by Calculated Risk September 16, 2024 1:06 PM

In June I wrote: The Art of a Soft Landing

Some excerpts and updated graphs…

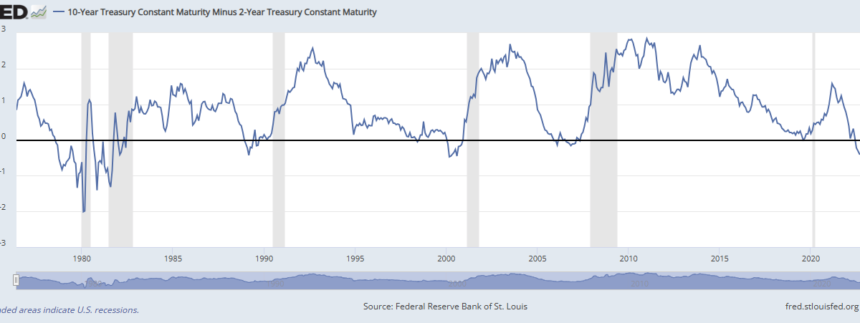

The “technique for a soft landing” requires the Fed to cut rates fast enough to keep economic growth positive, but slow enough not to reignite inflation. In my view, a soft landing is achieved if growth remains positive, inflation returns to target, and the yield curve flattens or normalizes (longer-term yields exceed short-term yields).

The good news is that growth remains positive and inflation is approaching the 2% target, but the yield curve remains inverted, so we’re not out of the woods yet.