Fiat-based loyalty business

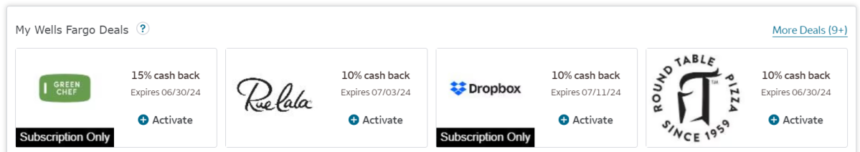

I’ve worked at Mastercard in their San Francisco office for the past 10 years building card linked rewards solutions to drive merchant loyalty. It’s a sexy business where cardholders receive merchant rewards through their bank and get discounts on eligible spend at participating merchants. Below is a sample of rewards/transactions I got from my Wells Fargo bank account:

The offer drives new customer acquisition, reactivates dormant customers, and increases spending frequency and “basket size” among existing customers. Overall, this marketing solution is highly effective in driving increased spending behavior, primarily through credit card (and some debit card) payment channels.

The emergence of Bitcoin

Bitcoin as a means of exchange has not received much attention. Bitcoin holders are supposed to hold Bitcoin, and there are understandable fears that spending will trigger taxable events, but let’s put these concerns aside for a moment and consider the business opportunity to drive merchant loyalty with Bitcoin rather than fiat currency. What will change? It is no exaggeration to say that Bitcoin will completely transform its value proposition, delivering an unprecedented economic surplus with efficiencies and use cases that fiat currency can never match.

cost

Offering a fiat merchant offers program is an expensive undertaking, requiring large and complex technology stacks and teams to authenticate participating merchants, review merchant agreements, allocate offers to cardholders within forecasted marketing budgets, detect eligible spend events, reward cardholders with statement credits when they redeem their cards, compile reports for merchants showing program effectiveness, and reconcile billing. Most importantly, all consumer spending is done on credit cards, the most expensive payment channel (to merchants).

Bitcoin Rails significantly reduces the steps in this process. Merchants can participate in a model similar to Google Adwords via a self-service portal where they authenticate with a Bitcoin commitment to fund their marketing budget in real-time (which may also be phased out in real-time and never possible with fiat offer programs). Banks and card processors are no longer involved as gatekeepers to the end-to-end solution, and they and their associated costs/fees are completely removed from the value chain. Most importantly, because redemption transactions are now all done on low-cost Lightning Network Rails, not only are direct credit card fees (typically 3%+) eliminated, but also the indirect costs of chargebacks and fraud.

A new paradigm

Fiat rail means that consumers who participate in a bank’s merchant rewards program typically do not receive notification that they have successfully redeemed a discount at the point of sale, and the discount itself does not appear as a statement credit until days later. Banks can invest in real-time notification rewards redemption solutions, but this is very expensive and complicated, and must be done on a bank-by-bank basis. Very few banks have done this, and there is no universal protocol that can be leveraged.

Merchant funding of fiat offerings must be done up front through committed budget pre-funding, and if not, payment is tracked by a typical “30 day” type credit agreement backed by contractual obligations.

Bitcoin Rails completely upends these traditional frameworks. Consumers notification To get that peace of mind when taking advantage of Bitcoin-native offers in real time at the point of sale, however they Get discount Payments are also made in real-time. Not only that, but technologies like LN Bits and Bolt 12 support “split payments”, allowing Bitcoin-native offer providers/businesses to also get paid in real-time at the same point of sale. This essentially removes the need for a fiat “claim” step. Merchants simply specify the offer value, minimum spend threshold, and most importantly, stock You need to see your remaining offers/discounts (marketing budget) in real-time. Such changes are not possible in fiat channels where you need to commit your budget weeks in advance. We’ve only scratched the surface here on the long list of unfair advantages that Bitcoin gives you in delivering merchant offers programs, but we’ll stop here for now.

important point

Reach: Offers programs are essentially two-way marketplaces, and to make it worthwhile for merchants to participate, it is important to have as large a consumer base as possible. The Bitcoin user base, and what I call the “Bitcoin-curious” user base, while growing, is still a relatively small segment.

Targeting: Fiat merchant offer programs have a silver bullet that is not available in Bitcoin, at least not directly: consumer transaction history. This history allows merchants to carefully spend their marketing budget on specific consumer segments such as new, dormant, and loyal groups. This is a valuable tool to ensure the best return on advertising spend (ROAS) and also allows for insightful pre- and post-test “incremental” reporting to prove increased spend on marketing campaigns. This is very compelling and useful for merchants who need to justify spend on offer campaigns.

That being said, I would argue that these caveats are mitigated by the potential for retailers to attract the Bitcoin user demographic broadly and without targeting it, as it is extremely valuable. Bitcoin-friendly retailers attract the wealthy, influential, and fanatically loyal. It is a first-mover advantage for retailers in any vertical/category to be the first to attract this valuable demographic.

The above are just a few examples of how Bitcoin removes unprecedented costs from traditional systems, significantly increases merchant profit margins, and provides a more immediate, intuitive, and satisfying consumer experience. This long list of unfair advantages offered by Bitcoin-native merchants cannot be replicated by any of their fiat-operated competitors. This is based on our experience over the past decade working on CLO merchant loyalty programs.

Michael Saylor has said “Buy Bitcoin and wait.” For many of us Bitcoin enthusiasts, there is an opportunity to not just “wait” but to actively drive hyperbitcoinization. I am taking this step with my merchant offer, leveraging my expertise and experience to bring a Bitcoin Native offer to life. I am curious what dramatic cost savings and new unique use cases other Bitcoin enthusiasts can discover by looking back at their experience and expertise from working in fiat mining and rethinking it through the lens of Bitcoin.

This is a guest post by John McCabe. The opinions expressed here are entirely his own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.