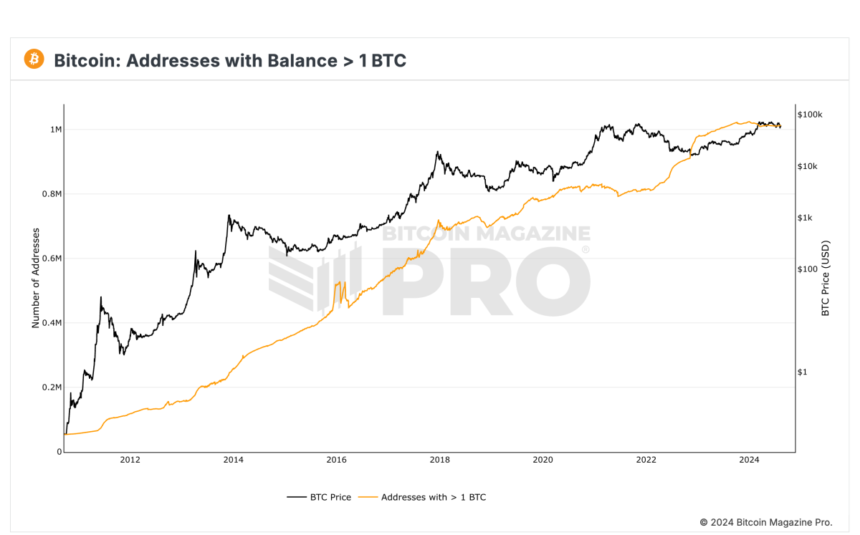

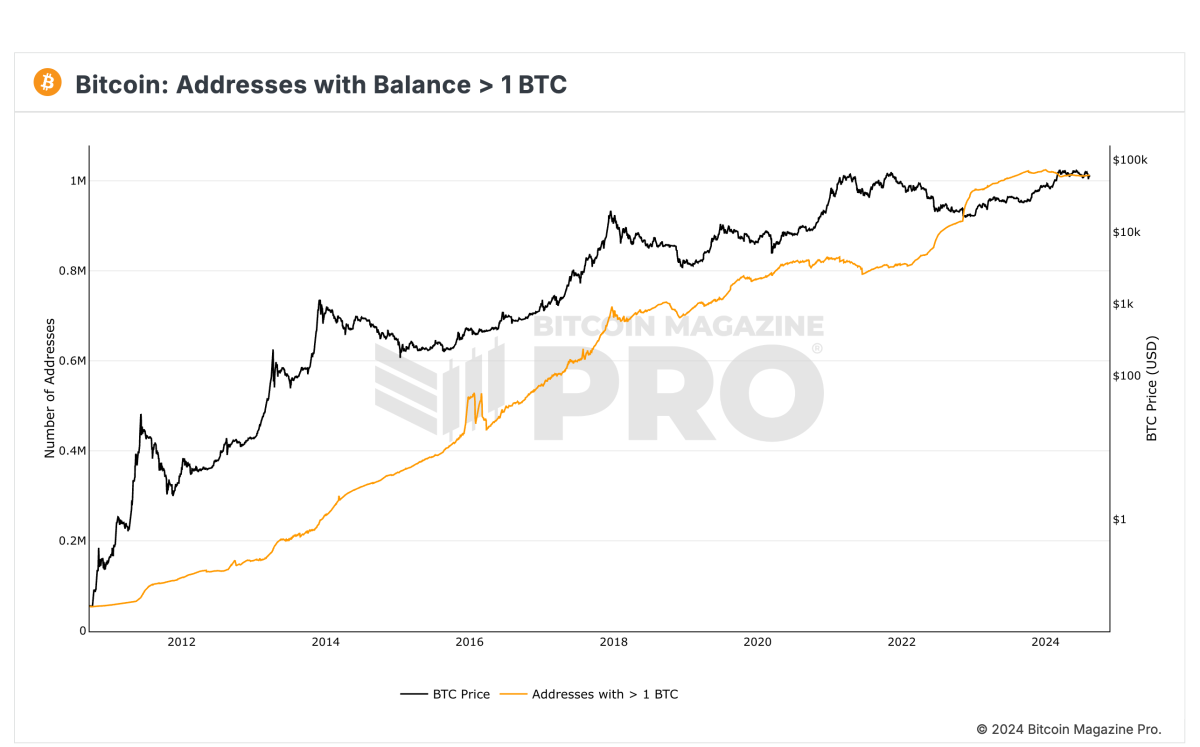

According to the data Bitcoin Magazine ProThere are 1,012,650 Bitcoin addresses containing 1 BTC or more.

This means that over 1 million BTC could be taken off the market and held by powerful actors, a significant portion of the 21 million BTC that will exist. Demand continues to grow, with US spot Bitcoin ETFs holding a total of over 901,000 BTC and major corporate Bitcoin holder MicroStrategy holding 226,500 BTC. Additionally, MicroStrategy plans to raise $2 billion to purchase more Bitcoin, further highlighting the trend of institutional investors buying and holding large amounts of BTC, tightening available supply as demand increases.

The number of Bitcoin addresses holding more than 1 BTC has historically lagged behind the price of BTC. However, over the past two years this trend has reversed and the number of these addresses has been growing faster than the price of Bitcoin. This change reflects growing adoption and increasing long-term confidence in Bitcoin as more users accumulate and hold large amounts of Bitcoin.

The increase in addresses holding more than 1 BTC indicates that both retail and institutional investors are actively accumulating Bitcoin. With only 21 million BTC to be mined and approximately 19 million BTC already in circulation, demand for Bitcoin appears to be increasing as users seek to secure the limited supply.

For more information, insights and to sign up for access to Bitcoin Magazine Pro data and analysis, please visit the official website. here.