In today’s Calculated Risk Real Estate newsletter: New York Fed: Mortgage originations by credit score, delinquencies rising, foreclosures remaining low

A brief excerpt:

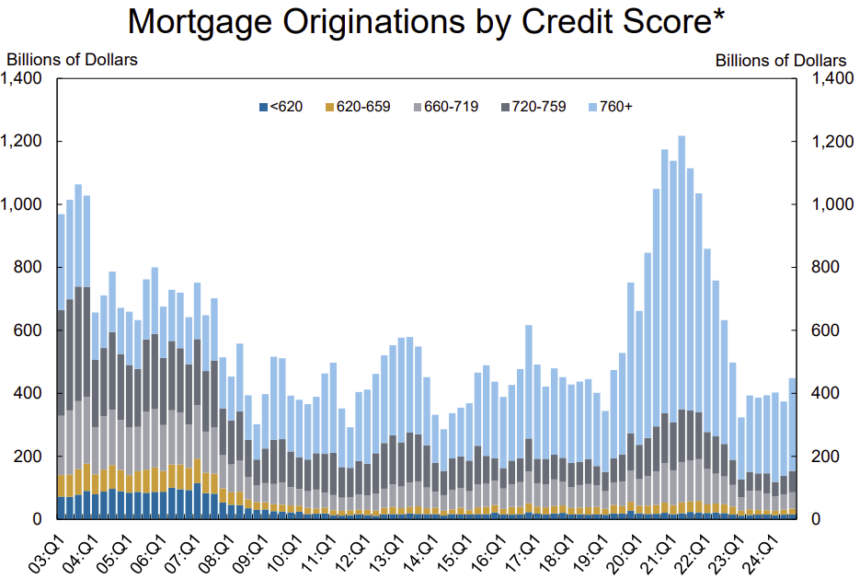

The first graph shows mortgage originations by credit score (this includes both purchases and refinances). Look at the difference in credit scores these days compared to the bubble period (2003-2006). These days, there are very few loans available to borrowers with credit scores below 620, and rarely below 660. The majority of loans these days are to borrowers with credit scores above 760.

…

The main reason I have been advocating is solid underwriting. Rather than comparing the current housing boom to the bursting of the bubble, look to the 1978-1982 era for a lesson.

The main reason I have been advocating is solid underwriting. Rather than comparing the current housing boom to the bursting of the bubble, look to the 1978-1982 era for a lesson.

There’s a lot more to this article.