In the keynote speech of MicroStrategy World: Bitcoin for Enterprise, MicroStrategy Executive Chairman Michael Saylor conducted a masterclass on corporate finance and the power of Bitcoin to significantly enhance a company’s balance sheet. Saylor emphasized Bitcoin. single Solutions for capital appreciation in an inflationary environment.

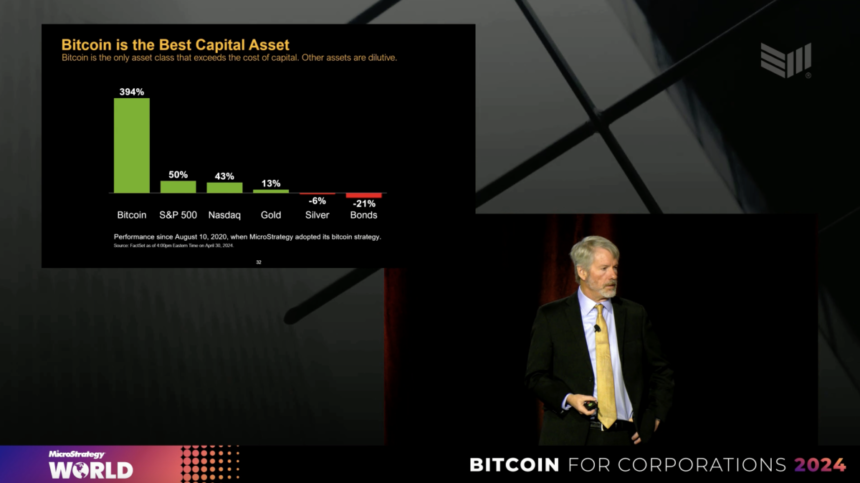

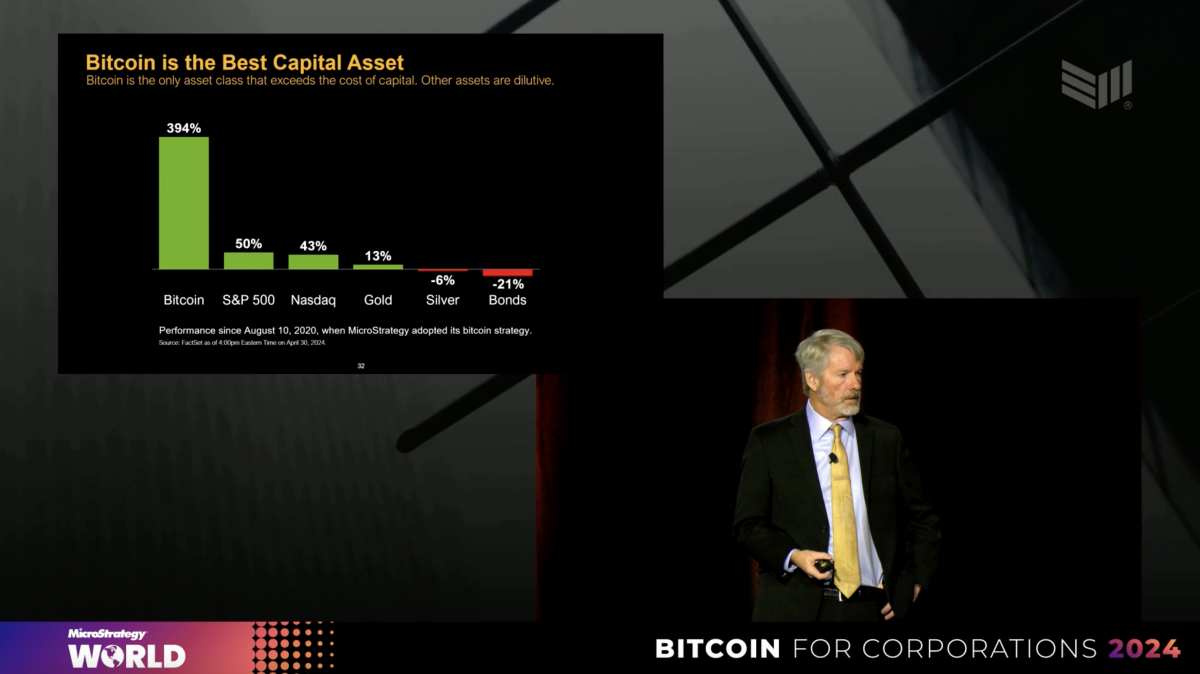

In his speech, Thaler likened the cost of capital to a benchmark that a company must exceed. increase Evaluating its purchasing power, “Bitcoin is only Assets that exceed the cost of capital. To put it another way, teeth dilute everything else”

To explain further, truth Regarding the cost of capital, he says, “S&P is a modern proxy for the cost of capital…If you had to choose one metric, which would capture how rapidly the world’s money supply is expanding in dollars?” Is that so?” he said. Probably the S&P 500…that’s another way to look at inflation. ”

Saylor went on to emphasize his belief that all assets except Bitcoin are not accretive to a company’s balance sheet, despite general acceptance. In particular, he highlighted the relative underperformance of silver, gold, and U.S. Treasuries.

“If[a company]invests in Treasury bills, it can earn 3% after tax on a cost of capital of 12% per year. It’s destroying the shareholder value of the dollar… The story here is that bonds have no value, right? They’re a terrible capital asset. Silver doesn’t work. Gold isn’t keeping up with the cost of capital. ”

There is no second best crypto asset

MicroStrategy’s executive chairman pointed out the key differences between Bitcoin and alternative cryptocurrencies like Ethereum, and expressed the importance and need for proof-of-work based agreements in the creation of digital products.

“When the Bitcoin spot ETF was approved in January, we saw the writing on the wall. By the end of May, we would know that Ethereum would not be approved. And if Ethereum is not approved, this Sometime in the summer, it will be clear to everyone that Ethereum is considered a crypto security, not a commodity. Then we’ll see Ethereum, BNB, Solana, Ripple, Cardano, all on the stack. Masu.”

When it comes to Bitcoin’s energy use, Thaler brought up the idea of a “physical connection to the real world” that is part of Bitcoin’s consensus. He described the network as “raw digital power standing in the way of those who seek to undermine the integrity of the network…The network is powered by decentralization that pushes the entire network to its limits.” It creates dynamics.” The power grid explores stalled energy. ”

forever on the rise

Thaler’s beliefs and use of physics-based metaphors were still present when talking about Bitcoin’s price rise and continued monetization. “It never fades. The chart never goes down. It only goes in one direction. Bitcoin is a ratchet of capital. It’s a one-way ratchet. Archimedes said, ‘If I have a lever long enough and a place to stand Give me something, and I can move the world.” Bitcoin is where it stands.”

“There is no idea more powerful than the digital transformation of capital…No force on earth can stop an idea whose time has come. This is an idea. Its time has come. It cannot be stopped. I would like to end with the view that it is the best. What is the best?