by Calculated Risk July 24, 2024 7:00 AM

From the MBA: Latest MBA Weekly Survey Shows Fall in Mortgage Applications

According to the Mortgage Bankers Association’s (MBA) Weekly Mortgage Application Survey for the week ending July 19, 2024, mortgage applications fell 2.2% from the previous week.

The Market Composite Index, a measure of mortgage application volume, decreased 2.2% from the previous week on a seasonally adjusted basis. The unadjusted index decreased 2% from the previous week. The Refinance Index increased 0.3% from the previous week and was 38% higher than the same week a year ago. The seasonally adjusted purchasing index fell 4% from the previous week.The unadjusted purchasing index was down 4% from the previous week. That’s 15 percent lower than the same week a year ago..

“Mortgage rates continued to decline, with the 30-year fixed rate dropping to 6.82%, its lowest level since February 2024,” said Joel Kang, MBA vice president and deputy chief economist. “Refinance applications were boosted by conventional and FHA application activity as some borrowers seized the opportunity to make a move. Additionally, the conventional refinance index was at its highest level since September 2022.”

“Purchase applications declined as homebuying challenges continue at current interest rate levels and home price growth remains strong in many markets,” Kang added.

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased from 6.87% to 6.82%, and points for loans with an 80% LTV (loan-to-value ratio) increased from 0.57 (including origination fees) to 0.59.

Add emphasis

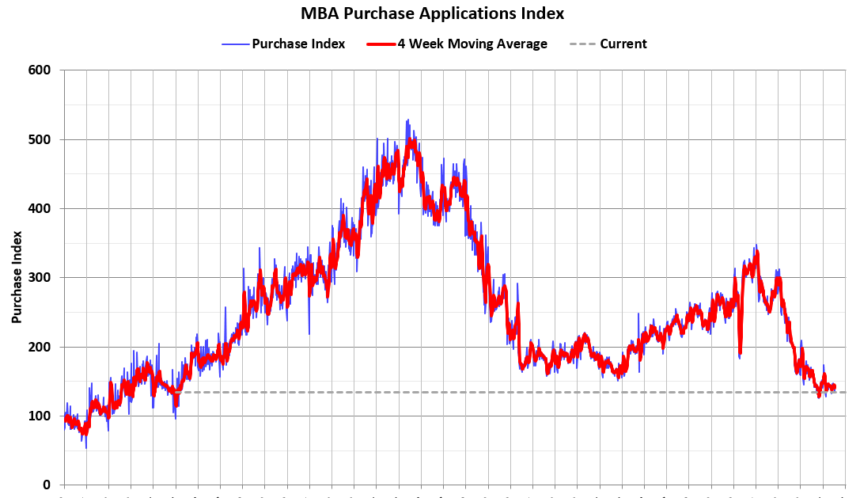

The first chart shows the MBA Mortgage Purchase Index.

Purchasing activity was down 15% year-over-year on an unadjusted basis, according to the MBA.

Red is the four-week average (blue is weekly).

Purchase application activity has increased slightly from lows in late October 2023 but remains below the lowest levels seen during the housing bubble collapse.

Rising mortgage rates caused the refinance index to fall sharply in 2022 before remaining roughly flat since then and recently picking up slightly.