This week is Naked Capitalism’s fundraising week. 818 donors have already invested in our efforts to fight corruption and predation, especially in the financial sector. Join us! Donation pageHere’s how to donate by check, credit card, debit card, PayPal, Clover, or Wise. Why are we doing this fundraiser?, What we accomplished last yearAnd our current goal is to Preventing death from overwork.

This is Eve. We have noted early on that Russia has a large market share in many key commodities and supplies, including neon, and that Russia may restrict supplies to gain an advantage. In parallel, there have been some concerned and angry comments (by the author) about the fact that the US is dependent on Russian uranium at the start of special military operations. This article summarizes a Bloomberg report on Putin’s remarks, indicating that he has instructed his officials to look into the issue and consider whether it would be to Russia’s advantage to ban or restrict Western purchases. From Bloomberg:

Russian President Vladimir Putin has asked his government to consider whether it makes sense to restrict exports of some commodities, including nickel, titanium and uranium, in retaliation for Western sanctions.

“Russia has the largest reserves of strategic raw materials in the world: uranium, titanium, nickel,” Putin said during a televised government meeting. As Western sanctions limit the export of some Russian products, such as diamonds, “maybe we should think about restrictions too,” he said. Such restrictions should not harm Russia, he said…

The London Metal Exchange banned new imports of Russian nickel and aluminum in April in response to U.S. and U.K. sanctions, but Russia sells most of its production to end consumers. The U.S. also banned imports of Russian uranium and new nickel, copper and aluminum this year.

“I am not saying that we need to do this tomorrow, but we could consider imposing certain restrictions on supplies to foreign markets, not only of the products I mentioned, but also of other products,” Putin said.

The U.S. has passed legislation implementing the ban, which will take effect on August 11, 2024, making Putin’s speculation akin to trying to close the barn door after the horses have left for the next county. (As an aside, note the exaggerated interpretation of the headline, suggesting Putin is considering the idea, and portraying the move as emotional “revenge” rather than retaliation.) But the law has a loophole that would let trucks drive by. From the Department of Energy:

Recognizing that in the short term, implementation of the ban could prevent nuclear reactors from operating, the Act authorizes the Secretary of Energy, in consultation with the Secretaries of State and Commerce, to waive the ban and permit the import of Russian uranium if the applicant can demonstrate that there are no alternative sources of uranium or that such imports are in the national interest. Any waivers granted by the Secretary of Energy are subject to aggregate annual limits and will expire on January 1, 2028.

The Heritage article explains that the real issue is enrichment capacity, and that the United States’ ability to cut off supplies from Russia depends on private investors stepping up and funding the expansion of enrichment capacity. From Heritage:

The United States receives about 19 percent of its electricity from 93 commercial nuclear power plants that use uranium as fuel.

Uranium is an abundant mineral worldwide, but the capacity to enrich it for use in nuclear power plants is much more limited: Russia has about 46% of the world’s enrichment capacity, while the United States has just 9.5%.

But the United States is the largest consumer of the type of uranium used for fuel, called low-enriched uranium (LEU). This means the U.S. can only produce about 20 percent of its LEU needs domestically. The rest of its needs come from enrichment facilities in the U.K., Germany, and the Netherlands. About 25 percent comes from Russia.

Shortly after the invasion, Biden halted oil imports from Russia. Now Washington is moving to ban uranium imports. The bill has three main parts, preventing black market imports by banning the import of low-enriched uranium from Russia or any Russian entity and banning low-enriched uranium that is “determined to have been bartered, swapped, or otherwise obtained” to circumvent the ban, in effect until 2040.

A long-term ban is crucial because expanding enrichment takes time and money: if the ban is lifted or waived and cheap Russian LEU becomes available to U.S. buyers again, investors are unlikely to expand production capacity to supplement Russian supplies.

While growing demand for non-Russian uranium fuel is already driving the United States’ only domestic commercial enrichment facility to expand its production capacity, a long-term ban on imports from Russia is needed to provide the market certainty needed to justify investment in a broader expansion of the sector.

The Heritage Foundation points out two problems with the bill: first, it argues that the exemptions we cited would undermine certainty of domestic demand, and second, it calls for the agency to “get out of the way” and be as lenient as possible when it comes to permitting enrichment and uranium mining.

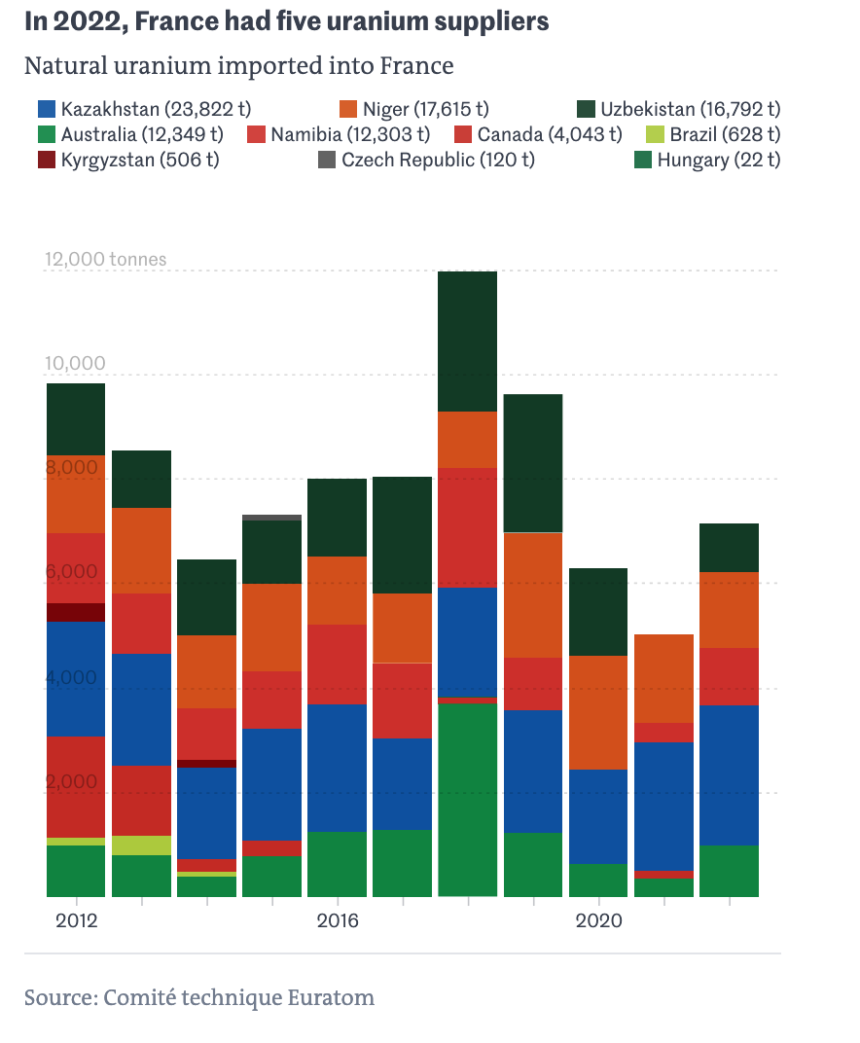

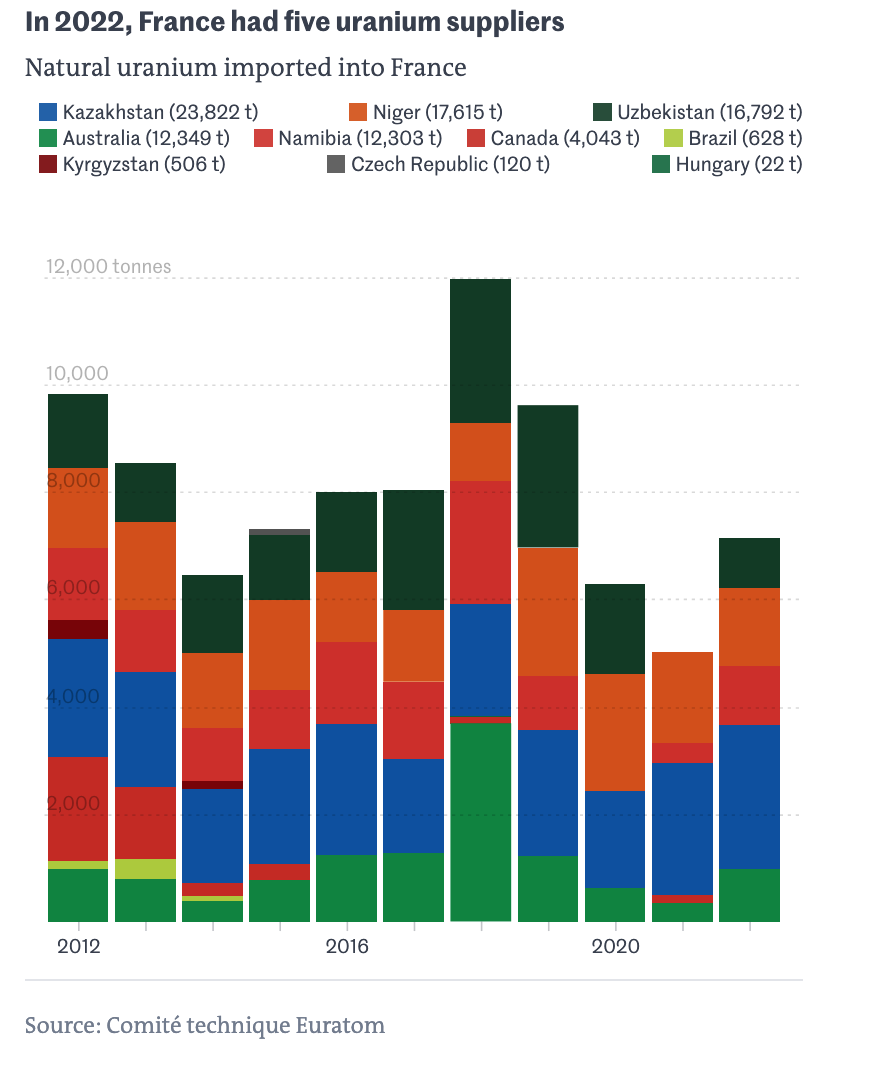

Even though nuclear power is more important in France’s energy mix than the US (France exports electricity), it uses much less Russian uranium: EDF uses about 8,000 tonnes of uranium per year, of which, as far as I know, only 153 tonnes comes from Russia. A graph from an article published in Le Monde in 2023 about France’s uranium resources in Africa. Russia is not included as a material source.

That said, for reasons of space, this humble blogger will not go into which countries may be squeezed if Russia were to restrict exports to Collective West member states for some or all of the other goods for which it is a major supplier. If Russia moves forward, we can expect to see an analysis in 2022 with more up-to-date data than what we have published.

Article by Alex Kimani, veteran financial writer, investor, engineer and researcher at Safehaven.com. Oil prices

Russian President Putin in Moscow Consider limiting Bloomberg reported on Wednesday that China will halt exports of some commodities, including uranium, nickel and titanium, in retaliation for Western sanctions.

“Russia has the world’s largest reserves of strategic raw materials such as uranium, titanium and nickel.“Western sanctions are restricting the export of Russian products, including diamonds, so we are taking measures to prevent this,” Putin said in a video conference with the government.You might also want to consider limitations.” he said, adding that such restrictions should not harm Russia.

The United States and its Western allies have imposed numerous sanctions on the Russian economy as punishment for the war in Ukraine, but many vital materials, including nickel, palladium and uranium, are not subject to any restrictions and continue to flow to Western countries.

In June, EU-approved sanctions It is the first EU sanctions against Russian natural gas. According to Belgium, which holds the EU presidency, the EU is set to impose unprecedented sanctions on Russia’s lucrative natural gas sector, measures that could reduce Moscow’s war chest by hundreds of millions of dollars.

However, the proposed sanctions would not affect the majority of Russia’s liquefied natural gas (LNG) exports to the EU. Instead, the sanctions would prohibit EU countries from re-exporting Russian LNG after receiving it, and would also bar the EU’s involvement in upcoming LNG projects in Russia. The sanctions would also prohibit the use of EU ports, finance and services to re-export Russian LNG, essentially meaning that Russia would have to overhaul its LNG export model. Currently, Russia supplies LNG to Asia via Europe, with Belgium, Spain and France as its main hubs.

“If transshipment is not possible in Europe, long voyages on ice-resistant tankers may be necessary.“Laura Page, a gas expert at data analytics firm Kpler, told Politico that Russia “Because the ships cannot return quickly enough, they may not be able to unload much cargo from Yamal..”

Norway and the United States have replaced Russia as Europe’s largest gas suppliers. Norway supplied 87.8 billion cubic meters (billion cubic metres) of gas to Europe last year, accounting for 30.3 percent of total imports, while the United States supplied 56.2 billion cubic meters, making up 19.4 percent of total imports.