by Calculated Risk June 29, 2024 8:11 AM

The main report scheduled for this week is the June employment report, due out on Friday.

Other important reports include the ISM manufacturing survey for June, June auto sales, and the trade deficit for May.

—– Monday, July 1st —–

10 am: ISM Manufacturing Index The consensus forecast is that the ISM index will rise to 49.0 in June from 48.7 in May.

10 am: Construction Expenditures Construction spending is expected to increase 0.3% in May.

—– Tuesday, July 2 —–

9:30 AM: Debate with Fed Chairman Jerome Powell, Policy Panel Discussionat the European Central Bank (ECB) Central Bank Forum 2024 in Sintra, Portugal.

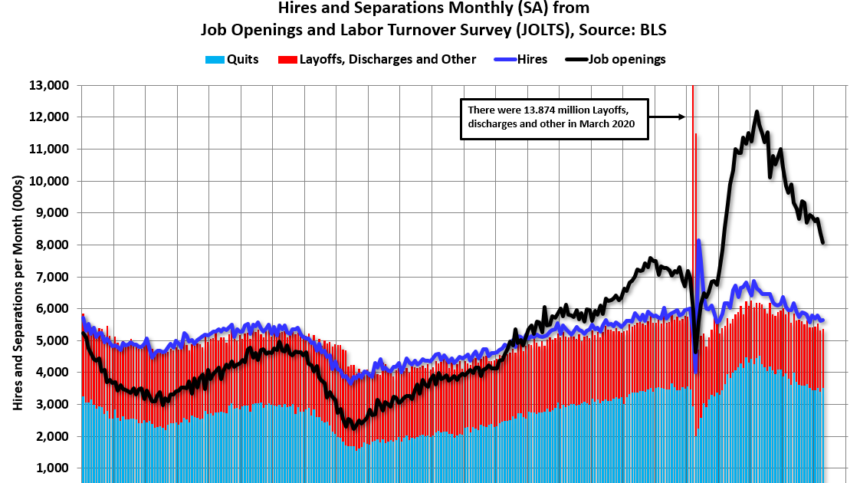

The graph shows job openings from JOLTS (black line), hiring (dark blue), layoffs, layoffs and others (red columns), and resignations (light blue columns).

The number of job openings in April fell to 8.06 million from 8.36 million in March.

The number of job openings (yellow) was down 19% year-on-year, and the number of resignations was down 3% year-on-year.

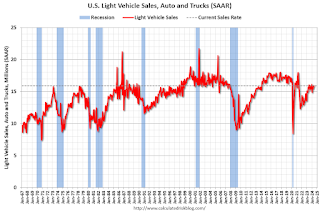

Light vehicle sales in June are expected to be 15.9 million units (seasonally adjusted annualized rate), unchanged from May’s 15.9 million units.

This graph shows light vehicle sales since BEA began collecting data in 1967. The dashed line is last month’s sales rate.

Wards Auto Sales forecasting The SAAR in June was 15.9 million.

—– Wednesday, July 3 —–

7:00 AM EST: The Mortgage Bankers Association (MBA) Mortgage Purchase Application Index.

8:15 AM: ADP Employment Report June employment. This report covers private sector payrolls only, not government payrolls. June employment is projected to be 170,000, up from 152,000 in May.

8:30 AM: Unemployment claims (weekly) The report is due to be released. The consensus is for new claims to be 228,000, down from last week’s 233,000.

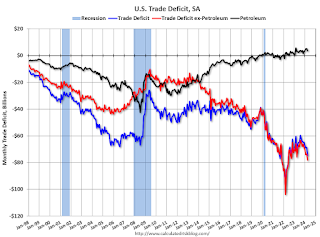

This graph shows the US trade deficit with and without oil up to the latest report. The blue line is the total deficit, the black line is the oil deficit, and the red line is the trade deficit excluding petroleum products.

The trade deficit is widely expected to be $72.2 billion. The U.S. trade deficit was $74.6 billion last month.

10 am: ISM Service Index The June forecast calls for a decline to 52.5 from 53.8.

2 pm: FOMC MinutesConference on June 11-12, 2024

US markets close at 1pm. independence day holiday.

—– Thursday, July 4th —–

all US Market It will be closed In compliance independence day

—– Friday, July 5th —–

8:30 AM: Employment Report Employment is expected to increase by 180,000 in June, with the unemployment rate expected to remain unchanged at 4.0%.

8:30 AM: Employment Report Employment is expected to increase by 180,000 in June, with the unemployment rate expected to remain unchanged at 4.0%.

An estimated 272,000 jobs were added in May, bringing the unemployment rate to 4.0%.

This chart shows the number of jobs added each month since January 2021.