

Combining generative AI with innovative payment engines – 4 promising use cases

Based on customer best practices, OpenWay has identified four areas where the combination of Gen AI with an advanced payments processing platform will deliver the greatest benefits:

1. Quickly create new products and easily test them

Product managers use Way4’s flexible rules to create unique payment products in areas such as issuing, acquiring, switching, wallets, BNPL, digital currencies and more.

Trained by managers in co-pilot mode, Gen AI can automate many steps in product configuration and enhance elements such as pricing, loyalty programs and value-added services.

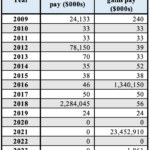

sauce: Open Way

2. Optimizing customer service costs

Once a customer makes a request, the Gen AI chatbot initiates a rich data exchange with Way4, which allows Gen AI to quickly resolve the reported issue, offer the customer new personalized products and services, and even request Way4 to instantly create a new contract.

For example, if a customer goes on a trip abroad, Gen AI can have Way4 transfer funds between bank accounts in different currencies or issue a virtual multi-currency prepaid card.

3. Strengthening risk management

During transaction monitoring, Gen AI analyzes vast amounts of customer and transaction data from multiple systems.

By continually learning from new data, our detection algorithms improve and reduce false positives.

After receiving the newly calculated risk score from Gen AI, Way4 adjusts authorization scenarios in real time.

4. Identifying strategic opportunities

Gen AI can leverage Way4’s wealth of data, including Level 2 and 3 data, to identify new revenue opportunities for payments businesses.

Way4 takes information such as the contents of a shopping cart and instantly applies various purchasing restrictions and incentives, and Gen AI can identify government agencies and nonprofits that might be interested in this feature and generate targeted offers.

Additionally, Gen AI can also analyze customer feedback, spending patterns, and emerging lifestyle trends to suggest improvements to existing products.

For example, if a new travel destination becomes popular, Gen AI can prompt Way4 to add another currency account to an existing card.

This highlights how Gen AI in payments can transform various aspects of the financial industry.

The Future of Generative AI in Payments

If these and other potential use cases are fully implemented in the banking industry, Gen AI could deliver an additional value worth US$200 billion to US$340 billion per year, according to McKinsey.

Partnering with OpenWay on the Gen AI-enhanced payments project will enable organizations to capture a share of this lucrative market and secure a revenue stream for early innovators.

Read more about OpenWay’s Gen AI digital payments use case here.

Featured Image Credit: Free Pick