by Calculated Risk June 26, 2024 1:46 PM

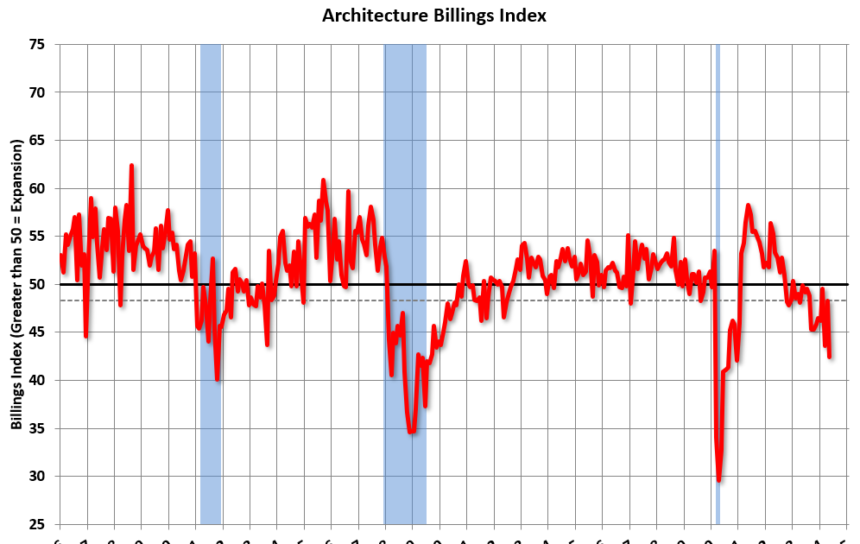

Note: This index is primarily a leading indicator of new commercial real estate (CRE) investment.

From the AIA: ABI May 2024: Business environment for construction companies continues to soften

The AIA/Deltek Architecture Billings Index (ABI) score fell to 42.4 this month.More firms reported lower invoice volumes in May than in April. Additionally, the pipeline of new work coming into firms is increasingly softening. Inquiries for new projects continue to increase, but at a slower pace than in recent months. Additionally, the value of newly signed design contracts declined further in May, following a small decline in April. Despite the high inflation of the past few years having largely subsided, high interest rates are still causing hesitation among many clients.

Corporate claims remained soft in May across all regions and sectors. Claims declined for the fourth consecutive month for companies in all regions of the country, as conditions remained weakest for companies in the Midwest. Business conditions for institutional-focused companies also softened further in May, while fewer commercial/industrial and multifamily-focused companies reported declines in claims in May than in April. However, the majority of companies in both specializations still reported weak business conditions.

…

The ABI score is a leading economic indicator of construction activity, providing a forecast of future non-residential construction spending activity approximately 9-12 months ahead. The score is derived from a monthly survey of construction firms measuring changes in the number of services provided to clients.

Add emphasis

• Northeast (47.7), Midwest (41.7), South (46.0), West (46.3)

• Sector index breakdown: Trade/Industrial (48.2); Institutional (43.2); Apartment complex (47.3)

This graph shows the Architecture Billing Index since 1996. The index fell from 48.3 in April to 42.4 in May. A reading below 50 indicates a decline in demand for architects’ services.

Note: This includes commercial and industrial facilities such as hotels, office buildings and apartment complexes, as well as schools, hospitals and other facilities.

Since the index typically leads CRE investment by 9-12 months, the index is suggesting a slowdown in CRE investment in 2024.

Keep in mind that multifamily billings fell in August 2022, marking the 22nd consecutive month of declines. (Revised). This suggests that apartment housing starts will fall further.