by calculated risk October 23, 2024 02:48:00 PM

Note: This index is primarily a leading indicator for new commercial real estate (CRE) investments.

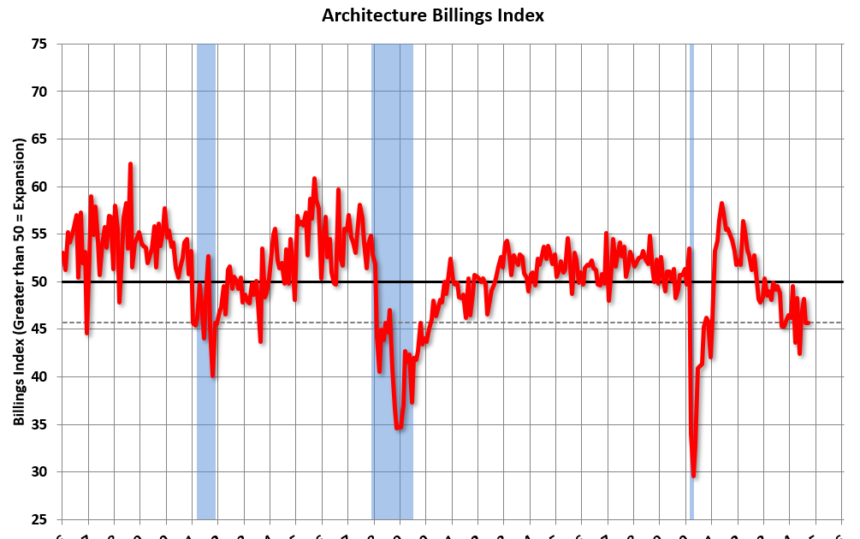

From AIA: Construction companies’ billings worsen in September

This month’s AIA/Deltek Architecture Billings Index (ABI) score was 45.7.as the majority of businesses continue to report a decline in billings.

Despite the Fed’s recent announcement of interest rate cuts, customers remain cautious about future projects. Inquiries for potential new projects continue to increase, but the pace has slowed since the beginning of the year. Additionally, the value of new design contracts signed by companies fell for the sixth straight month in September, but the pace of decline has slowed somewhat in recent months. However, companies still reported an average backlog of 6.4 months, which is still above the historical average before the pandemic, and even as the influx of new jobs slows, existing jobs in the pipeline remain It is a good indicator of the work of the person.

The economy continued to be weak nationwide in September. For the third month in a row, businesses in the West had the slowest billings, followed by businesses in the Midwest. But while business conditions may be on the verge of improving for businesses based in the South, there was only a slight decline this month. With solid expertise, Companies specializing in multifamily housing saw billings fall further in September.Meanwhile, billings for commercial/industrial-focused companies also remained fairly low. Billings also continued to decline for institutional specialty firms, but at a slower pace than for other specialty firms, which has continued since the beginning of the summer.

…

The ABI score is a leading economic indicator of construction activity and provides a glimpse into the future of nonresidential construction spending activity for approximately 9 to 12 months. This score is derived from a monthly survey of architecture firms that measures changes in the number of services provided to clients.

Emphasis added

• Northeast (46.4). Midwest (45.0); South (49.5); West (42.6)

• Sector index breakdown: Commerce/Industrial (44.2). institutional (48.5); Apartment complex (41.7)

This chart shows the Architecture Billings Index since 1996. The index for September was 45.7, unchanged from 45.7 in August. A value below 50 indicates a decline in demand for the architect’s services.

Note: This includes commercial and industrial facilities such as hotels and office buildings, apartment complexes, schools, hospitals, and other facilities.

The index typically leads CRE investing by 9 to 12 months, suggesting a slowdown in CRE investing through 2025.

Note that multifamily claims decreased in August 2022, marking the 26th consecutive month of negative charges. (with corrections). This suggests that Multifamily’s start will be even weaker.