by Calculated Risk July 30, 2024 9:00 AM

S&P/Case-Shiller release Monthly Home Price Index for May (“May” is the three-month average of closing prices for March, April, and May).

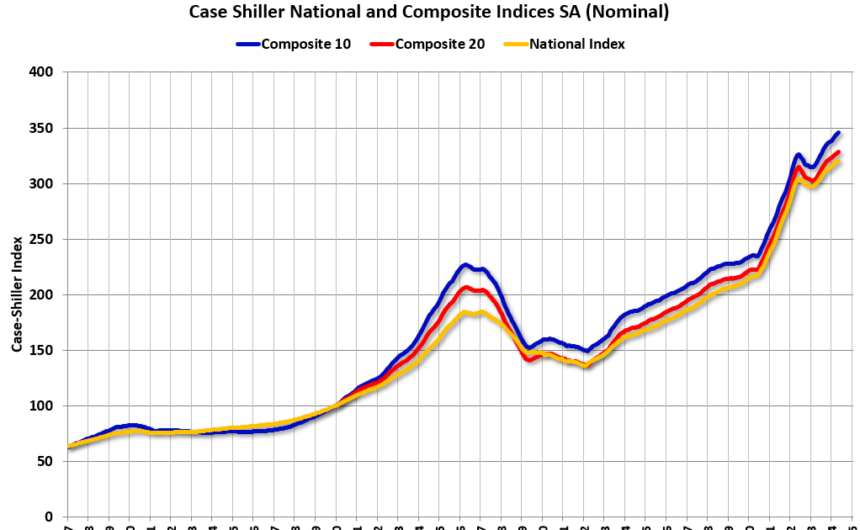

The release includes prices for 20 individual cities, two composite indexes (10 cities and 20 cities), and a monthly national index.

From S&P S&P CoreLogic Case-Shiller Index to Reach All-Time High in May 2024

S&P CoreLogic The Case-Shiller U.S. National Home Price NSA Index, which covers all nine U.S. census tracts, recorded a 5.9% year-over-year increase in May.New York had the highest year-over-year increase of the 20 cities in May, increasing 9.4%, followed by San Diego and Las Vegas with increases of 9.1% and 8.6%, respectively. Portland again ranked last with the lowest year-over-year growth, increasing just 1.0% year-over-year in May.

…

The upward trend in the U.S. national index, 20-city composite index and 10-city composite index continued to slow from last month, increasing by 0.9%, 1.0% and 1.0%, respectively, on a seasonally unadjusted basis.After seasonal adjustment, the U.S. national index recorded a 0.3% month-over-month change, consistent with the previous month, while the 20-city and 10-city composite indexes recorded month-over-month changes of 0.3% and 0.4%, respectively.

“While annual growth has slowed recently, this may be more relevant for 2023 than 2024, as recent performance remains promising,” said Brian D. Luke, head of commodities, real and digital assets. “Our home price index is up 4.1% year-to-date, its fastest start in two years. Our national index, which covers the six months since mortgage rates peaked, has risen over the past four months, erasing the stagnation experienced late last year. Overall, all 20 markets covered continue to trade in a homogenous pattern. Heading into the 2024 presidential election, traditionally Republican states are neck and neck with Democratic states, both averaging 5.9% annual growth.”

“The Big Apple is back at the top of the leaderboard, upsetting San Diego which had held the top spot for six months. New York’s 9.4% annualized return beat San Diego by 0.3% and Las Vegas by 0.7%. All 20 markets recorded annual gains over the past six months. The last time such a long streak was seen was during the height of the COVID-19 housing boom, when all markets saw three consecutive years of gains. This latest gain pales in comparison in both time period and annualized gains, with above-trend growth of 6.2%. As home prices rise, waiting for favorable changes in lending rates remains costly for potential buyers.”

Add emphasis

The first chart shows the nominal seasonally adjusted Composite 10 index, the Composite 20 index, and the national index (the Composite 20 index was launched in January 2000).

The Composite 10 Index rose 0.4% in May (SA). The Composite 20 Index rose 0.3% in May (SA).

The national index increased by 0.3% in May (SA).

Composite 10 SA increased 7.7% year over year. Composite 20 SA increased 6.8% year over year.

The national index SA increased by 5.9% year-on-year.

The annual price change was close to what we expected, and we’ll provide more details later.