Yves here. Israel’s barbaric conduct of its wars, the deteriorating situation in Ukraine, and the hard-fought US presidential election have been dominating the news. That makes it way too easy for legitimately important stories to go by the wayside, particularly ones involving scams. Blue hydrogen is one of the far too many supposed climate easy fixes that are taken up by promoters and sold as far more effective than they are (keep in mind that overstated impact justifies overspending).

But blue hydrogen, as DeSmog explains below, looks far more cynical than that. A pet initiative of fossil fuel companies, its backers are trying to claim it should get “low carbon” subsidies. DeSmog’s analysis shows that, based on the performance of existing projects, it should not qualify.

By Aline Nippert. Originally published at DeSmogBlog. This is the fourth part of a DeSmog series on carbon capture and was developed with the support of Journalismfund Europe and published in partnership with Le Monde

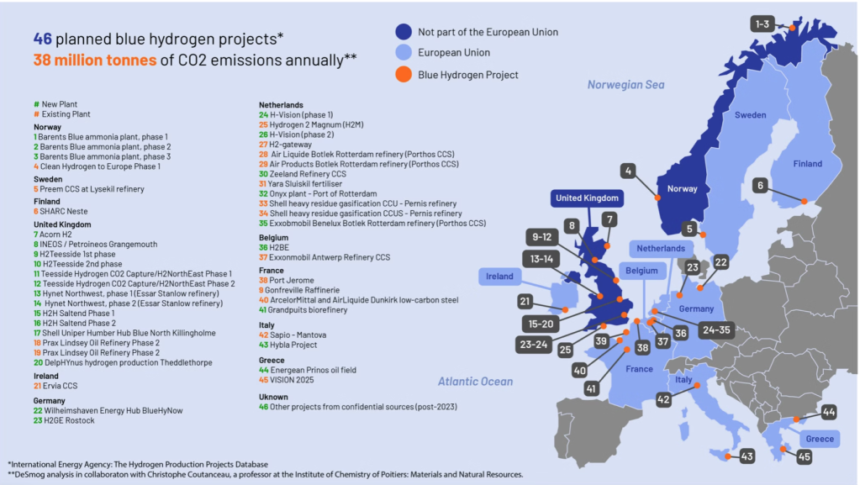

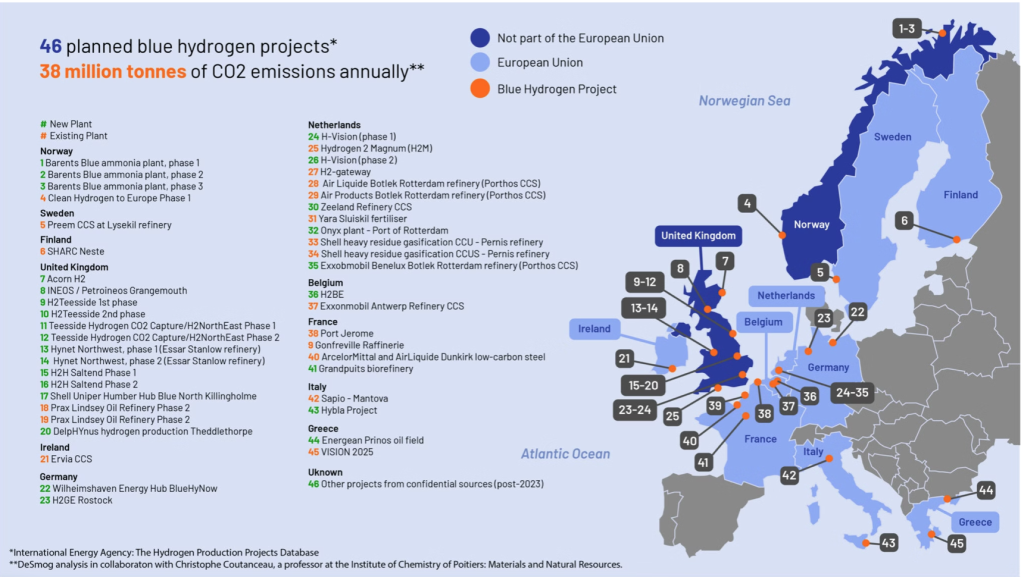

Billed by the fossil fuel industry as a climate solution, dozens of planned blue hydrogen projects in Europe could consume more natural gas each year than France, and produce emissions on a par with Denmark, a DeSmog analysis has found.

The findings raise new questions over blue hydrogen’s climate impact as EU officials deliberate over technical standards that could allow the technology to count as “low-carbon” — and thus qualify for billions of euros in subsidies.

The term blue hydrogen is used to describe hydrogen made from natural gas, where carbon capture and storage(CCS) technology is deployed to trap much of the large amounts of carbon dioxide (CO2) generated during the production process, then bury it underground.

Hydrogen emits no CO2 at the point of use. If produced cleanly, the molecule is theoretically capable of decarbonising various sectors, including chemicals and petrochemicals, steel, cement, power, road transport and potentially aviation.

Although Europe has yet to produce any blue hydrogen at scale, Shell, BP, Equinor, TotalEnergies, Eni, and ExxonMobil are among dozens of oil and gas companies promoting the technology as a way of meeting climate goals.

However, industry has yet to provide the kind of comprehensive data needed to estimate how far any possible climate benefits from switching to blue hydrogen produced by the planned projects may offset the residual CO2 emissions and methane leaks associated with making it.

To begin to fill this gap, DeSmog teamed up with Christophe Coutanceau, a professor at the Institute of Chemistry of Poitiers: Materials and Natural Resources, and co-lead of a hydrogen working group at the French National Centre for Scientific Research, known by its French acronym CNRS. (Details of the methodology used can be found at the end of this story).

By reviewing extensive industry reports and technical data on 46 proposed blue hydrogen projects in the EU, UK and Norway listed by the Paris-based International Energy Agency (IEA), DeSmog found that 27 involve building new hydrogen production facilities. Another 15 envisage retrofitting existing hydrogen plants with carbon capture, while the status of four remained undetermined. More than a third of the total volume of hydrogen gas produced by these 46 projects would be used for oil refining — the main use of hydrogen today, according to a DeSmog tally of available data.

In collaboration with Coutanceau, DeSmog estimated that these 27 new blue hydrogen facilities could consume 48 billion cubic metres (bcm) of natural gas each year — about a tenth of the total consumption in the EU, UK and Norway in 2022 (499 bcm), and more than the annual amount of gas burned in France (38 bcm).

DeSmog’s analysis estimated the total annual emissions associated with the 46 planned blue hydrogen projects at 38 million tonnes of CO2 equivalent (CO2e) — about as much as Denmark or Switzerland emitted in 2022 (42 million tonnes of CO2). Our calculations factored in methane leaks in the natural gas supply chain and the partial efficiency of carbon capture units.

A further 33 million tonnes of CO2 could be released while the plants are being built in the one-off process used to manufacture the amine-based solvent used in the most common types of capture units, the analysis found.

“We should be very cautious with blue hydrogen. We should not buy into a false sense of complacency that it is a low-carbon fuel,” said Lorenzo Sani, power analyst at financial think tank Carbon Tracker, who reviewed DeSmog’s methodology and findings. “A badly managed development of blue hydrogen will increase carbon emissions while creating new gas demand that risks extending energy security concerns.”

The concerns were echoed by Paul Martin, a chemical engineer and decarbonisation consultant at Spitfire Research, who also reviewed the findings.

“This analysis confirms the fact that so-called ‘blue’ hydrogen is rather ‘blackish blue’,” Martin said. “Even technological innovations in the field of hydrogen production from fossil gas don’t change this.”

Coutanceau, the CNRS hydrogen expert, underscored the huge scale of the task fossil fuel companies face in realising plans to sequester the captured CO2 in disused oilfields in the North Sea.

“In addition to the tens of million tonnes of CO2 equivalent that blue hydrogen projects would release every year, what are we going to do with the captured CO2?” Coutanceau said. “There’s talk of underground storage in saline cavities, but to my knowledge this infrastructure doesn’t yet exist on an industrial scale.”

In April, workers began boring a hole under the seawall at the Port of Rotterdam, marking the start of construction of the Porthos carbon capture and storage project — which aims to start sequestering CO2 captured at two planned blue hydrogen projects in a disused offshore gas field from 2026.

Equinor, Shell and TotalEnergies plan to store millions of tonnes of CO2 under the North Sea in their Northern Lights joint venture, which opened a storage facility near Bergen last month. Equinor says the project will initially store 1.5 million tonnes of CO2 a year — with that capacity already committed to ammonia, cement and bioenergy plants.

Lack of Data

Hydrogen Europe, an industry association grouping hundreds of companies — ranging from Shell and BP, to utilities and engineering firms — dismissed concerns over the potential emissions footprint of the planned blue hydrogen projects, saying substituting blue hydrogen for fossil fuels would have a net climate benefit.

“You want me to admit that we have a lot of CO2 emissions because of blue (hydrogen). That’s not true,” Jorgo Chatzimarkakis, Hydrogen Europe’s CEO, told DeSmog in an interview. “You have to look at the big picture: With blue hydrogen, there will be fewer CO2 emissions than if you used natural gas as your (source of fuel). You criticize the fact that we’re reducing emissions. I don’t understand the logic.”

According to the Hydrogen Council, a global trade association, producing one kilogram of blue hydrogen using natural gas and a high level of capture (90 to 98 percent) would emit a maximum of 3.9 kilograms of CO2 — 70 percent less than a conventional hydrogen plant.

However, it’s difficult to independently estimate the decarbonisation potential of the planned blue hydrogen projects without access to data showing how the gas will be used, and thus how far it might reduce demand for fossil fuels.

“For now, we don’t have enough data,” Coutanceau said. “To arrive at a precise calculation of avoided emissions, we’d need to know whether the hydrogen would be used as a feedstock in a manufacturing process, to produce heat, or used in fuel cells to produce electricity. It’s not the same (decarbonisation) gain.”

Hydrogen Europe declined to respond to DeSmog’s request for an estimate for the quantity of CO2 emissions that could be saved by the 46 proposed blue hydrogen projects. The Global CCS Institute, an oil and gas industry body, did not respond to a request for comment.

Regarded as one of the most authoritative models for decarbonising the energy system, the IEA’s Net Zero by 2050 Roadmap sees an increase in global blue hydrogen production capacity to 18 million tonnes (Mt) by 2030 from the negligible amounts produced today. But the 46 planned blue hydrogen projects in Europe alone would produce 10 million tonnes of blue hydrogen — or more than half the global total needed in the IEA scenario, DeSmog found.

Only a handful of the proposed projects have received a final investment decision, meaning there is no guarantee they will all be built. Nevertheless, climate advocates say the discrepancy between the scale of the proposed build-out, and the Net Zero 2050 roadmap, raises questions over whether industry is intent on using blue hydrogen to preserve demand for natural gas, even as Europe transitions away from fossil fuels.

‘Make-or-Break Moment’

Fossil fuel companies, utilities and industrial gas producers are vying for a share of a cumulative total of $100 billion in state support for hydrogen projects that had been announced by EU member states and other European countries by 2023, according to data from BloombergNEF.

Some climate groups are urging governments to back “green” hydrogen — the term used for hydrogen produced in an emissions-free but energy-intensive process powered by wind and solar. In contrast to blue hydrogen’s reliance on natural gas as a feedstock, green hydrogen is made using large quantities of water.

The EU has set up Hydrogen Bank to help scale up the technology, with the Renewable Energy Directive stipulatingthat 42 percent of hydrogen used in industry will have to be produced solely from renewable energy sources by 2030, and 60 percent by 2035.

But environmental groups are concerned that industry lobbyists may convince the European Commission to shift those obligations from green hydrogen to a more loosely defined “low-carbon” hydrogen — which would include blue hydrogen projects. That could crowd out investment in green hydrogen, which is much costlier to produce.

“If selection is based solely on price, since blue hydrogen will be cheaper than green hydrogen, blue hydrogen projects will (win out) and will make green hydrogen disappear,” Geert De Cock, electricity and energy manager at Transport & Environment, a Brussels-based research and advocacy group, told DeSmog. “In my opinion, this is a frontal attack on green hydrogen.”

In April, Transport & Environment and other environmental groups, joined by wind and solar companies, wrote an open letter urging the European Commission to adopt a “robust definition” for low-carbon hydrogen, with stringent conditions attached to blue hydrogen production.

The Renewable Hydrogen Coalition, environmental tank Bellona, and the Environmental Defense Fund were among signatories urging Commissioner for Energy Kadri Simson and Commission Vice-President Maroš Šefčovič to ensure the new rules reflected the entirety of greenhouse gas emissions associated with a particular blue hydrogen project; set a minimum rate of carbon capture; and set maximum rates for methane leakage.

The letter’s signatories also call for a guarantee that any blue hydrogen to qualify as “low-carbon”, “will only be produced from existing (not additional) gas production capacity”.

“If the rules are sufficiently strict, the new (blue hydrogen) projects will not happen,” De Cock said. “It is really make-or-break for the industry.”

Betting on Blue

Today, almost all industrial hydrogen is of the “grey” variety, where the CO2 emitted during the process of making it from natural gas is vented into the atmosphere, accounting for about two percent of global CO2 emissions, according to the IEA. About half of this hydrogen is used in oil refining, where the gas is used to strip sulphur from refined products, and make diesel and other oils.

Some climate advocates suspect that the fossil fuel industry is backing blue hydrogen in part because the resulting demand for natural gas will serve to prolong the useful life of existing gas deposits, drilling rigs, pipelines and other infrastructure. That could reduce the risk that the EU’s goal to slash carbon emissions by 55 percent by 2030 will saddle oil and gas companies with billions of euros of stranded assets.

In the Netherlands, site of 12 of the 46 proposed blue hydrogen projects, U.S. industrial gases company Air Products and French rival Air Liquide have announced plans to retrofit their existing grey hydrogen plants in the Port of Rotterdam with carbon capture equipment to produce blue hydrogen. “Hydrogen plays a critical role in the energy transition and in mitigating the effects of climate change,” Air Products says on its website.

The captured CO2 will be handled by Porthos, a joint venture between state-owned firms Energie Beheer Nederland, Gasunie, and the Port of Rotterdam Authority. The project aims to store 2.5 million tonnes of CO2 captured annually from various industries in depleted gas fields under the North Sea for 15 years, starting in 2026.

Elsewhere in the Netherlands, in the maritime province of Zeeland, Air Liquide is building a new plant to supply blue hydrogen to Zeeland Refinery, a joint venture between TotalEnergies and Russia’s Lukoil. Air Liquide is also participating in the Kairos@C project in the Belgian port of Antwerp, which aims to capture more than 14 million tonnes of CO2 over its first 10 years of operations, including from two blue hydrogen plants.

“The Group has a complete portfolio of technological solutions and services to support the decarbonisation of its customers around the world,” Air Liquide said in its 2022 strategic plan.

American-German gas manufacturer Linde, which is headquartered in the UK, also sees blue hydrogen as a growth opportunity. “Blue hydrogen is the next step,” the company says on its web page. “Gray and blue hydrogen are important stepping stones on the path to green hydrogen as they will allow for the necessary frameworks and infrastructures to be developed while green hydrogen production reaches the necessary scale.”

Oil Companies Spy Opportunities

The track record of the fewer than 10 existing commercial blue hydrogen plants in operation has been uneven. For example, Shell’s Quest project in Canada, capable of producing 900 tonnes of hydrogen a day, captured five million tonnes of CO2 from 2015-2021 — but released more than 7.5 million tonnes of greenhouse gases during the same period, according to a report based on official data collated by Global Witness.

Nevertheless, oil companies are talking up the benefits of blue hydrogen, with TotalEnergies, Eni, Shell and BP all characterising the gas as a clean fuel that can be used to bridge the gap before green hydrogen becomes more economical.

In January last year, Norway’s state-owned oil company Equinor signed a memorandum of understanding with the German energy provider RWE to jointly develop blue hydrogen projects in Norway for export via pipeline to Germany. Equinor announced last month that it had scrapped the plans, citing excessive costs and insufficient demand.

In the UK, site of 14 of the 46 blue hydrogen projects on the drawing board, BP is developing a large-scale blue hydrogen plant, called H2 Teesside. The project aims to produce 160,000 tonnes of blue hydrogen a year, with the developers pledging to capture two million tonnes of associated CO2 emissions and bury them under the North Sea.

“The project is already well advanced,” said Sani, the power analyst at Carbon Tracker, and author of a June reporton blue hydrogen in the UK. “Although the final investment decision has not yet been taken, several agreements have already been concluded, and the construction of a new (liquefied natural gas) terminal to supply the plant with fossil gas has been proposed.”

Meanwhile, U.S. major ExxonMobil, which has various carbon capture interests in the Netherlands, Belgium and UK, describes blue hydrogen as “one of the few proven technologies that could deliver significant reductions in CO2 emissions in high-emitting, hard-to-decarbonise sectors.”

Battle of Perceptions

Industry groups are keen to kick-start the planned blue hydrogen projects by portraying them as equivalent to their green hydrogen rivals — downplaying the differences in the emissions footprint of the technologies, and focusing on economics.

“It’s about decarbonisation, it’s not about colour,” said Chatzimarkakis, the Hydrogen Europe CEO, reiterating a position commonly advanced by industry. “If we start to criticize technologies that help to decarbonise, to the energy transition, we’re making a big mistake. We need to be ‘technology diverse’. We need to have every technology that allows for CO2 abatement to play its role.”

Under existing EU rules, the maximum threshold of greenhouse gas emission for hydrogen to be considered “low-carbon” is equivalent to that of green hydrogen: 3.38 kilograms of CO2e per kilogram of hydrogen. But whether or not a particular blue hydrogen facility meets that definition depends on the methodology used to calculate its emissions.

In May, the EU adopted a raft of new rules on gas and hydrogen under its Green Deal climate framework — and tasked officials with developing a methodology for determining which hydrogen projects count as “low-carbon” within a year. The European Commission published a draft of the new rules on September 27, and opened a month-long public consultation.

The draft proposed that blue hydrogen projects should be subjected to a “full life-cycle analysis” — meaning that emissions estimates would include factors such as methane leakages during the production and transport of the natural gas, and stringent rules for assessing carbon capture rates.

But the devil is in the details, campaigners say.

In a response to the draft, Transport & Environment questioned the rigour of proposed measures to factor in methane leakages, while Bellona noted a lack of measures to deter the build-out of new natural gas infrastructure.

Many more questions remain unanswered.

The draft suggests that all emissions associated with the process of capturing CO2, then transporting the gas and injecting into undersea storage sites, will be taken into account when measuring the carbon footprint of a blue hydrogen project. But the rules are silent on the question of whether the emissions associated with the production of the amine-based solvent needed to operate the most common carbon capture technology should also be factored in.

It has also yet to be determined how to account for likely leaks of hydrogen — which is considered an “indirect” greenhouse gas because it causes chemical reactions that affect concentrations of methane, ozone, and stratospheric water vapor, as well as aerosols. Other questions include: How will the natural gas supply chain be certified? And how to ensure such certifications are accurate? Would it make more sense to calculate the warming impact of the methane over a period of 20 years (84 times greater than CO2), as advocated by environmental groups, or 100 years (28 times greater), as desired by industry?

“European policymakers need to set strong guarantees for blue hydrogen projects, as they risk derailing net zero strategies if they are developed without addressing supply chain emissions,” said Carbon Tracker’s Sani. “Without stringent regulatory frameworks, blue hydrogen could inadvertently become a setback in our fight against climate change.”

Variations in the methane leakage rates in different gas-producing regions further complicate efforts to calculate blue hydrogen’s carbon footprint.

Norway’s gas industry is said to limit its leakage rates to below 1.0 percent — less than the estimated global average of 1.4 to 2.0 percent. However, with Norway’s gas production committed to existing customers, it seems likely that future blue hydrogen projects will turn to suppliers such as the United States, where shale oil and gas reserves are being massively exploited, and estimates for the proportion of methane molecules escaping into the air can be 3.5 percent, or higher. In some parts of the U.S., such as the Permian Basin in New Mexico, leakage rates above 9.0 percent have been recorded — meaning that even within a given country, where the gas comes from can have a big impact on the level of climate harm.

Chatzimarkakis, of Hydrogen Europe, said the origin of the natural gas was outside the scope of his group’s remit. “I don’t know where the gas will come from,” he said. “We are not a gas lobby. That’s not our business.”

Aline Nippert’s new book Hydrogen Mania: An Investigation into the Totem of Green Growth is published in French by Le passager clandestin.

Additional reporting by Michael Buchsbaum and Sharon Kelly

We began by examining the 51 proposed blue hydrogen projects in the EU, UK and Norway featured in a databasemaintained by the International Energy Agency (data current as of October 2023). We excluded four projects in the UK that have been canceled (H2 Leeds City Gate project; Cavendish Phases 1 and 2; and a project at the Fawley refinery) and one in Norway (Aukra CCS). To simplify the calculations, we assumed that all the projects used natural gas, commonly used to make hydrogen in Europe. (Hydrogen can also be produced from oil and coal).

Project by project, we trawled specialised websites, press releases, and technical reports to ascertain whether the developers were planning to retrofit an existing grey hydrogen plant to produce blue hydrogen — or build a new blue hydrogen plant from scratch.

We found developers were planning:

- 15 retrofits

- 27 new projects

- 4 undetermined

Estimating Natural Gas Consumption

We used the developer’s projections for how much blue hydrogen a given plant would produce each year to estimate how much natural gas it would consume.

We used a standard assumption that it takes 3.6 kilograms of methane (the main ingredient of natural gas) to produce 1.0 kilogram of hydrogen.

We then increased the result by 22 percent to reflect scientific estimates for the additional natural gas that would be required to power the carbon capture process. The total amount of natural gas required by the 46 plants (new plants and retrofits) was estimated at 67 billion cubic metres (bcm).

We concluded that the planned 27 new blue hydrogen facilities would consume a total of 48 billion bcm of natural gas each year as a feedstock — about a tenth of the total consumption in the EU, UK and Norway in 2022 (499 bcm), and more than the amount of gas burned in France (38 bcm).

Estimating CO2 Emissions

To estimate the amount of carbon dioxide equivalent (CO2e) associated with the 46 planned blue hydrogen projects, we took various factors into account:

- The amount of CO2 that would be emitted directly each year during the process of producing blue hydrogen, which is a factor of the average efficiency of the capture equipment (either 60 percent or 90 percent depending on the type of production process): 18 million tonnes.

- The amount of CO2e escaping into the atmosphere each year as a result of methane leaks during the process of extracting, storing and transporting the natural gas. (Between 20 and 48 million tonnes of CO2e for leakage rates of 1.5 percent and 3.5 percent respectively).

- The amount of CO2 generated by the one-off production of the amine-based solvent used in most carbon capture units: (33 million tonnes). Since the solvent can be reused, the emissions associated with solvent production will only occur when the plants are being built.

In all, we estimated that building all 46 blue hydrogen projects would lead to the minimum release of 38 million tonnes of CO2e every year — on a par with Denmark’s annual emissions of 42 million tonnes.

Here is a more detailed breakdown of each stage of our calculations:

Carbon Capture Efficiency

Under existing blue hydrogen technology, about 40 to 60 percent of the CO2 molecules present in a given volume of flue gas are captured, according to the IEA. We therefore estimated a 60-percent capture rate for the 15 retrofit projects.

For the 27 new-build projects, we assumed 90 percent efficiency, in line with industry projections for next generation capture technologies.

Multiplying the total amount of CO2 released during the production process by the percentage capture rate (90 percent for new plants; 60 percent for retrofits) leads to 18 million tonnes of CO2 emissions.

Amine-based Solvent

The most common carbon capture technologies rely on an ammonia-derived solvent to absorb CO2 molecules in the flue gases. We calculated the one-off emissions associated with the necessary ammonia production at 33 million tonnes of CO2, using the following assumptions:

- Producing 1.0 tonnes of ammonia generates 2.4 tonnes of CO2 .

- 250 kilograms of ammonia are required to produce 1.0 tonne of solvent

- 1.4 tonnes of solvent are needed to capture 1.0 tonne of CO2

Note: We excluded the nine blue hydrogen projects involving Air Liquide, whose Crypocap carbon capture technology does not rely on an amine-based solvent.

Industry says it is working to decarbonise ammonia production by using blue hydrogen as a feedstock. However, only four of the 46 proposed blue hydrogen projects are designed to produce ammonia.

Methane Leakage

To convert the likely quantity of methane leakage associated with the projects into CO2e, we multiplied the quantity of methane by a factor known as Global Warming Potential (GWP).

Methane exerts a greater warming effect in the short term, before it gradually breaks down. That means its GWP is higher over a 20-year horizon (84 times greater than that of CO2) than a 100-year horizon (28 times greater).

Estimates for the amount of methane that leaks during the extraction, transport and storage of the natural gas used to make blue hydrogen vary widely, depending on the origin of the gas.

Conservatively, assuming a leakage rate of 1.5 percent (and a GWP of 28 over a 100-year horizon), the emissions due to methane leaks associated with the natural gas used to feed the 46 projects equal 20 million tonnes of CO2e per year.

Less conservatively, assuming a 3.5 percent leakage rate (and a GWP of 28), this figure more than doubles to 48 million tonnes of CO2e per year.

Under various assumptions, the methane leakage associated with the 46 blue hydrogen projects could range from 20 million tonnes of CO2e (leakage rate of 1.5 percent and GWP of 28) to 117 million tonnes of CO2e (leakage rate of 3.5 percent and GWP of 84).

Expert Review

DeSmog’s analysis was carried out earlier this year in collaboration with Christophe Coutanceau, a professor at the Institute of Chemistry of Poitiers: Materials and Natural Resources, and co-lead of a hydrogen working group at the French National Centre for Scientific Research, known by its French acronym CNRS.

Power analyst Lorenzo Sani, who has carried out similar work on blue hydrogen projects in the UK for Carbon Tracker, and Paul Martin, chemical engineer and decarbonisation consultant at Spitfire Research, reviewed our methodology and findings.