This week is Naked Capitalism’s fundraising week. 259 donors have already invested in our efforts to fight corruption and predation, especially in the financial sector. Join us! Donation pageHere’s how to donate by check, credit card, debit card, PayPal, Clover, or Wise. Why are we doing this fundraiser?, What we accomplished last yearAnd our current goal is to Support the critics.

This is Eve. This post is posted without any time frame. Former Israeli General Yitzhak Birk warned in an editorial in the Haaretz newspaper. If the resistance axis continues its war of attrition against Israel, Israel will collapse within a year. Burke was referring more to military persistence and growing internal divisions. But the worsening economic situation is another pressure point.

The article understates where things are heading. First, it does not detail how the continued need to keep soldiers mobilized places a burden on the economy. Second, it does not acknowledge the number of Israelis who have left the country since the war began, an immediate loss of both labor and demand. Keep in mind that many believe skilled jobs are over-represented among those who left the country because they are in high demand. It is unclear how many will return. Israel’s appeal was that it enjoyed a European standard of living and was considered a safe haven for Jews. If either or both continue to be questioned, many of those who fled may never return.

Third, another source of potentially lasting damage is business closures, and the article explains that, unsurprisingly, business closures are significant and expected to increase.

Finally, this article does not address a topic that is addressed in several links in a links feature that will be published shortly today, namely, Israel’s efforts to destroy what remains of the West Bank’s economy.

By Amr Saber Algahi, Senior Lecturer in Economics, Sheffield Hallam University and Konstantinos Lagos, Senior Lecturer in Business Economics, Sheffield Hallam University. conversation

rear 11 months of warIsrael is facing its biggest economic challenge in years. Data shows that the Israeli economy is The sharpest deceleration One of the richest countries in the Organisation for Economic Cooperation and Development (OECD)OECD).

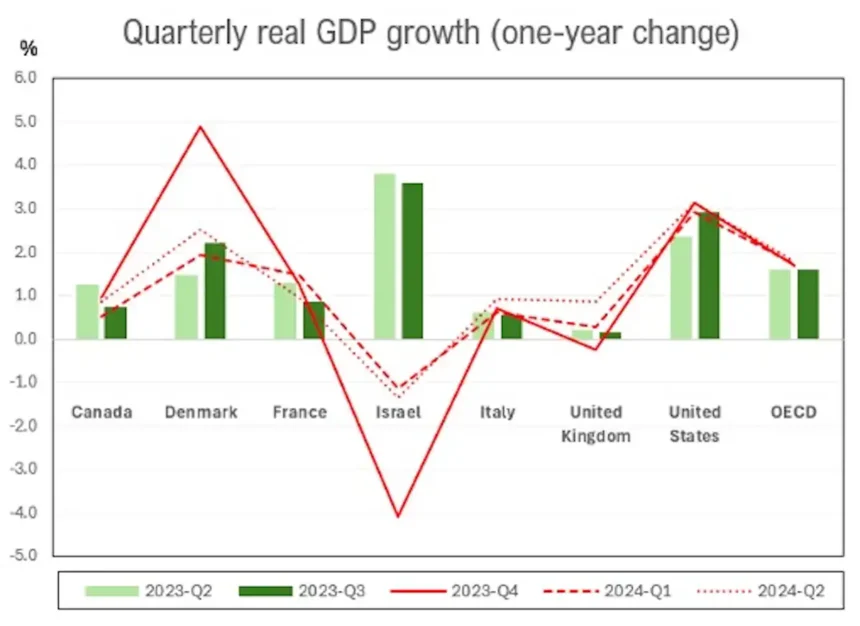

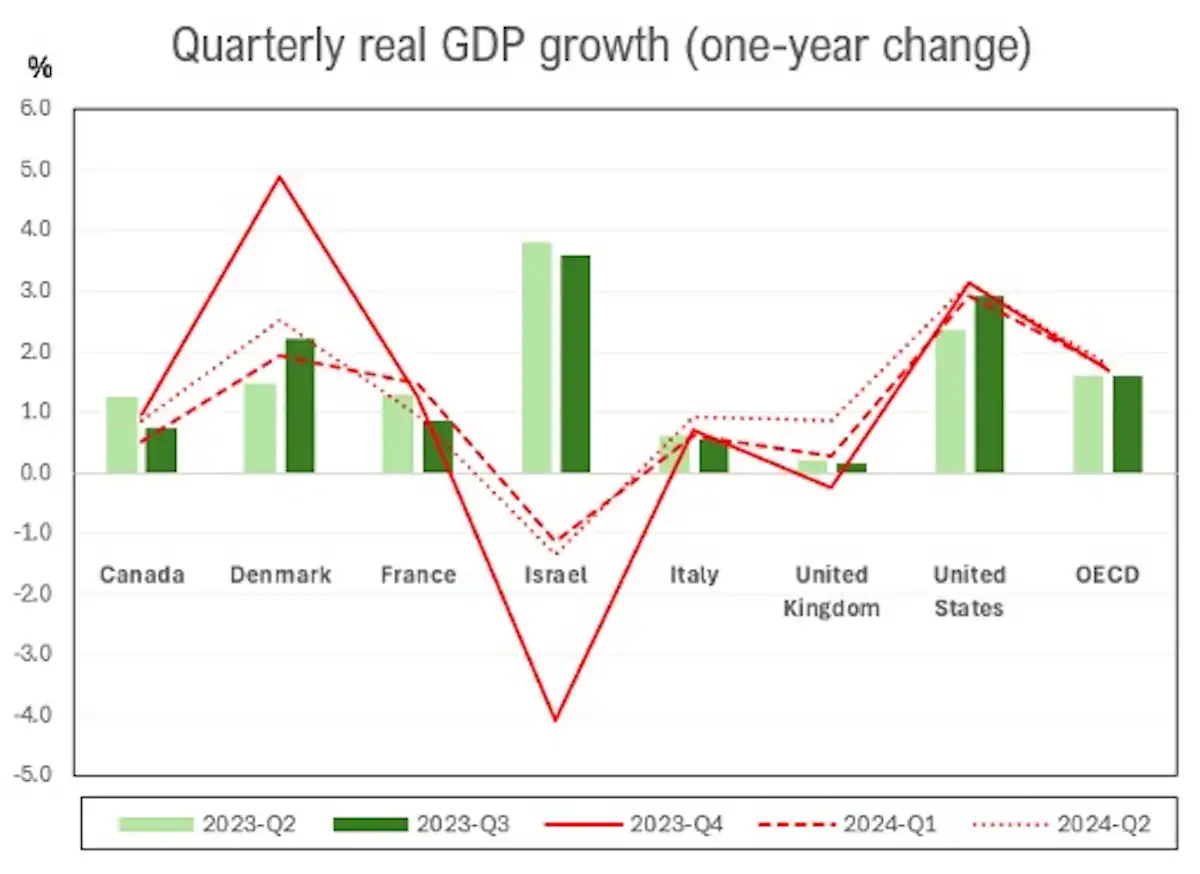

GDP fell 4.1% in the weeks following the October 7 election. Hamas-led attacksAnd this slump continued into 2024, with further declines of 1.1% and 1.4% in the first two quarters.

This situation is Nationwide strikeOn September 1st, the country’s economy came to a very brief halt amid widespread public anger over the government’s handling of the war.

A chart showing quarterly GDP growth for several OECD countries alongside the OECD average. Israel shows the most extreme fluctuations, declining sharply from October to December 2023. Amr Saber Algarhi & Konstantinos Lagos / OECD, CC BY-ND

A chart showing quarterly GDP growth for several OECD countries alongside the OECD average. Israel shows the most extreme fluctuations, declining sharply from October to December 2023. Amr Saber Algarhi & Konstantinos Lagos / OECD, CC BY-ND

Of course, Israel’s economic challenges are Total Destruction Gaza’s economy is deteriorating, but as the war drags on it hurts Israeli finances, business investment and consumer confidence.

Before the war, Israel’s economy was mainly TechnologyCountry’s annual GDP per capita 6.8% increase It will reach 4.8% in 2021 and 4.8% in 2022, much higher than in most Western countries.

But the situation has changed dramatically since then. In a July 2024 forecast, the Bank of Israel predicted: revision The company lowered its growth forecast for 2024 to 1.5% from the 2.8% it predicted earlier this year.

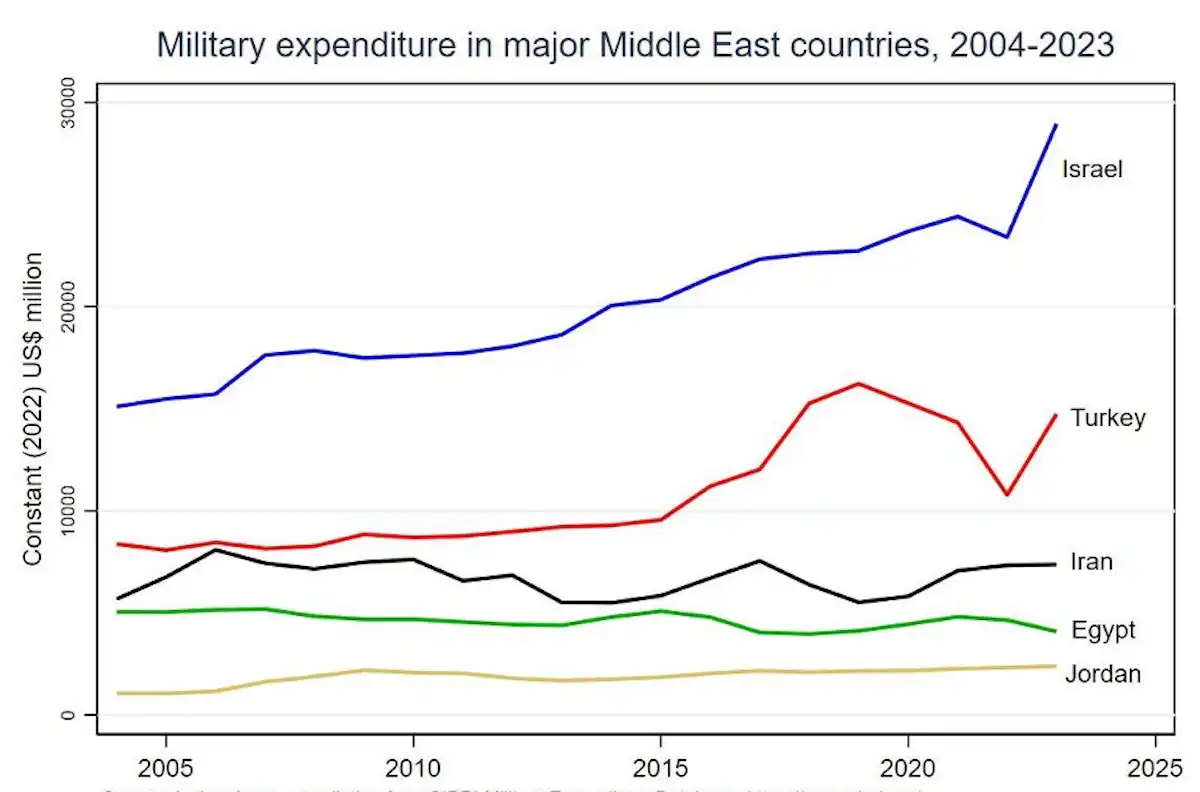

With fighting in Gaza showing no signs of abating and the conflict with Hezbollah on the Lebanese border intensifying, the Bank of Israel Estimation The cost of the war is projected to reach $67 billion by 2025. Military Aid PackageWithout U.S. aid, Israel’s finances may not be sufficient to cover these costs.

This means Israel will face tough choices about the allocation of resources: it may need to cut spending in some areas of the economy, for example, or increase debt, which means bigger future loan repayments and higher service costs.

Israel’s deteriorating financial situation has led major rating agencies to Downgrade Country Status. Fitch LoweredIsrael’s credit rating was downgraded from A+ to A in August. Increased military spending Expand It will raise the fiscal deficit to 7.8% of GDP in 2024, from 4.1% the previous year.

It could also jeopardize Israel’s ability to maintain its current military strategy, which is aimed at continued operations in Gaza. Destroy Hamasrequires ground troops, advanced weapons, and ongoing logistical support, all of which comes at significant economic cost.

Israel’s military spending is consistently the highest in the Middle East. Amr Saber Ararhi & Konstantinos Lagos / SIPRI Military Expenditures Database, CC BY-NC-ND

Beyond macroeconomic indicators, the war has had a profound effect on certain sectors of the Israeli economy. For example, the construction sector Nearly a thirdIn the first two months of the war, agriculture Hit by a blowProduction also fell by a quarter in some regions.

almost 360,000 reservists More than 120,000 Israelis were drafted at the start of the war, but many have since returned home. Driven away from home In the border areas, 140,000 Palestinian workers from the West Bank Not allowed Since the October 7 attack, he has been unable to enter Israel.

The Israeli government is trying to fill this gap. Introduction of workers There is a shortage of talent from India and Sri Lanka, but many key positions will remain vacant.

it is Estimation While many companies are postponing new projects, staff shortages, supply chain disruptions and declining business confidence could force up to 60,000 Israeli businesses to close in 2024, the report said.

Although tourism is not a major part of the Israeli economy, it has been heavily affected. Since the start of the war, tourist numbers have fallen dramatically. 1 out of 10 hotelsStores across the country are facing possible closure.

The War’s Widespread Impact

The war may have hit the Israeli economy hard, but the impact on the Palestinian economy has been far more severe and will take years to recover.

Many Palestinians in the West Bank have lost their jobs in Israel, and Israel has Tax revenueGroups that collect on behalf of Palestinians have left the Palestinian Authority Financially strapped.

Trade in the Gaza Strip has also halted, with many Palestinians Rely on assistanceAt the same time, an important communication channel is Disconnected Critical Infrastructure Destroyed.

The impact of the war extends beyond Israel and Palestine. In April, the International Monetary Fund (IMF) said The firm predicted “sluggish” growth in the Middle East at just 2.6% in 2024, citing uncertainty caused by the war in Gaza and the threat of a full-scale regional conflict.

The escalation of violence in Gaza has had ever-wider economic impacts. For example, Israel’s bombing of Gaza in 2008 Oil prices It fell about 8%, sparking concern in markets around the world.

Israel’s war on Gaza is fast approaching its first anniversary and has taken a huge economic toll. Only a permanent ceasefire can repair the damage and pave the way for recovery in Israel, Palestine and the wider region.