Eve is here. This is an informative overview of President Trump’s tariffs and tax policy. Note, as anyone with economic knowledge should, that this post also predicts that new tariffs will reduce growth relative to the status quo.

This article does not discuss the expected rise in inflation. The reason estimates are less clear is that the effects are difficult to disentangle. For example, from CNBC:

It’s hard to say exactly how much prices will rise. Clark Bellin, chief investment officer at Bellwether Wealth, said the relationship is certainly not as simple and simple as some Democrats have suggested, arguing that the tariffs act as a “20% sales tax.” It’s not direct.

“Especially given the inflation that we’re experiencing, it’s hard to come up with a line that says, ‘Prices went up this much because of tariffs,'” he says.

Vox raises the question of whether Republicans on the Supreme Court will block these measures. I suspect that Democrats are not expected to join in, following the gist of Napoleon’s advice: “Don’t get in the way when your enemy makes a mistake.”

Box also found experts who are not hesitant to estimate the impact of Trump tariffs, but note that the numbers vary widely. From Vox:

President Trump has inherited a strong economy and low inflation, but he has proposed imposing 10-20% tariffs on all imports and a 60% tariff on all imports from China. . Yale University’s Budget Institute estimates that this policy alone could increase consumer prices by up to 5.1% and reduce U.S. economic growth by up to 1.4%. An analysis by the Peterson Institute for International Economics, a think tank, found that President Trump’s tariffs, when combined with other proposals such as mass deportations, could increase inflation by 6 to 9.3 percentage points.

If Trump presses ahead with his tariff proposals, they will no doubt be challenged in court — and perhaps in the Supreme Court…

Will this Supreme Court allow the enactment of policies that could thwart Trump’s presidency and thereby derail Republican hopes for a political realignment that could ruin the Democratic Party in the wilderness? I wonder if there is?

The legal arguments supporting President Trump’s unilateral imposition of high tariffs are as follows. amazingly strong. Although several federal laws give the president very broad authority to impose tariffs, the limits imposed by these laws are very vague.Presidential proclamations imposing such tariffs are not unprecedented. 1971, President Richard Nixon imposed a 10 percent tariff on almost all foreign products,it is A federal appeals court upheld. Congress subsequently amended some of the laws that President Nixon relied on, but the presidentProperty in which a foreign country or its nationals have or have had any interest” remains in the book.

Law enforcement has one way to rein in President Trump’s tariffs. The Republican majority of the Supreme Court ruled that: unchecked veto for policy decisions by the executive branch that these judges found too ambitious. in Biden vs. Nebraska (2023), for example, a Republican judge invalidated the Biden administration’s major student loan forgiveness program, despite the fact that the program: specifically authorized by federal law.

Nebraska suggests that Nixon-style tariffs should be abolished, at least if Republican judges want to use their own powers to consistently veto executive branch actions. nebraska The executive branchHuge “economic and political importance”” The president’s proclamation potentially restoring inflation levels in 2022 certainly seems to fit within this framework.

Vox’s works Additional details regarding potential legal jousting are included.

Written by Bill Haskell. It was first published in angry bear

Now that we have a new president who supports tariffs, we need to start talking about how those tariffs will affect our economy and our people. of tax foundation Angry Bear readers are provided with simple explanations that are easy to understand. If Mr. Trump is able to accomplish this and drive it out of Congress, I don’t think it would be very advantageous from an economic growth perspective. Additionally, your 2017 expenses will be covered. tax Workforce Reduction Act (TCJA) has not yet paid for itself in terms of economic growth.

The TCJA was supposed to disappear under the Biden administration. Biden was removed as a candidate and Democrats lost the election because they did not vote. This is very similar to what happened in 2016 with Clinton vs. Trump. Maybe the Democrats don’t support a woman as president? More on that later when we dig into the numbers.

This commentary on Trump’s tariffs and jewelry tariffs has multiple sources. If you need additional information or want to read more of my comments, I’ll link them to each one.

introduction

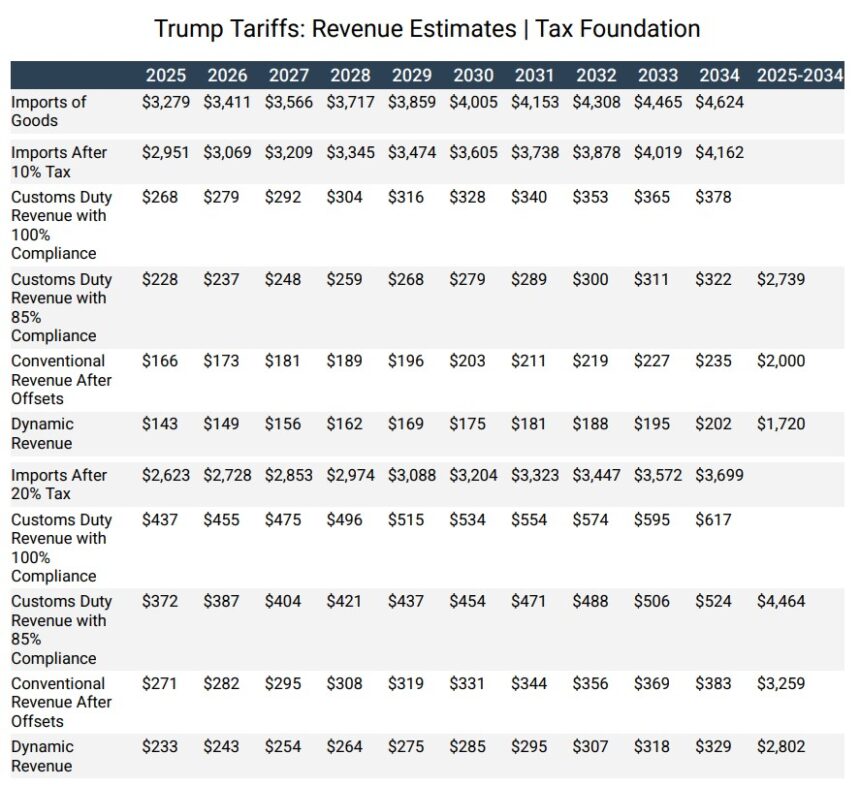

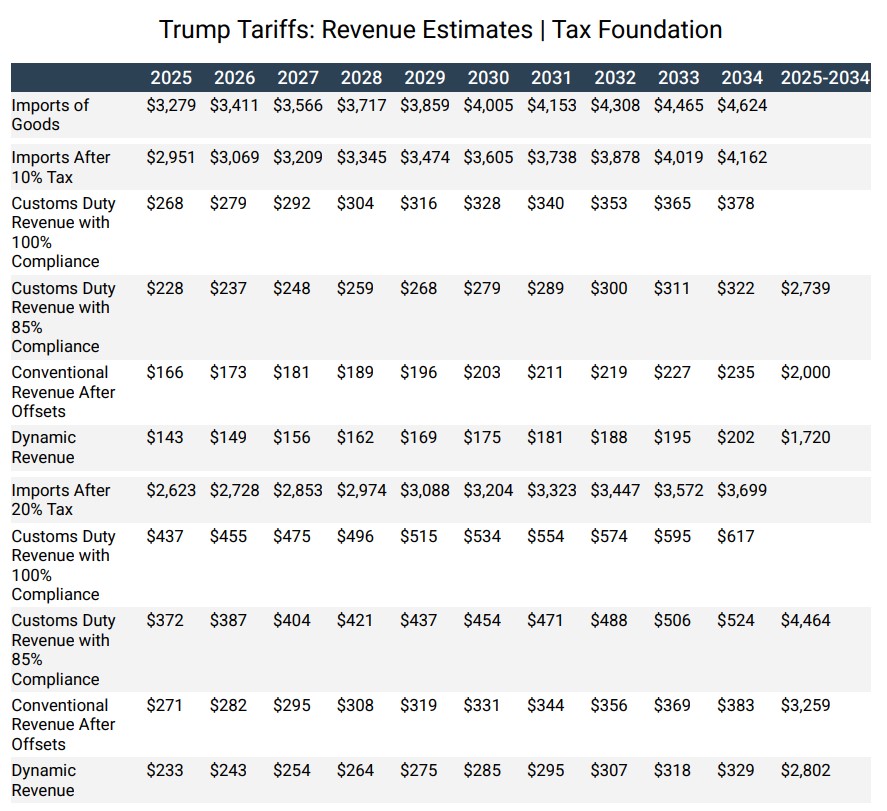

next president donald trump have proposed implement universal baseline customs duty Regarding imports when he took office. We estimate that a 10% universal tariff would raise $2 trillion and a 20% universal tariff would raise $3.3 trillion from 2025 to 2034, before considering what happens to taxes. shrink the US economy.

In 2025, a 10% universal tariff would increase taxes for U.S. households by an average of $1,253, and a 20% universal tariff would increase taxes for U.S. households by an average of $2,045.

The increased revenue from the tariffs will not reach the amount needed to fully offset the revenue losses from the expiring provisions in 2017. tax Workforce Reduction Act (TCJA) permanent.

Trump’s income estimates universal standard tariff (billion)

Process for estimating the revenue impact of tariffs

How do you estimate how much revenue a universal tariff would increase? Start with a baseline forecast of goods imports over the next 10 years. Imposing an import tax will reduce the purchase of foreign products, resulting in a decrease in the amount of imports. Apply an import elasticity of -1 to predict how imports will decrease in response to a 10 percent tariff and a 20 percent tariff. Therefore, the extent to which import volumes are reduced depends on the applicable tariff rate, which means that doubling the tax rate does not necessarily double revenue.

Multiply the import from there tax base The initial duty that would accrue under full compliance, calculated at the inclusive tariff rate (tax rate divided by 1 plus the tax rate), before being adjusted to reflect an average compliance rate of 85%. Estimate your income. tax disparity.

After compliance adjustment and before recording revenue, payroll tax offset; due to a universal tariff of 10 percent; $2.7 trillion of customs revenue and a universal tariff of 20% would generate $4.5 trillion Refers to customs revenue.

Total revenue

The total revenue raised is less than the tariff revenue generated by the tariff because the tariff reduces revenue (taxes paid as mentioned above) and reduces the collection of income and payroll taxes. Our previous revenue estimates, which take into account income and payroll tax offsets, suggest that a 10% tariff would increase revenue by $2 trillion, and a 20% tariff would increase revenue by $3.3 trillion over 10 years.

And what about the economy?

Both taxes (duties) are shrink America’s economic size. The dynamic score is smaller: $1.7 trillion for a 10 percent tariff and $2.8 trillion for a 20 percent tariff. If other countries retaliate, even partially, for tariffs imposed by the United States, the economy will shrink further and revenues will fall even further. For example, it is estimated that imposing a 10% tariff on all U.S. exports would reduce tax revenues by more than $190 billion over 10 years on a dynamic basis.

Have tariffs been tried?

President Trump, who is in his second term, once said this during his first term. One of his main foreign policy goals is to rein in global adversaries like China and resolve the growing trade deficit (defined as U.S. imports exceeding exports) with U.S. trading partners. The goal was to work on this. President Trump’s approach to achieving this goal has been to enact tariffs specifically focused on China. These tariffs have negatively affected trade between the United States and China, causing importers to shift to Mexico’s west coast instead of shipping directly to the United States. As a result, trade between Mexico and China increased by 60% in one year. and . . . The product was being shipped north to the U.S. by truck, but additional measures avoided tariffs. If Mexico wins, what about America? there is nothing . . .

Tariffs were supposed to benefit average Americans, who would buy cheaper products made at home. Another example, this time Steel. The United States tried to stop the sale of steel companies. In politically charged cases, U.S. Steel took the first action. sell Despite decades of government rule, the company was transferred to Japan-based Nippon Steel Corporation subsidy. Strategically, this would have been a good idea if the plant was up to date. That wasn’t the case. China will probably lose out on this sale.

It didn’t become reality. The policy goal of creating and protecting American jobs has failed. A 2021 study by the U.S.-China Business Council found that President Trump’s tariffs had the following consequences: Estimation 245,000 jobs were lost in the US.