by Calculated Risk September 18, 2024 11:51 AM

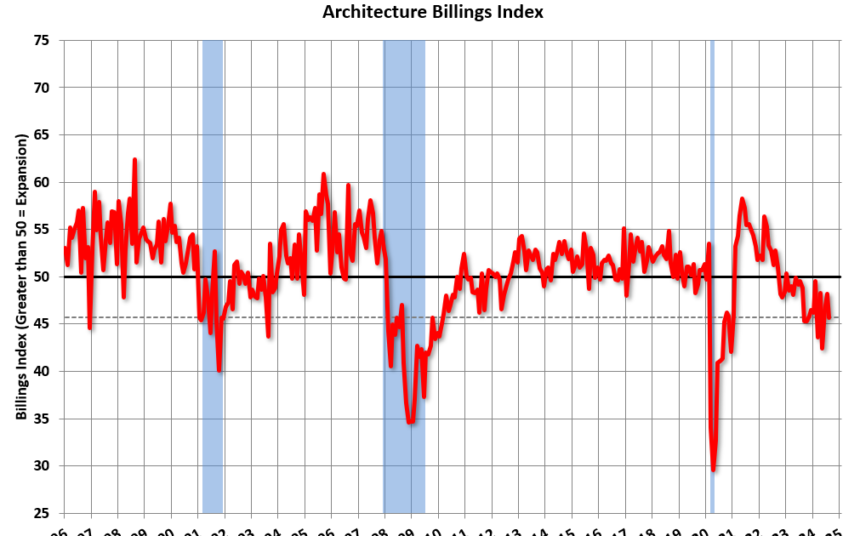

Note: This index is primarily a leading indicator of new commercial real estate (CRE) investment.

It’s been almost two years since the firm has experienced sustained growth, but while job inquiries continue to grow and clients are still interested in new projects, converting those inquiries into actual new projects remains a challenge, as the value of newly signed design contracts declined for the fifth consecutive month in August.

Economic conditions weakened in all regions of the country in August, with businesses in the West reporting the weakest performance for a second consecutive month. Sales at businesses in the Northeast had remained stable over the past two months but fell back into negative territory this month. Businesses across all specialties also saw sales declines in August. Conditions are particularly soft for companies specializing in apartment complexes..

…

The ABI score is a leading economic indicator of construction activity, providing a forecast of future non-residential construction spending activity approximately 9-12 months ahead. The score is derived from a monthly survey of construction firms measuring changes in the number of services provided to clients.

Add emphasis

• Northeast (48.2), Midwest (46.6), South (46.8), West (45.7)

• Sector index breakdown: Trade/Industrial (46.6); Institutional (47.4); Apartment complex (44.0)

This graph shows the Architecture Billing Index since 1996. The index fell from 48.2 in July to 45.7 in August. A reading below 50 indicates a decline in demand for architects’ services.

Note: This includes commercial and industrial facilities such as hotels, office buildings and apartment complexes, as well as schools, hospitals and other facilities.

Because the index typically leads CRE investment by 9-12 months, the index suggests that CRE investment will slow through 2025.

Keep in mind that multifamily billings fell in August 2022, marking the 25th consecutive month of declines. (Revised). This suggests that apartment housing starts will fall further.