This week is Naked Capitalism’s fundraising week. 819 donors have already invested in our efforts to fight corruption and predation, especially in the financial sector. Join us! Donation pageHere’s how to donate by check, credit card, debit card, PayPal, Clover, or Wise. Why are we doing this fundraiser?, What we accomplished last yearAnd our current goal is to Preventing death from overwork.

Readers who have been following the very long story of the lawsuits against fund management giants KKR and Blackstone and other involved parties, including leaders such as Henry Kravis and Steve Schwarzman, will understand that the defendants have so far prevented the litigation, which began in 2017, from reaching discovery. The very rough version of the allegations is that KKR and Blackstone violated their very strict fiduciary duties in Kentucky by misrepresenting the potential risks and returns of customized hedge funds that they established and managed for the Kentucky Retirement System, the state’s public pension fund.

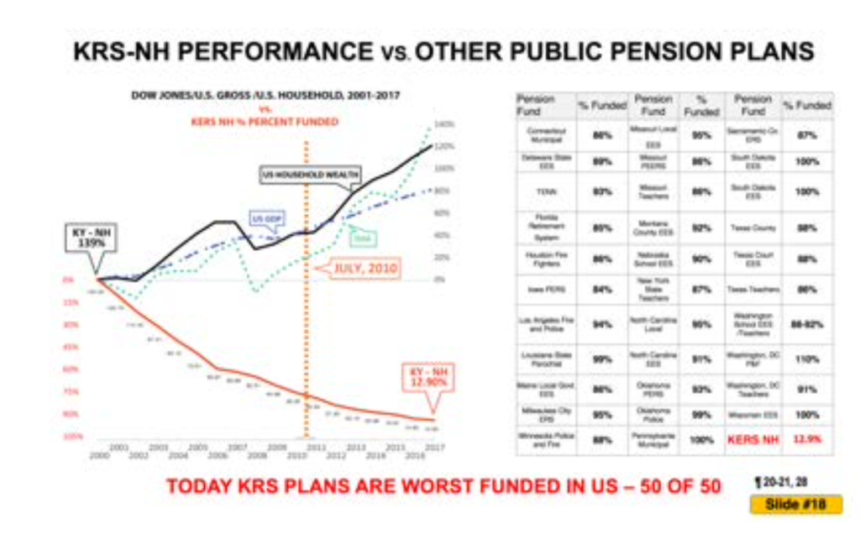

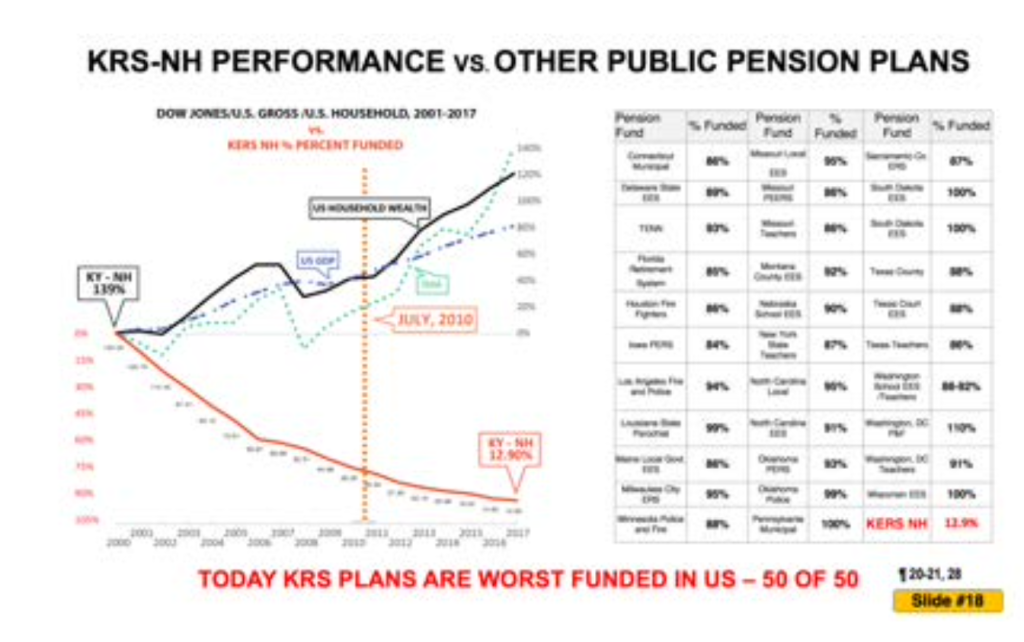

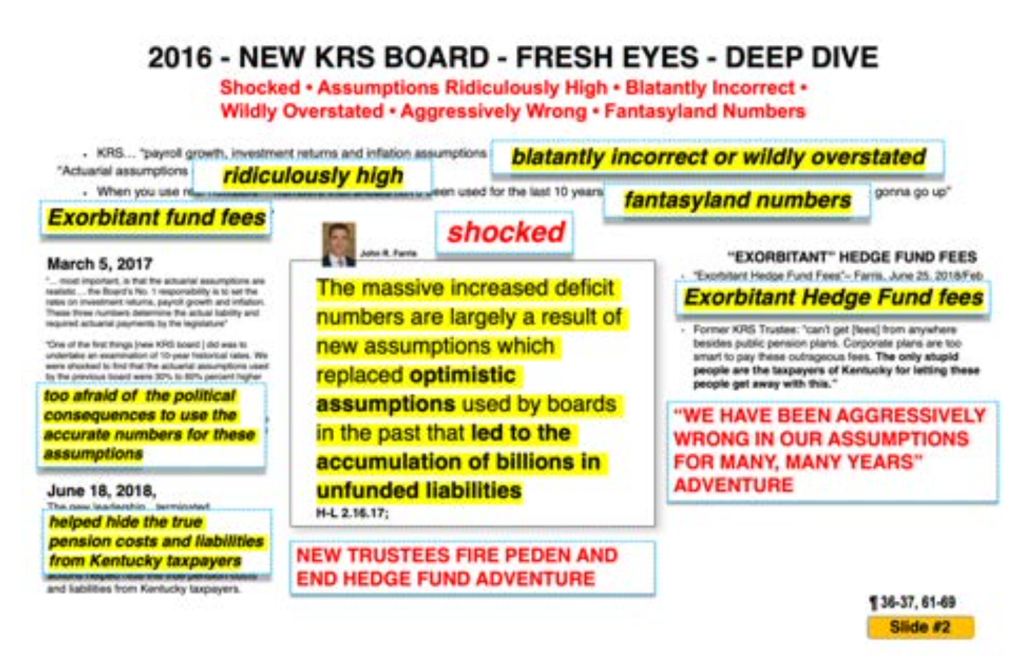

From the very first post on this site, I have pointed out that hedge funds are a poor investment option, especially for public pension funds, because they do not outperform traditional investment strategies. Hedge funds of funds are even worse because they introduce a second layer of fees (investors not only pay the hedge fund’s fees, but also a second fee to the manager who selected the group of hedge funds).

Kentucky Retirement Systems initially conducted a study when it became aware of the worst underfunding problem in the U.S. But a few years later, the company decided to take the plunge, at least in part due to poor management by non-independent consultants (a breach of fiduciary duty). These funds, with cute names like Daniel Boone, were sold as an unlikely combination of low risk and high returns, but they fell short of expectations so badly that you would have been better off just putting cash in a bank account. And yet the managers collected hundreds of millions of dollars in fees.

Our status update is provided in the form of two court filings embedded below, the Plaintiffs’ Response to the Appeals Court Filings, and the Defendants’ underlying Writ Petition. But first, again in broad terms, let’s explain how we got to this point.

The first case, Mayberry v. KKR, was a derivative action. The most common type of derivative action is one brought by shareholders to assert rights actually held by management and/or the board of directors who have not used those rights to protect the interests of shareholders (the plaintiff must demonstrate “futile claims” that the party who should assert the rights has not asserted them or is expected not to assert them despite the plaintiff’s efforts). The first case was brought to the Kentucky Supreme Court and dismissed for lack of standing as a result of adverse precedent after the first case was filed. The standard was established that participants in defined benefit plans could not be considered to have suffered a specific (concrete) loss unless the pension fund actually paid less than the plan was obligated to pay. Mere losses in the fund that seemed certain to eventually result in a shortfall were not enough.

But the plaintiffs’ lawyers resuscitated the case and won a major victory in May. To quote from our article at the time:

It seems like forever ago now, but the latest big move in the long-running Kentucky Retirement System litigation in which the underfunded pension fund is seeking restitution was Kentucky Attorney General Daniel Cameron’s bold move to join the suit on behalf of all the alleged potential plaintiffs. This was despite the former Attorney General filing a motion in support of a legal team led by Michele Lerac, her fearsome and controversial husband, former top securities litigation lawyer Bill Lerac, and other highly skilled lawyers in their efforts to obtain damages from financial industry giants KKR, Blackstone, PAAMCO (a former affiliate of bond giant Pimco), their top executives (!!!), and their many co-conspirators and supporters. The basis of the lawsuit was breach of fiduciary duty and other misconduct in the sale and management of custom hedge funds…

For those of you following this story, the case was originally called Mayberry v. KKR…

Mayberry v. KKR subsequently reached the Kentucky Supreme Court, which dismissed the case for lack of standing due to intervention by the federal court of appeals and Supreme Court decisions made after the case was first filed.

In the case of an intervention decision, the plaintiff is usually allowed to restate his or her case.

But then came another act of sabotage. As it became clear that the plaintiffs were not going to go away easily after their loss at the Kentucky Supreme Court, Attorney General Daniel Cameron got out of bed. In July 2020, he stepped in on their behalf and shamelessly rewrote their original filing (with the help of one of the original lead lawyers, Anne Oldfather, whose loyalty was questioned from the start). He later asserted that he had a total monopoly on the field, in the sense of representing the state (which he funds), the Kentucky Retirement System, and its beneficiaries. The Kentucky Retirement System whined, pointing out that it was one of the state agencies that chose its own lawyers, not empowering Cameron to act on its behalf.

The core legal team attempted to file a restructured lawsuit, retaining some plaintiffs with so-called “hybrid” “Tier 3” plans (with both defined benefit and defined contribution elements) and adding other Tier 3 plaintiffs. There is a lot of precedent that allows participants in defined contribution plans to sue for losses of plan assets even if they have not begun to withdraw funds. This resolved the previous standing issue. Admittedly, these beneficiaries represent a much smaller amount of the Kentucky Retirement System’s overall funds, but the facts of the damages were probably enough to lead to discovery.

In late December 2020, the Court dismissed nearly all of the repetitions in the case, except for the third tier claims mentioned above (now called Taylor v. KKR)…

The defendants successfully sought to have Shepherd removed from the case, citing his strong stance on Mayberry v. KKR during his reelection campaign.Shepherd stepped down in May 2022.The defendants must have believed that a more conservative judge would favor them. It seems that it never occurred to them that a competent judge would not blindly accept a coastal judge, regardless of his ideological leanings.

con manThe financiers were selling out of respect for their positions.Judge Thomas Wingate has finally issued an order on the numerous motions to dismiss, almost all by different defendants. The sheer scale of the task, combined with the need to sort through a plethora of prior claims, appears to have caused significant delays. The consent order is well-founded, and appears to have gained added credibility from the Attorney General’s rejection of the notion that Tier 3 plaintiffs can be adequately represented, and his personal denial of the motions to dismiss of highly influential defendants, including KKR, Blackstone, PAAMCO, and private equity heavyweights Henry Kravis, George Roberts, Steve Schwarzman, and Tomlinson Hill.

Needless to say, the fact that a third tier of plaintiffs got the green light to begin discovery has further complicated life for the Attorney General, who, incidentally, was not Daniel Cameron, who retired earlier this year, leaving this mess of unfinished business on the desk of his successor, Republican Russell Coleman.

And finally, remember that everyone familiar with this case understands what the real leverage is: exposing the misdeeds of big, well-regarded private equity leaders and delving deep into the economic and commercial relationships between those top leaders and their companies.

Now, the latest development: The defendants immediately appealed to the Court of Appeals, despite the absence of a trial court ruling. They also appealed the original lawsuit in Mayberry v. KKR.

Interlocutory appeals, which are usually filed before a lower court has heard and decided a case, are generally looked down upon in most U.S. courts as far as I know. But Kentucky’s procedure appears to give unlimited rights to try the tactic. Appeals Procedure Rules It is referred to as “RAP 60” in the filing below.

Plaintiffs (who are now defendants in this appeal but will be referred to here as Plaintiffs or Real Parties in Interest) review the RAP 60 filing in the first embedded document below. It shows how this case continues to have a manipulative motion process. One of the tactics in the filings by KKR and co. is to repeatedly misrepresent past decisions and the facts of the case. I hope someone reads the filing to the end, but this is an example of Tier 3 Plaintiffs refuting the false claims of hedge fund bigwigs.

Can the Attorney General properly represent Tier 3 plaintiffs? No. Any recoveries by the Attorney General go to the Kentucky General Fund, while recoveries by Tier 3 plaintiffs go to the Kentucky State Retirement System.

The Tier 3 plaintiffs were in defined benefit plans and therefore, according to previous rulings, do not need to go back to court: their plans had defined benefit and defined contribution portions, and they suffered losses in the defined contribution portion because of the hedge fund’s mismanagement.

A Tier 3 action is a derivative action. No, it asserts a direct claim.

Blackstone, KKR, and their executives claim that they would suffer irreparable harm if the litigation proceeds. This is an absurd claim, given that the bar for “irreparable harm” is so high. In fact, both KKR and Blackstone have stated in public filings that the pending litigation will not materially affect them. As for the individual defendants, their enormous wealth (documented in the filings) backs this up.

And let’s not forget that these very determined efforts to thwart discovery are intended to thwart investigation of the details behind false facts such as:

Now, unfortunately, wealthy fund managers may be lucky enough to have an appointed Court of Appeal judge who may side with them due to their lack of patience for factual and legal arguments. But Justice Wingate has given a very careful and detailed judgment to forestall that from happening. So, pay attention.

00 Response to Write Petition Compression

00 Summary only (2024-07-03) Tier 3 Writ Petition with Evidence Defs.