According to a new report by American payments consultancy CMSPI, produced in collaboration with Amazon: Explore Payments trends and regulation in Asia Pacific (APAC), focusing on the impact of rising card fees on merchants and regulators’ responses to these challenges.

The report highlights the role of regulation, such as capping interchange fees and promoting alternatives to bank payments, in intervening to reduce costs for merchants and increase competition in the payments market. It also explores the growing adoption of real-time payments, which are being adopted in many countries as a more efficient and cost-effective alternative to traditional card payments.

The report looks at Asia Pacific’s four largest retail payments markets – Japan, India, Singapore and Australia – and examines key trends across each jurisdiction in terms of costs, consumer behavior and regulation. It notes that rising card fees in the region are having a significant impact on merchant acceptance costs, leading to regulatory action in various markets.

In response to these challenges, some countries have implemented measures to limit fee inflation and create a more efficient payments environment. These measures include capping interchange fees to limit the effects of reverse competition and mandating competition for card payments through the use of joint badging. Joint badging means that a single payment card has at least two or more payment card networks enabled, allowing the card to be used for transactions on multiple payment networks, improving accessibility.

Other regulatory initiatives include mandating price disclosure of interchange fees and ensuring merchants’ right to surcharge. Surcharging refers to the practice of merchants adding an additional fee to a transaction when a customer chooses to pay with a particular payment method, usually a credit card. This surcharge is intended to recover the costs associated with accepting card payments.

Payment Regulations and Merchant Fees

The study uses publicly available data to explore countries’ approaches to intervening in rising card costs and analyzes how these efforts have affected card acceptance costs. We find that in most cases, regulatory interventions have had a positive impact on merchant acceptance and costs.

For example, Australia introduced interchange fee caps on both credit and debit transactions in 2003. This measure significantly reduced acceptance costs for merchants: from the first quarter of 2003 to the first quarter of 2004, the average acceptance costs for Visa and Mastercard fell from 1.45% to 1.08%.

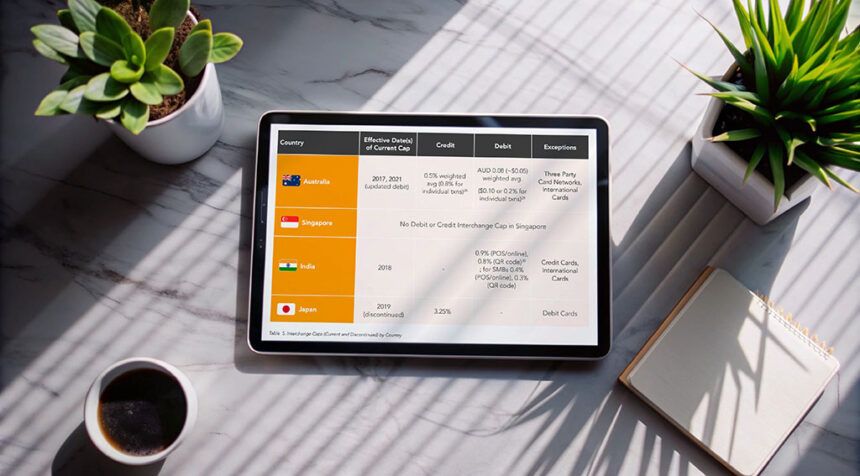

Of the four Asia Pacific countries surveyed, only Australia currently has interchange caps on credit and debit transactions. India has implemented interchange caps for debit and United Payments Interface (UPI) network transactions, but does not have caps on credit transactions.

Japan had previously implemented a 3.25% interchange cap on credit card transactions, but after strong opposition from the credit card industry, lawmakers reversed course and gave card companies discretion on whether to keep the cap in place.

Finally, while Singapore does not have any formal interchange caps, there are instances of surcharges being imposed in certain areas, suggesting some level of regulatory activity around card payments.

Merchants have long criticized Visa and Mastercard for charging high interchange fees, or “swipe fees,” on credit and debit card transactions. Swipe fees typically consist of a percentage of the total sale price plus a small fixed fee, averaging 1.5% to 3.5% per transaction. According to According to Bankrate.com, these fees will reach $172 billion by 2023, more than doubling over the past decade. According to to the Merchants Payments Coalition, which represents retailers, grocery stores, convenience stores and gas stations;

Real-time payments as an alternative

To improve the payments environment and promote competition, many governments are investing in bank payments infrastructure, allowing both merchants and consumers to benefit from more efficient and cost-effective payment solutions.

Pay by Bank is a payment method that allows customers to pay for goods and services directly from their bank account, without the need for a credit or debit bank. These solutions are an attractive alternative to digital payments, offering efficiencies such as faster settlements, greater interoperability and lower costs than traditional card rail services. Digital wallets can also be built on and integrated with Pay by Bank rails, stimulating innovation and further expanding alternatives to card-based transactions.

In some countries, the use of bank payment solutions has increased dramatically, surpassing cards’ share of in-store and online retail payments.

In India, UPI, a bank-backed payments infrastructure and instant payments system, has become the preferred digital payment method, accounting for 53.4% of transactions and 84% of all electronic transactions by 2023. According to 2024 Primetime Real Time Report from ACI Worldwide.

Last year, India became the world’s largest instant payments country, processing approximately 130 billion real-time payments by 2023, accounting for 49% of the total global real-time transactions. This figure exceeds the real-time payments of the next nine countries in the global market combined.

In Singapore, real-time payments adoption is low, accounting for just 11.8% of all transactions and 29.5% of total payment value in 2023. By 2028, spending on real-time payments is expected to overtake both non-real-time electronic and paper-based payments.

Global real-time payments hit a new record last year, with a total of 266.2 billion transactions expected in 2023, marking 42.2% growth year-on-year.

Featured Image Credit: Free Pick