by calculated risk October 21, 2024 11:00:00 AM

In today’s Translated Risk Real Estate newsletter: NMHC regarding apartments: “Market conditions have been sluggish for 9 consecutive quarters”

excerpt:

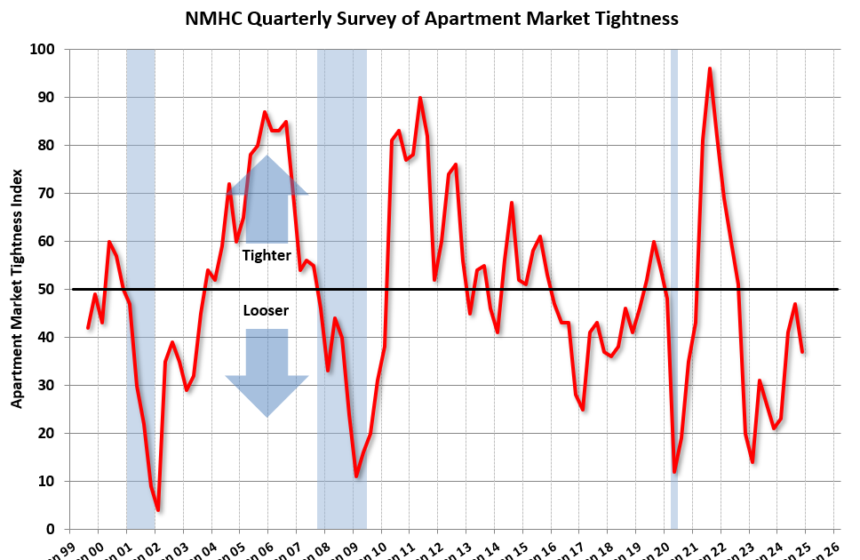

The October 2024 quarterly survey of apartment market conditions by the National Multifamily Housing Council (NMHC) showed signs of improvement in apartment market conditions. All indexes except the market tightness (37) index show a better picture for the current quarter, with sales (67), equity financing (63) and debt financing (77) all at break-even levels. (50).

…• Market Stress Index for the current quarter was 37, below the break-even level of 50, indicating easing market conditions for the ninth consecutive quarter. Nearly half (46%) of respondents believe market conditions are unchanged compared to three months ago, while 40% of respondents believe markets are easing, up from 27% in July. It increased from 15% of respondents said the market is tighter than it was three months ago.

This index is a good leading indicator of rents and vacancy rates, indicating rising vacancy rates and further weakness in asking rents. this is, Conditions eased for 9 consecutive quarters than last quarter.

There’s a lot more to this article.