This week is Naked Capitalism’s fundraising week. 216 donors have already invested in our efforts to fight corruption and predation, especially in the financial sector. Join us! Donation pageHere’s how to donate by check, credit card, debit card, PayPal, Clover, or Wise. Why are we doing this fundraiser?, What we accomplished last yearAnd our current goal is to Support the critics.

This is Eve. Reports about China effectively squeezing the rare earth market and the lack of strong alternatives oddly fail to mention how the US ceded ground in rare earths, a decline that became evident decades ago. From a post in 2010:

Reader James S. pointed to a helpful article in MIT Technology Review: “Can the U.S. rare earths industry recover?”Our only complaint about this solid article is that the summary downplays some important aspects of the article.

The United States is rich in metals essential to many green energy technologies, but engineering and research and development expertise is shifting overseas.

Indeed, while the article discusses U.S. and foreign engineering expertise in rare earth mining, it details how difficult rare earth mining is in general (or, more precisely, separating the materials, not the parts where you find them) and the considerable additional hurdles posed by conducting the mining in an environmentally friendly manner. Thus, the issue is not simply acquiring the specific technical know-how, but rather making further progress in reducing environmental costs.

And this issue has been mentioned often in explanations of why rare earth production moved to China in the first place. It was a messy problem, and developed countries didn’t want to do it. China was happy to accept the environmental damage. For example, the New York Times wrote Point out:

China feels entitled to take the lead for a brutally simple environmental reason: China currently controls most of the world’s supply of rare earth elements, not just through geological good fortune (though that does play a part), but because China has been willing to do the dirty, toxic, and often radioactive work that the rest of the world has long shied away from.

from MIT Technology Review:

Getting from rock to the pure metals and alloys needed for manufacturing requires several steps that U.S. companies no longer have the infrastructure or intellectual property to perform…

In the 1970s and 1980s, California’s Mountain Pass mine produced over 70% of the world’s supply. But in 2009, there was no production in the U.S., and ramping up production again would be difficult, costly and time-consuming…

The two mines that will ramp up production the fastest are Mountain Pass, which is being developed by Molycorp, and Mount Weld, which is being developed by Lynas outside Perth, Australia. Mountain Pass has the advantage of being well established, but the company cannot use the processes used in the mine’s heyday because they would be economically and environmentally unsustainable.

Several factors complicate the refining of rare earth elements. First, all 17 elements tend to occur together in the same deposits, and have similar properties that make them difficult to separate from one another. They also tend to occur in deposits that contain radioactive elements, especially thorium and uranium. These elements can pose a threat if the “tailings,” the mushy waste product of the first step in separating rare earth elements from their containing rocks, is not properly handled…

Mountain Pass’s decline began in the 1990s when Chinese producers began undercutting mine prices, and at the same time tailings safety issues arose. When the Mountain Pass mine was operating at full capacity, it produced 850 gallons of waste brine containing these radioactive elements every hour, every day of the year. The tailings were transported through 11 miles of pipelines to evaporation ponds. In 1998, Mountain Pass, then owned by a subsidiary of the oil company Unocal, had problems with a pipeline rupturing and leaking tailings, and four years later the company’s tailings storage permit expired.

Meanwhile, throughout the 1990s, Chinese mines gained a foothold in the rare earth metals market. China began extracting these elements as a by-product of its iron ore mines in the north of the country, called Bayan Obo. Mining both products from the same place initially helped keep prices low, and China invested in research and development into rare earth processing, eventually opening several small mines and encouraging manufacturers who used these metals to set up facilities in the country.

Returning to the current post, the second problem is the failure of the US to provide resources, funding and support. Vassal Given the importance of rare earths to defense production, the United States has been a staunch ally, but given that the United States and its NATO allies are unable to keep up with Russian military production and the production gap is widening in Russia’s favor, it once again becomes clear that our supposed leaders are unable to plot their way out of a paper bag.

Jennifer Cali writes for MetalMiner, the largest metal-related media site in the U.S. according to a third-party ranking site. Oil prices

- Chinese restrictions on rare earth mining and exports have disrupted global supply chains and sent prices soaring.

- U.S. companies, particularly in the defense sector, are vulnerable to such disruptions because of their reliance on Chinese rare earth elements.

- Diversifying supply chains, investing in domestic production and recycling, and exploring alternative technologies are key strategies to mitigate risks.

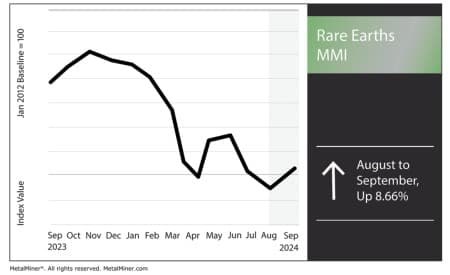

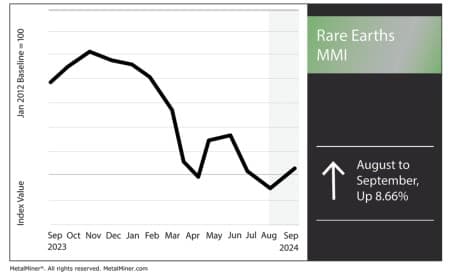

Rare Earth MMI (Monthly Metals Index) experienced a steady decline since May, before reversing and rising 8.66%. Many parts of the rare earth index, including neodymium and terbium oxides, reversed their price movements. China’s recent crackdown on rare earth supplies has shifted the global market, generating significantly more bullish sentiment in the short term, and that trend is likely to continue. Weekly with MetalMiner Newsletter.

China’s crackdown on rare earths leads to higher prices

Over the past few months, China’s crackdown on rare earth minerals and broader regulatory tightening have rippled through global markets. China has long dominated the rare earth minerals market, producing roughly 90% of the world’s refined rare earth output. This dominance gives Beijing significant influence over the global supply chain of critical minerals such as neodymium, praseodymium, and dysprosium, elements essential for magnets used in everything from electric vehicles to wind turbines.

Jiangxi province, one of China’s rare earth production centers, was one of the provinces that led a four-month campaign against illegal mining activities. While cracking down on illegal mining will benefit the market in the long run, drive above Rare Earth Element Prices In the short term.

Tight supply and demand

Many expect demand for rare earth elements to continue to grow due to the drive towards green energy. In fact, some analysts predict that this continued global growth will create a mismatch between supply and demand. Recent steps by China to crack down on illegal mining and tighten regulations have put new pressure on the global rare earth element market.

Some analysts predict that the rare earth market will go from a surplus to a global shortage by the end of 2024. A few analysts expect that there could be a global shortage of 800 tonnes of NdPr, a key component of permanent magnets, by the end of the year. Meanwhile, China’s decision to cut its rare earth production quotas will widen the gap, Pushing up prices.

US Defense Sector in Crisis

China’s export restrictions on rare earth processing technology are creating supply chain problems for defense companies, making it difficult to secure reliable sources of materials. Companies such as Raytheon and Lockheed Martin need rare earth elements for fighter jets, radars and missile systems. Recognizing this vulnerability, the U.S. Department of Defense has warned of national security risks associated with an over-reliance on rare earth elements. Chinese Rare Earth.

What U.S. companies can do to mitigate the risks

While reliance on Chinese rare earths creates challenges, U.S. companies have options to mitigate the risks and prevent economic loss.

First, U.S. companies need to diversify their supplier networks. Countries like Australia, Brazil and Canada also have significant rare earth reserves and continue to increase production. In recent years, companies like Australia’s Lynas Rare Earths have been particularly Neodymium and Praseodymium.

Meanwhile, the US government continues to actively encourage domestic production of rare earths to reduce reliance on Chinese suppliers. MP Materials, which operates the Mountain Pass rare earth mine in California, plays a key role in this effort. The US Department of Defense is also investing in building local rare earth mines. Processing FactoryThis is to enable the country to source these resources domestically.

Another strategy is to recycle rare earth elements from products that have reached the end of their life cycle. Rare earth recycling technology is still in its infancy but has great potential as a long-term solution to supply chain challenges. Companies in industries such as technology and automotive that handle large amounts of rare earth-containing products can benefit from investing in recycling infrastructure to recover these valuable materials from obsolete products. Electronics and Automotive.