of German The government moved another 2,375 bitcoin, worth about $138 million, to the exchange on Thursday, continuing a months-long selloff of seized reserves.

Latest update: 🇩🇪 German government deploys 2,375 more staff #Bitcoin This will be worth $138 million to the exchange.

They have 13,000 BTC left. HODL! ✊ pic.twitter.com/80dOE7iWyj

— Bitcoin Magazine (@BitcoinMagazine) July 11, 2024

Germany initially obtained nearly 50,000 bitcoins after the Federal Criminal Office (BKA) seized them from the now-shuttered piracy site Movie2K in 2013. At today’s prices, the reserves are worth more than $2 billion.

Since mid-June, the government Stable sales A huge treasury of Bitcoins being sent to major exchanges such as Coinbase, Kraken, Bitstamp and OTC Trading Desk.

Germany has sold more than 25,000 Bitcoins worth about $1.5 billion in the past month. According to on-chain data:After the latest sale, he now has just 13,100 bitcoins, valued at $765 million.

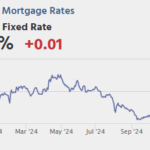

The drawn-out liquidation has caused bitcoin’s price to sink, falling below $55,000 in July amid growing selling pressure, but analysts say the end of the sales could provide relief as the government’s reserves dwindle.

The remaining $765 million is a relatively small portion of Bitcoin’s daily trading volume and Germany’s original Bitcoin holdings. Once Germany runs out of its remaining coins, the downward pressure will disappear and the persistent bearish impact will cease.

Some experts predict that if bitcoin sales continue at their current pace, the government could use up its entire seized bitcoin stockpile as soon as September. A halt to the sales could pave the way for prices to rise.

The liquidation has drawn criticism from Bitcoin advocates. German parliament. Members argue that the government should hold scarce digital assets rather than sell them for euros.

Either way, the sale of Bitcoin has brought Germany more than $1.5 billion in cash so far, and with limited supply, the controversial sell-off could soon die down, giving the price of Bitcoin a boost again.